AUTHOR : HANIYA SMITH

DATE : 21/10/2023

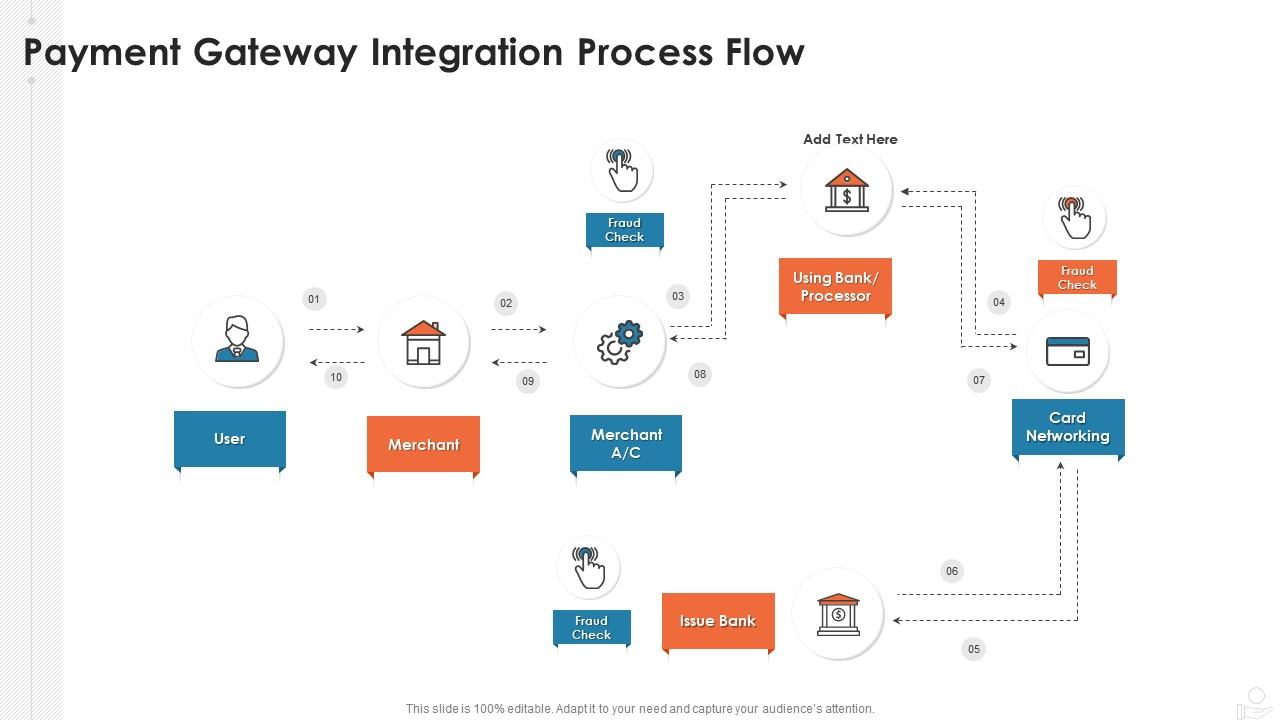

In today’s digital age, seamless payment processing is crucial for businesses of all sizes. Payment gateway integration is a pivotal step in ensuring that your customers can make secure and hassle-free online payments. In this article, we’ll explore the payment gateway integration process, breaking it down into easy-to-understand steps, and discuss the significance of this process for your business.

Introduction to Payment Gateway Integration

Payment gateway integration is the process of connecting your e-commerce platform to a payment gateway, allowing you to accept online payments securely and efficiently. It’s a fundamental aspect of online business operations and plays a crucial role in customer satisfaction and revenue generation.

Choosing the Right Payment Gateway

Selecting the appropriate payment gateway is the first and most critical step in the integration process. Factors to consider include transaction fees, supported payment methods, security features, and compatibility with your e-commerce platform.

Setting Up Your Merchant Account

To begin the integration, you must have a merchant account with the chosen payment gateway. This account facilitates the transfer of funds from customer payments to your business bank account.

