AUTHOR : REHA SI

DATE : 03-11-23

Introduction

In today’s digital age, conducting business online has become the norm. Whether you are a small e-commerce store or a large corporation, having a secure and efficient payment gateway merchant account is crucial for processing online transactions seamlessly. In this article, we will delve into the world of payment gateway[5] merchant accounts, exploring what they are, how they work, and why they are vital for your online business.

What Is a Payment Gateway Merchant Account?

To begin, let’s clarify the fundamental concept: what exactly is a payment gateway[1] merchant account? This topic serves as the foundation for our discussion.

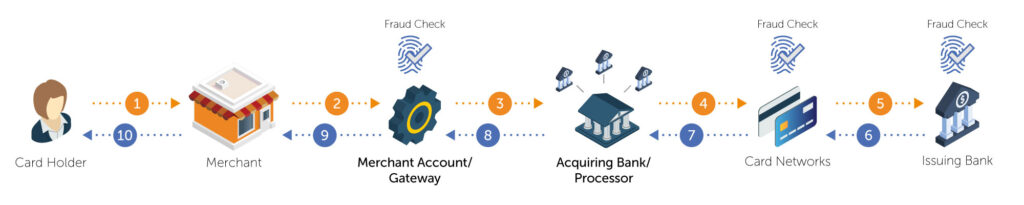

The Mechanics of Online Payments

Understanding how online payments work is essential. We’ll break down the intricate process step by step, simplifying it for everyone, from tech enthusiasts to beginners.

Why Your Business Needs a PGMA

Exploring the key reasons why a payment gateway merchant account[2] is a must-have for any online business. We’ll discuss security, convenience, and customer trust.

Ensuring Payment Security

One of the most critical aspects of online transactions is security. How payment gateway merchant accounts keep your customers[3]‘ data safe.

Streamlining the Checkout Process

A user-friendly checkout process can significantly impact your sales. Learn how payment gateways[4] enhance the customer experience.

Types of Payment Gateways

Dive into the various types of payment gateways available and understand which one suits your business needs the best.

Hosted Payment Gateways

Discover the advantages and disadvantages [5]of hosted payment gateways for your online business.

Self-Hosted Payment Gateways

Learn about self-hosted payment gateways and their customization options.

API-Integrated Payment Gateways

Explore the technical aspects of API-integrated payment gateways and their advantages.

Setting Up Your PGMA

Now that you understand the different types of payment gateways, it’s time to delve into the process of setting up your very own payment gateway merchant account.

Choosing the Right Payment Gateway Provider

Selecting the perfect payment gateway provider for your specific business requirements can be a game-changer.

Integration with Your E-commerce Platform

Discover how to seamlessly integrate your payment gateway with your e-commerce website, ensuring a smooth online shopping experience for your customers.

The Benefits of Payment Gateway Merchant Accounts

Let’s discuss the multiple advantages of having a payment gateway merchant account and how it can enhance your online business.

Increased Sales

Find out how a reliable payment gateway can boost your sales and revenue.

Global Reach

Expand your business globally with a payment gateway that supports international transactions.

Common Challenges and How to Overcome Them

No system is without its challenge. We’ll explore common issues faced by businesses with payment gateway merchant accounts and how to overcome them.

Chargebacks and Fraud Prevention

Learn about strategies to minimize chargebacks and protect your business from fraud.

Payment Gateway Fees

Understand the fees associated with payment gateways and how to manage them effectively.

Expanding Your Market Reach

One of the significant advantages of having a payment gateway merchant account is the ability to expand your market reach. With the right payment gateway, you can tap into a global audience. International customers can make purchases in their preferred currencies, leading to increased sales and a broader customer base. This accessibility to a global market is particularly beneficial for e-commerce businesses aiming for growth and scalability.

Easy Integration with E-commerce Platforms

A seamless integration with your e-commerce platform is crucial for a positive customer experience. Payment gateways are designed to work smoothly with popular e-commerce platforms like Shopify, WooCommerce, Magento, and others. This means that you can quickly set up your payment gateway merchant account, connect it to your online store, and start accepting payments without extensive technical expertise. It’s a user-friendly solution that ensures your customers have a hassle-free shopping experience.

Building Customer Trust

Confidence is the bedrock of every thriving online enterprise. When customers see that you offer a secure and well-known payment gateway, it instills confidence in their minds. A recognizable payment gateway can help alleviate concerns about online fraud and data security. The trust factor can lead to more repeat customers and positive word-of-mouth recommendations, which are invaluable for your business’s growth.

Conclusion

In conclusion, a payment gateway merchant account is the lifeblood of your online business. Its role in ensuring secure and hassle-free online transactions cannot be overstated. By selecting the right payment gateway, integrating it seamlessly, and understanding the potential challenges, you can take your online business to new heights.

FAQs

- What is a payment gateway merchant account? A payment gateway merchant account is a secure platform that facilitates online transactions for businesses, allowing them to accept payments from customers via various payment methods.

- How do payment gateways enhance security? Payment gateways employ encryption and security protocols to protect customer data, reducing the risk of data breaches and fraud.

- What types of payment gateways are available for businesses? Payment gateways come in various forms, including hosted, self-hosted, and API-integrated options, each with its unique features and benefits.

- What is the role of payment gateway fees in online transactions? Payment gateway fees are associated with processing online payments and may vary. Businesses should understand these fees to manage their finances effectively.

- How can I choose the right payment gateway provider for my business? Selecting the ideal payment gateway provider involves considering factors such as business type, budget, and the provider’s reputation for reliability and security.