AUTHOR : HANIYA SMITH

DATE : 20/10/2023

In today’s fast-paced digital world, e-commerce has become the go-to platform for businesses to expand their reach and increase revenue. To facilitate smooth online transactions, the integration of a secure and efficient payment gateway is of paramount importance. This article will delve into the intricacies of payment gateway integration in a website, elucidating its significance, the steps involved, and the key considerations for seamless online transactions.

Introduction

In an era where online shopping and digital transactions have become the norm, it’s essential for businesses to offer a seamless and also secure payment experience to their customers. Payment gateway integration plays a pivotal role in this, and in this article, we will explore the key aspects associated with it.

What is a Payment Gateway?

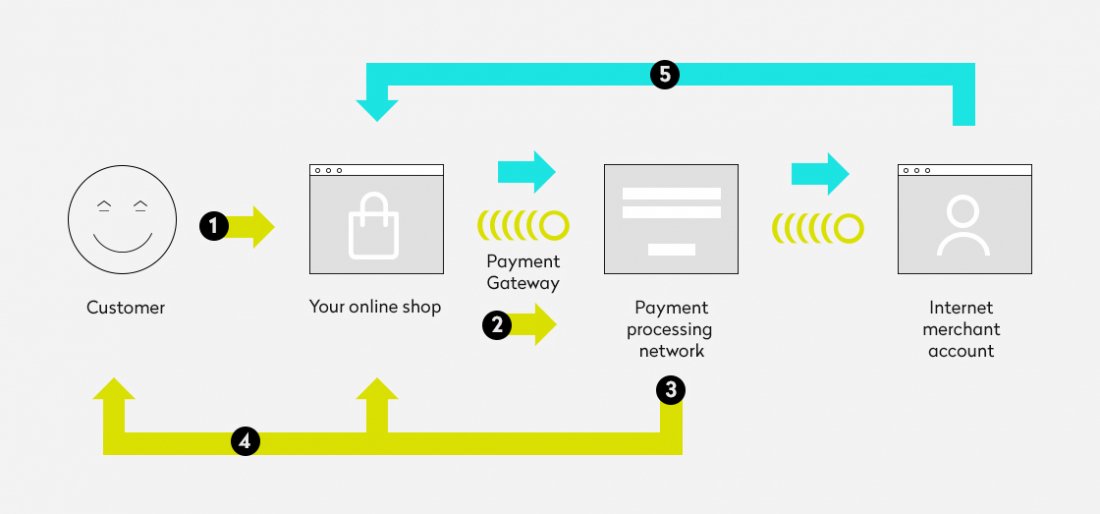

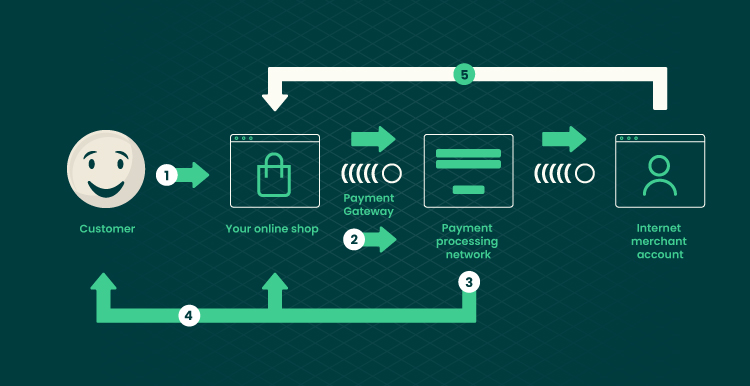

A payment gateway is a technology that acts as a bridge between a website and a financial institution, facilitating the secure transfer of payment information. It encrypts sensitive data, such as credit card numbers, ensuring that transactions are safe and also protected from potential threats.

Why Payment Gateway Integration Matters

Payment gateway integration is crucial for several reasons. Firstly, it enables businesses to accept online payments, opening up a vast customer base. Additionally, it enhances user trust and also helps in reducing cart abandonment rates, which can be detrimental to online businesses.

Types of Payment Gateways

There are various types of payment gateways available, each catering to different business needs. These include hosted payment gateways, API-based gateways, and also self-hosted gateways. Choosing the right one depends on factors like control, customization, and compliance.

Choosing the Right Payment Gateway

Selecting the appropriate payment gateway for your website is a critical decision. It involves considering factors such as transaction fees, payment methods supported, geographical coverage, and also security features. Make sure to align your choice with your business objectives.

Steps for Payment Gateway Integration

The process of payment gateway integration can be broken down into several steps:

Understanding Your Business Requirements also

Start by recognizing the unique demands and also objectives of your business.This will guide your choice of a payment gateway and its integration.

Selecting the Payment Gateway Provider

Choose a reliable payment gateway provider that aligns with your business requirements. Common choices encompass PayPal, Stripe, and also Authorize.Net.

Registration and Documentation also

Complete the necessary paperwork and also registration process [1]with the chosen provider. This includes sharing business information and bank details.

Integration Process

This step involves embedding the payment gateway into your website’s code. It requires technical expertise and also must be done accurately.

Testing the Integration

Before going live, thorough testing is essential to ensure that the payment gateway works seamlessly and securely.

Go Live!

Once you are satisfied with the integration and also testing, it’s time to make the payment gateway [2]live on your website.

Ensuring Security in Payment Gateway Integration

Safety becomes a top priority in the realm of online transactions. Utilize SSL certificates, data encryption, and follow industry standards also to protect customer data.

Mobile-Friendly Integration

With the proliferation of mobile devices, it’s vital to ensure that your payment gateway is optimized for mobile users. This enhances the overall user experience.

User Experience (UX) Matters

A seamless and also intuitive payment process can significantly impact the user experience. Ensure that the payment gateway is easy to navigate and understand.

Payment Gateway Maintenance

Regular updates and maintenance are necessary to keep your payment gateway functioning optimally. This includes security patches and also feature enhancements.

Common Integration Challenges

Despite the benefits, payment gateway [3]integration can pose challenges such as technical complexities, compatibility issues, and also compliance with evolving regulations.

The Cost Factor

While integrating a payment gateway, it’s important to consider the associated costs, including transaction fees and also subscription charges.

International Considerations

If your business operates internationally, ensure that the payment gateway supports multiple currencies and also complies with global regulations.

The Future of Payment Gateway Integration

As technology advances, payment gateway integration is expected to become even more streamlined and also secure, further enhancing the online shopping experience.

Conclusion

Payment gateway integration is the cornerstone of a successful e-commerce business. It ensures secure and convenient transactions, thereby boosting customer trust and also satisfaction. By selecting the right payment gateway and also following best practices for integration, businesses can thrive in the digital marketplace.

FAQs

1. What is a payment gateway? A payment gateway [4]is a technology that facilitates secure online transactions by encrypting and also transferring payment information between a website and a financial institution.

2. What’s the strategy for picking the perfect payment gateway for my enterprise?To choose the right payment gateway, consider factors such as transaction fees, supported payment methods, geographical coverage, and security features.

3. Why is security crucial in payment gateway integration? Security is essential to protect customer data and build trust. Utilize SSL certificates, encryption, and also adhere to industry standards.

4. What are some common challenges in payment gateway integration? Common challenges include technical complexities, compatibility issues, and also compliance with evolving regulations.

5. How can I ensure a seamless user experience with my payment gateway? Ensure that the payment gateway is mobile-friendly, intuitive, and also easy to navigate to enhance the user experience.