AUTHOR : HANIYA SMITH

DATE : 23/10/2023

Introduction

In the fast-paced world of e-commerce, a seamless payment experience is paramount. Payment gateway integration is the process of connecting an online business’s website or application to a payment processing network. This ensures that customers can securely and conveniently complete their transactions. In this article, we will delve into the intricacies of a payment gateway integration project and how it can significantly impact your online business.

Understanding Payment Gateways

What is a Payment Gateway?

A payment gateway is a technology that facilitates the secure transfer of payment data between a customer and the merchant. It plays a pivotal role in authorizing and processing transactions.

How Does it Work?

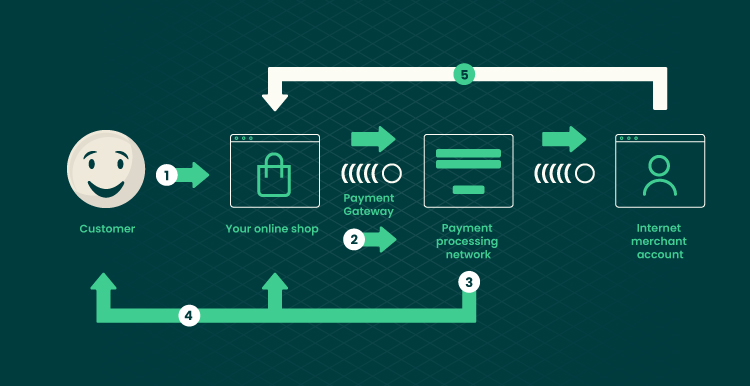

When a customer makes a purchase online, the payment gateway acts as the intermediary between the merchant’s website and the bank. It encrypts sensitive information, verifies the validity of the payment, and also transfers funds from the customer’s account to the merchant’s account.

The Importance of Integration

Why Integrate a Payment Gateway?

Integrating a payment gateway into your website or application offers numerous benefits. It enhances the customer experience, increases security, and also streamlines the payment process, leading to higher conversion rates.

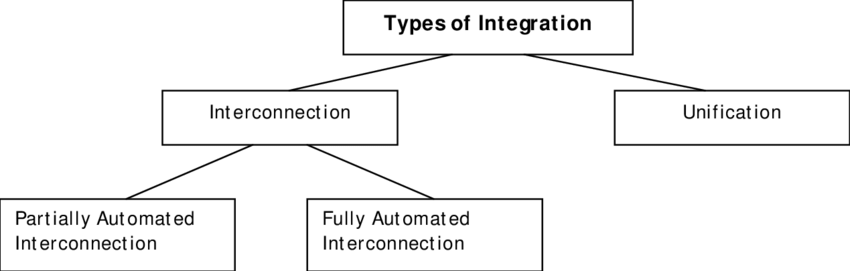

Types of Integration

There are different methods of integrating payment gateways. These include direct API integration, hosted payment pages, and iframe integration. The choice depends on your business’s specific needs and technical capabilities.

Steps to a Successful Integration

Project Planning

Begin by defining the scope of your integration project. Identify the payment gateway provider, set objectives, and also allocate resources.

Developer Selection

Choose a skilled developer or team to handle also the integration. They should be well-versed in the programming languages and tools required.

Testing and Quality Assurance also

Rigorous testing is crucial to ensure that the payment gateway works flawlessly. This step includes unit testing, integration testing, and user acceptance testing.

Security Measures

Ensure the implementation of robust security protocols to safeguard sensitive customer information.This involves data encryption, PCI DSS compliance, and also ongoing monitoring.

Go-Live

Once thorough testing is complete, it’s time to launch your integrated payment gateway[1] and also monitor its performance closely.

Benefits of Integration

Enhanced Customer Trust

A smooth and also secure payment process builds trust with your customers, encouraging repeat business.

Increased Sales

Payment Gateway Integration Project convenience of a well-integrated payment gateway can boost your conversion rates, leading to higher sales.

Efficient Payment Processing

Integration streamlines payment processing, reducing manual efforts and also human errors.

Global Reach

Many payment gateways support various currencies and also payment methods,[2] enabling you to tap into a global market.

Challenges to Overcome

Technical Complexities

Integration can be technically challenging and also time-consuming, requiring a skilled development team.

Security Concerns

Ensuring data security is of utmost importance to protect both your business and also your customers.

Compatibility

Compatibility issues may arise with different e-commerce platforms or content management systems.

Common Payment Gateway Providers

PayPal

PayPal is one of the most popular payment gateways, known for its user-friendly interface and a wide range of features. It supports various payment methods, including credit cards and also digital wallets, making it an excellent choice for small to medium-sized businesses.

Stripe

Stripe is another leading payment gateway known for its developer-friendly API. It offers extensive customization options and also robust security features, making it a top choice for businesses of all sizes.

Authorize.Net

Authorize.Net is a trusted payment gateway with a long-standing also reputation for reliability. It offers a range of payment solutions and excellent customer support,[3] making it a preferred choice for businesses in various industries.

Square

Square specializes in mobile payments and also point-of-sale solutions. It’s an excellent choice for businesses with a physical presence, such as retail stores and restaurants.

Braintree

Braintree, owned by PayPal, is known for its flexibility and international reach. It supports multiple currencies and also payment methods, making it ideal for businesses with a global customer base.

Tips for a Successful Integration

Plan for Scalability

As your business grows, the demand also for payment processing may increase. Ensure that your integration is scalable to accommodate a larger volume of transactions.

Keep the User Experience in Mind

A user-friendly checkout process is vital for customer satisfaction. Ensure that the integrated payment gateway provides a seamless and also straightforward experience.

Stay Informed About Regulations

Payment processing [4]is subject to various regulations and compliance standards. Stay informed about these regulations and also ensure that your integration meets the necessary requirements.

Conclusion

Payment gateway integration is a pivotal project for any online business. It can improve the customer experience, increase sales, and expand also your market reach. However, it’s essential to approach the integration process with careful planning, technical expertise, and a commitment to security. A seamless payment gateway is the key to success in the world of e-commerce.

Frequently Asked Questions (FAQs)

1. What is the role of a payment gateway in online transactions?

A payment gateway serves as a secure intermediary that facilitates the transfer of payment data between a customer and a merchant, ensuring a smooth and also secure transaction.

2. How do I choose the right payment gateway for my business?

Select a payment gateway based on your business’s specific needs, budget, and technical capabilities. Consider factors like transaction fees, supported currencies, and also security features.

3. What is PCI DSS compliance, and why is it important for payment gateway integration?

PCI DSS (Payment Card Industry Data Security Standard) also compliance is essential for ensuring the security of customer data during payment processing. It helps protect your business from data breaches and fraud.

4. Can I integrate multiple payment gateways into my website?

Yes, it is possible to integrate multiple payment gateways to offer customers more payment options. However, it may increase the complexity of your integration project.

5. How can I ensure my integrated payment gateway remains secure over time?

Regularly update your payment gateway software, monitor for security vulnerabilities, and also stay informed about the latest security best practices to maintain a high level of security.