AUTHOR : HANIYA SMITH

DATE : 20/09/23

In the digital age, where online transactions have become the norm, understanding the nuances of payment processing[1] is essential for businesses and consumers alike. Two terms that often cause confusion are “Payment Aggregator[2]“ and “Payment Gateway.” In this article, we will delve into these concepts, exploring their differences and similarities, and shedding light on their crucial roles in facilitating online payments.

Introduction

The world of e-commerce and online transactions has witnessed a significant transformation in recent years. With various payment solutions available, it’s crucial to differentiate between payment aggregators[3] and payment gateways[4] to make informed choices for your business.

What Is a Payment Gateway?

A payment gateway[5] is a technology that acts as a bridge between an online store and a financial institution. It enables the secure transmission of payment data during a transaction. Here’s how it works:

How Payment Gateways Work

- The customer initiates a payment by providing their payment details.

- The payment gateway encrypts this data to ensure security.

- The encrypted data is transmitted to the payment processor.

- The processor communicates with the customer’s bank to verify the transaction.

- Once approved, the payment gateway confirms the transaction to the merchant.

Key Features of Payment Gateways

- Secure data encryption

- Compatibility with various payment methods

- Real-time transaction processing

- Fraud prevention measures

What Is a Payment Aggregator?

A payment aggregator, on the other hand, is a service provider that simplifies the payment process for businesses by aggregating transactions from multiple merchants into a single merchant account. Let’s explore its operation:

How Payment Aggregators Operate

- Merchants sign up with the payment aggregator.

- The aggregator provides a shared merchant account.

- Customers make payments, which are aggregated into this account.

- The aggregator disburses the funds to individual merchants.

Key Features of Payment Aggregators

- Streamlined onboarding process

- Fast access to payment processing

- Shared merchant account

- Simplified fee structure

Payment Aggregator vs. Payment Gateway: A Comparative Analysis

To gain a better understanding, let’s compare these two payment solutions across several crucial aspects:

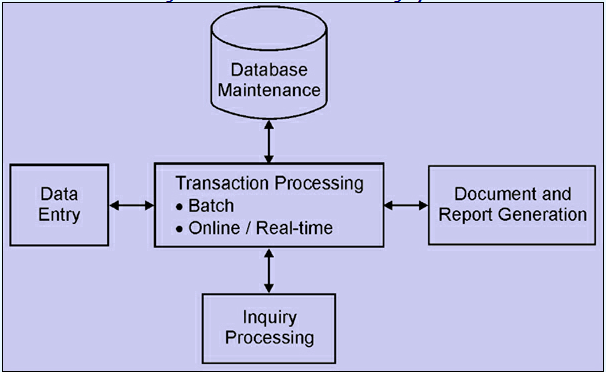

Transaction Processing

Payment gateways process transactions in real-time, providing instant authorization. Payment aggregators, on the other hand, batch transactions, which may lead to delayed access to funds.

Merchant Accounts

Payment gateways require merchants to have their own merchant accounts, while payment aggregators offer[1] shared accounts to multiple businesses.

Fees and Costs also

Payment gateways often have a more complex fee structure, including setup fees and also monthly charges. Payment aggregators usually charge a simplified flat fee per transaction.

Integration

Payment gateways may require more extensive integration efforts, while payment aggregators offer quick and easy setup also.

When to Choose a Payment Gateway

Choose a payment gateway if:

- You require real-time transaction processing.

- Your business prefers having its own merchant account.

- You can manage the associated costs and integration efforts also.

When to Choose a Payment Aggregator

Opt for a payment aggregator if:

- You want a streamlined onboarding process.

- You prefer a simplified fee structure.

- Your business can accommodate batch transaction processing.[2]

Advantages of Using a Payment Gateway

- Fast transaction processing.

- Full control over merchant accounts.

- Suitable for businesses with high transaction volumes.

Advantages of Using a Payment Aggregator

- Simplified setup and onboarding also.

- Predictable flat-rate fees.

- Ideal for small to medium-sized businesses.

Common Misconceptions

There are several misconceptions about payment aggregators and gateways, such as assuming they are interchangeable. It’s essential to understand their unique roles and features also.

Security Concerns

Both payment gateways and aggregators prioritize security. However, businesses must ensure PCI compliance and also adopt additional security measures to protect sensitive data.

Case Studies

Exploring real-world examples can provide insights into how businesses have benefited from choosing the right payment solution.[3]

Best Practices for Online Payment Processing

To ensure a seamless payment experience for your customers, follow best practices, including optimizing your checkout process and also enhancing security measures.

The Future of Payment Processing

As technology continues to evolve, so will payment processing methods. Stay updated on industry trends and also innovations to adapt to changing consumer preferences.

Conclusion

In conclusion, payment aggregators and payment gateways serve distinct roles in facilitating online payments. The choice between them depends on your business’s specific needs and also priorities. By understanding their differences, you can make informed decisions to enhance your payment processing capabilities.[4]

Frequently Asked Questions

- What is the primary difference between a payment aggregator and also payment gateway?

- Payment aggregators simplify the payment process by aggregating transactions into a shared merchant account, while payment gateways facilitate real-time transaction processing with individual merchant accounts.

- Are payment aggregators more cost-effective than payment gateways?

- Payment aggregators often offer a simplified fee structure, making them cost-effective for small to medium-sized businesses. However, the choice depends on your transaction volume and also specific requirements.

- Is PCI compliance necessary for businesses using payment aggregators?

- Yes, businesses using payment aggregators must ensure PCI compliance and also take additional security measures to protect customer data.

- Can I switch between a payment aggregator and also payment gateway as my business grows?

- Yes, businesses can transition between payment solutions based on their evolving needs. However, it’s essential to plan the transition carefully to minimize disruptions.