AUTHOR : ADINA XAVIER

DATE : 21/09/2023

In the ever-evolving landscape of e-commerce[1] and online businesses,[2] payment gateways[3] play a pivotal role in facilitating secure and convenient transactions. However, as businesses grow and diversify, it becomes essential to explore payment gateway[4] alternatives that offer flexibility, cost-effectiveness, and enhanced user experiences. In this article, we’ll delve into the world of payment gateway alternatives[5], shedding light on various options available to businesses looking to expand their horizons.

Understanding the Importance of Payment Gateways

Before we dive into alternative solutions, let’s briefly understand the significance of payment gateways in the digital realm. Payment gateways are like digital cashiers, processing transactions between customers and merchants securely. They encrypt sensitive data, verify transactions, and ensure that funds are transferred seamlessly. They are indispensable for online businesses, but they aren’t the only option.

Traditional Payment Gateways: The Basics

Traditional payment gateways, such as PayPal and Stripe, have been the go-to choice for countless businesses. They offer a reliable way to accept credit card payments and are known for their security measures. However, there are drawbacks, including transaction fees and limited customization options.

The Need for Alternatives

So, why seek payment gateway alternatives when these giants are available? The answer lies in diversification[1] and flexibility. Businesses need to adapt to changing customer preferences, and sometimes, traditional gateways may not provide the desired flexibility or cost-effectiveness.

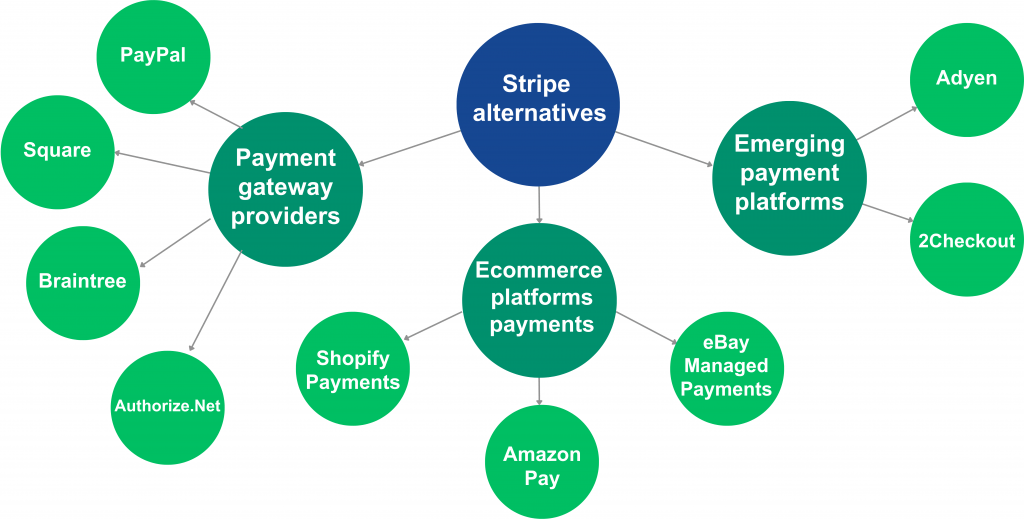

Exploring Payment Gateway Alternatives

1. Cryptocurrency Payments

Cryptocurrencies like Bitcoin and Ethereum have gained popularity as alternative payment methods. They offer fast, secure, and borderless transactions. Integrating cryptocurrency payments can attract tech-savvy customers and open up global markets.

2. Mobile Wallets

Mobile wallets such as Apple Pay and Google Pay have become a common sight in the digital payment[2] landscape. They provide convenience and enhanced security, making them a valuable alternative for businesses aiming to improve the checkout experience.

3. Direct Bank Transfers

Direct bank transfers or ACH payments can reduce transaction costs significantly. They are ideal for B2B transactions and recurring payments. Businesses can avoid credit card fees and ensure timely payments.

4. Buy Now, Pay Later Services

Buy Now, Pay Later (BNPL) services like Klarna and Afterpay are gaining traction among online shoppers. These services offer flexible payment options, attracting budget-conscious consumers.

5. Digital Wallet Aggregators

Digital wallet aggregators like PayPal-owned Braintree consolidate various payment methods[3] into a single platform. This simplifies the checkout process and caters to a broader audience.

Implementing Payment Gateway Alternatives

Once you’ve identified suitable payment gateway alternatives, the next step is implementation. Here are some key considerations:

1. Integration

Ensure seamless integration with your e-commerce[4] platform or website. Compatibility and ease of use are crucial for a positive customer experience.

2. Security

Prioritize the security of both customer data and transactions. Choose alternatives with robust encryption and fraud prevention measures.

3. User Experience

Evaluate the user experience offered by the chosen alternative. A smooth checkout process can reduce cart abandonment rates and boost sales.

4. Cost Analysis

Compare transaction fees, currency conversion rates, and any other associated costs. Choose alternatives that align with your budget and revenue goals.

The Evolution of Payment Gateway Alternatives

As technology advances and consumer preferences evolve, the landscape of payment gateway alternatives continues to expand. Let’s delve deeper into the evolving world of these alternatives and how they can benefit businesses:

Embracing Contactless Payments

In a post-pandemic world, contactless payments have gained immense popularity. Contactless cards, mobile apps, and even wearable devices enable customers to make quick and secure payments without physical contact. Businesses that adopt contactless payment options can offer their customers a safer and more convenient shopping experience.

The Role of Artificial Intelligence

Artificial Intelligence (AI) is transforming payment processing. AI-driven fraud detection systems are becoming increasingly sophisticated, helping businesses identify and prevent fraudulent transactions in real-time. Moreover, AI-powered chatbots are enhancing customer support by addressing payment-related queries promptly.

The Future of Payment Gateway Alternatives

The payment gateway landscape is in a constant state of flux, driven by technological innovation and changing consumer preferences also.

1. Decentralized Finance (DeFi) Solutions

DeFi is gaining momentum, and decentralized payment gateways are on the horizon. These platforms leverage blockchain technology to offer secure, transparent, and borderless transactions, bypassing traditional financial intermediaries.

2. Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is poised to become a mainstream security feature in payment processing[5]. It offers a high level of security while enhancing the user experience.

3. Integration with E-commerce Platforms

Payment gateway alternatives will continue to integrate seamlessly with popular e-commerce platforms like Shopify, WooCommerce, and Magento. This integration ensures a consistent and user-friendly shopping experience.

Conclusion

In the dynamic world of online commerce, staying ahead of the curve is essential. While traditional payment gateways serve their purpose, exploring payment gateway alternatives can open new avenues for your business. Whether it’s embracing cryptocurrencies, mobile wallets, or innovative BNPL services, diversification can lead to increased revenue and customer satisfaction.

FAQs

- Are payment gateway alternatives secure? Payment gateway alternatives are designed with security in mind. However, it’s crucial to choose reputable options and implement additional security measures as needed.

- Do payment gateway alternatives support international transactions? Many payment gateway alternatives offer international capabilities, making it easier to expand your business globally.

- Are there any hidden fees associated with payment gateway alternatives? Some alternatives may have fees, so it’s essential to carefully review their pricing structures and terms.

- Can I use multiple payment gateway alternatives simultaneously? Yes, it’s possible to integrate multiple alternatives to provide customers with various payment options.

- How can I decide which payment gateway alternative is right for my business? To make an informed decision, consider your target audience, transaction volume, and budget. Test different alternatives and gather feedback from customers to determine the best fit.