Understanding API Integration

API (Application Programming Interface) integration is the technical aspect of linking your website or application to the payment gateway. This process enables data exchange and also ensures that payment information is securely transmitted.

Testing the Integration

Before going live, thorough testing is necessary to ensure that the integration functions correctly. This includes testing various payment scenarios and also addressing any issues that may arise.

Security Measures

Security is paramount in payment gateway integration. Implementing encryption, SSL certificates, and other security measures is vital to protect sensitive customer data.

Customizing the Payment Page

Customization of the payment page allows you to maintain a consistent brand also image throughout the payment process. Additionally, it contributes to fostering trust among your clientele.

User Experience Considerations

A seamless user experience is essential to prevent cart abandonment. also Ensure that the payment process is user-friendly and easy to understand.

Mobile-Friendly Integration

Given the rise in mobile shopping, it’s essential that your payment gateway is mobile-responsive. A smooth mobile payment experience is crucial for customer satisfaction.

Alternative Payment Methods

Consider offering alternative payment methods such as digital wallets, cryptocurrency, and buy now, pay later options to cater to a broader customer base.

Handling Transactions also

Efficient transaction handling is crucial for managing payments, refunds, and also chargebacks. An organized approach ensures a smooth operation.

Monitoring and Reporting also

Regularly monitor payment transactions and also generate reports to gain insights into your business’s financial health.

PCI Compliance

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is an obligatory requirement.Ensure that your payment gateway adheres to these standards.

Scaling Your Payment Gateway

As your business grows, your payment gateway should be scalable to handle also increased transaction volumes. Ensure that your chosen gateway can grow with your business.

Customizing the Payment Page

Customizing the payment page is an essential step in maintaining a consistent brand image. By incorporating your logo, color scheme, and other brand also elements, you can instill trust and familiarity in your customers. Additionally, providing a seamless transition from your website to the payment page helps reduce cart abandonment rates. Customers should feel like they are still on your website during the payment process, which is achieved through effective customization.

User Experience Considerations

The user experience during the payment process plays a pivotal role in customer satisfaction. It’s vital to ensure that the payment process is straightforward and also easy to understand. Avoid overwhelming customers with unnecessary information or complex steps. Provide clear instructions and feedback at each stage of the payment process. The checkout process should be as smooth as possible, requiring minimal effort from the customer.

Mobile-Friendly Integration

Mobile shopping has become increasingly popular, and many customers prefer making payments via their smartphones. Therefore, it’s crucial to have a mobile-friendly payment gateway integration. Ensure that your payment gateway is responsive and also optimized for various mobile devices and operating systems. A seamless mobile payment experience can significantly improve customer satisfaction and conversion rates.

Alternative Payment Methods

In the modern e-commerce landscape, offering a variety of payment options can be a game-changer. Customers have diverse preferences, and by accommodating these preferences, you can attract a wider customer base. Consider integrating alternative payment methods such as digital wallets (e.g., Apple Pay, Google Pay), cryptocurrencies, and also buy now, pay later options. Diversifying your payment options can give you a competitive edge and attract more customers.

Conclusion

Payment gateway integration is the cornerstone of successful online transactions. A well-integrated payment gateway ensures the security of customer data and a seamless payment experience. By following the outlined steps, you can streamline your payment processes and also enhance the trust of your customers.

Frequently Asked Questions

- What is a payment gateway? A payment gateway is a service that enables online businesses to accept payments from customers via credit cards, digital wallets, and also other payment methods.

- How long does payment gateway integration take? The time required for integration varies depending on factors such as the complexity of your website and the chosen payment gateway. It can take anywhere from a few days to a few weeks.

- Is PCI compliance necessary for all businesses? PCI compliance is mandatory for businesses that handle credit card transactions. It ensures the security of customer payment data.

- Can I change my payment gateway after integration? Yes, it’s possible to change your payment gateway, but it may require additional integration work and testing.

- What should I look for when choosing a payment gateway? Factors to consider include transaction fees, supported payment methods, security features, and also compatibility with your e-commerce platform.