AUTHOR : ADINA XAVIER

DATE : 18/10/2023

In today’s digital age, the world of commerce[1] has shifted dramatically towards the online realm. With the global expansion of e-commerce[2], payment gateways[3] play a pivotal role in ensuring smooth and secure transactions for businesses[4] consumers alike. This comprehensive report dives into the world of payment gateways[5], shedding light on their significance, functionality, the impact they have on the digital economy.

Introduction

The advent of online shopping also digital payments has revolutionized the way we conduct business. Payment gateways are the unsung heroes of this revolution. Payment Gateway Report they are the digital bridges that facilitate secure transactions between buyers also sellers in the virtual marketplace.

Understanding Payment Gateways

Payment entrance are the technology that enables electronic transactions between a customer and a merchant. They ensure that sensitive financial information, such as credit card numbers, remains confidential and secure during online transactions[1].

Importance of Payment Gateways

These digital gatekeepers are vital because they provide a safe and efficient means of processing payments. Without payment entrance, online businesses would be vulnerable to fraudulent activities and the risk of losing customers due to security concerns.

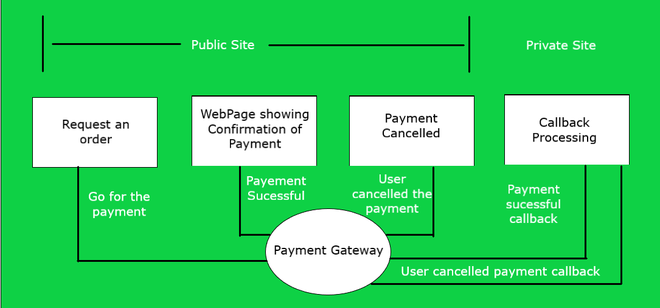

How Payment Gateways Work

Payment gateways work by encrypting data to ensure that it remains private and secure. They serve as intermediaries, passing transaction information between the merchant’s website also the payment processor.

Types of Payment Gateways

There are various types of payment gateways, including hosted gateways, self-hosted gateways, and also API-based entrance. Each has its unique features and suitability for different businesses.

Choosing the Right Payment Gateway

Choosing the appropriate payment gateway for your enterprise holds immense significance. Factors to consider include transaction fees[2], security features, the ease of integration.

Security Measures in Payment Gateways

Security stands as an absolute priority within the realm of payment gateways. Advanced encryption fraud prevention tools are implemented to safeguard sensitive data.

Integration of Payment Gateways

The integration of payment gateways with e-commerce websites is a seamless process, allowing businesses to accept payments with ease.

Payment Gateway Providers

There are several payment gateway providers in the market, each offering distinct services. Frequently favored choices encompass platforms like PayPal, Stripe, Square.

Challenges Trends in Payment Gateways

The payment gateway industry is constantly evolving, with challenges like cybersecurity threats the need for improved user experience. Keeping up with the latest trends is essential.

Benefits of a Reliable Payment Gateway

A reliable payment gateway contributes to a positive customer experience, which, in turn, boosts customer trust also loyalty.

Mobile Payment Gateways

As mobile usage surges, mobile payment gateways[3] have gained prominence, making it convenient for users to make purchases on their smartphones.

Global Expansion of Payment Gateways

Payment gateways have expanded their services globally, making cross-border transactions more accessible and efficient.

Impact on E-Commerce

Payment gateways have played a pivotal role in the growth of e-commerce by providing a secure also convenient way for consumers to make online purchases.

The Evolving Landscape of Payment Gateways

Payment Gateway Report The evolution of payment gateways has been quite remarkable from their initial inception. Initially, they were rudimentary, offering basic functionality. Today, they have evolved into sophisticated systems with advanced features. This evolution has been driven by the increasing demand for online transactions also the need for enhanced security.

Enhanced Security Features

The paramount concern for payment gateways is the security of financial information. With the rise of cyber threats, these gateways have incorporated robust security measures. They utilize encryption[4] technology, tokenization, also two-factor authentication to protect data from potential breaches.

Seamless User Experience

A crucial aspect of payment gateways is the user experience. They have become more user-friendly, offering a seamless also intuitive payment process. Customers can make purchases with just a few clicks, and this ease of use enhances the overall online shopping experience.

The Role of Payment Gateway Providers

Payment gateway providers are at the forefront of this digital revolution. They offer a range of services, catering to various business needs. Let’s explore a few of the leading payment gateway providers:

PayPal

PayPal is one of the most recognized also widely used payment gateway providers globally. It offers a variety of services, including PayPal Checkout, which allows customers to pay with their PayPal accounts or credit/debit cards.

Stripe

Stripe is known for its developer-friendly approach. It provides a range of APIs and tools that make integration easy. Stripe is popular among startups also businesses seeking customizable payment solutions.

Square

Square is known for its simplicity and versatility. It offers payment processing, hardware solutions, and even loans for small businesses.

Challenges in the Payment Gateway Industry

Despite their immense progress, payment gateways face ongoing challenges:

Cybersecurity Threats

Payment Gateway[5] Report Cybersecurity threats continue to evolve, and payment gateways must stay one step ahead. Data breaches can be catastrophic, affecting both businesses and consumers.

Competition

The payment gateway industry is highly competitive. Providers are continually innovating to gain a competitive edge. This competition can be advantageous for businesses, as it drives the development of new features and reduces costs.

Conclusion

In conclusion, payment gateways are the invisible yet critical components of the digital commerce landscape. They enable secure online transactions, contributing to the growth of e-commerce and fostering trust among consumers and businesses.

FAQs

1. Are payment gateways safe to use for online transactions?

Absolutely. Payment gateways use advanced encryption and security measures to protect your financial information.

2. How do I choose the right payment gateway for my online store?

Consider factors such as transaction fees, security features, and ease of integration to select the best payment gateway for your business.

3. Can I use a payment gateway for international transactions?

Yes, many payment gateways support international transactions, simplifying cross-border sales.

4. What are the common challenges faced by payment gateways?

Payment gateways face challenges such as cybersecurity threats and the need for enhanced user experience.

5. How do payment gateways benefit e-commerce businesses?

Reliable payment gateways enhance the customer experience, fostering trust and loyalty, which is essential for the growth of e-commerce.