AUTHOR : EMILY PATHAK

DATE : 21 – 09 – 2023

In today’s digital age, where e-commerce has become the norm and cash is no longer king, a robust and efficient payment gateway is the backbone[1] of any online business. In the vast landscape of e-commerce, Australia[2] stands out as a thriving market with its unique set of challenges and opportunities[3]. This article delves into the world of payment gateways in Australia[4], exploring the key players, regulatory landscape, and also the role they play in simplifying online transactions[5].

Introduction

Understanding Payment Gateways

In the digital realm, a payment gateway acts as the virtual bridge that connects customers, businesses, and financial institutions. It enables the secure and efficient transfer of funds, allowing customers to make online payments for products and also services.

The Significance of Payment Gateways in E-commerce

In the context of e-commerce, payment gateways{1} are the linchpin that ensures smooth and secure transactions. They are pivotal in creating a seamless shopping experience for customers, which, in turn, contributes to higher conversion rates and also customer satisfaction.

The Australian E-commerce Landscape

E-commerce Growth Trends

Australia’s e-commerce sector{2} has witnessed remarkable growth in recent years. With the convenience of online shopping becoming increasingly appealing to consumers, businesses have had to adapt and expand their online presence.

Unique Challenges Faced by Australian Businesses{3}

While the e-commerce boom presents lucrative opportunities, Australian businesses face distinct challenges, such as geographic isolation, diverse customer bases, and the need for reliable payment solutions tailored to the local market.

What is a Payment Gateway?

The Basics Explained

A payment gateway is essentially a virtual point of sale that securely processes online payments{4}. It encrypts sensitive data, such as credit card information, ensuring that transactions remain confidential and protected from cyber threats.

How Payment Gateways Ensure Security

Payment gateways employ encryption protocols and security certificates to safeguard data. They also facilitate two-factor authentication and fraud detection measures to bolster security further.

Key Players in the Australian Payment Gateway Market

Industry Leaders

Australia boasts a competitive payment gateway market with established leaders who offer a wide range of services. These industry giants have a strong track record of providing reliable payment solutions.

Emerging Players

In addition to established players, there is a growing number of innovative start-ups in the Australian payment gateway [5]sector. These emerging players introduce fresh ideas and also competition, ultimately benefiting businesses and consumers.

Choosing the Right Payment Gateway

Factors to Consider

Selecting the most suitable payment gateway is a critical decision for any e-commerce business. Factors to consider include transaction fees, payment methods supported, scalability, and compatibility with existing systems.

Tailoring Payment Solutions to Your Business

One size does not fit all in the world of payment gateways. Tailoring your payment solution to align with your business needs and also customer preferences can lead to improved customer satisfaction and increased revenue.

Regulations and Compliance

The PCI DSS (Payment Card Industry Data Security Standard) in Australia is a critical framework for safeguarding sensitive payment card data, ensuring the security and integrity of electronic transactions within the nation.

To ensure the security of payment card data, Australia follows the Payment Card Industry Data Security Standard (PCI DSS). Compliance with these standards is crucial for businesses handling cardholder information.

The Role of Regulatory Bodies

Various regulatory bodies oversee payment gateways in Australia, ensuring that they adhere to industry standards and consumer protection regulations.

The Customer Experience

Seamless Transactions

A key aspect of payment gateways is providing customers with a seamless and also hassle-free transaction experience. This not only boosts customer satisfaction but also encourages repeat business.

Building Trust through User-Friendly Payment Processes

Trust is paramount in e-commerce. Payment gateways that offer intuitive and also user-friendly interfaces instill confidence in customers, ultimately leading to higher sales.

Integration and Compatibility

E-commerce Platforms and Payment Gateways

Integration between your chosen e-commerce platform and also payment gateway is vital for smooth operations. Compatibility issues can result in lost sales and frustrated customers.

API Integration for a Smoother Experience

Application Programming Interface (API) integration allows for real-time data exchange between your website and also the payment gateway, ensuring a seamless and responsive checkout process.

Security Measures

Encryption and Data Protection

Payment gateways employ advanced encryption techniques to protect sensitive data during transmission. This level of security is crucial in preventing data breaches.

Fraud Prevention

Robust payment gateways incorporate fraud detection algorithms that identify and also flag suspicious transactions, minimizing the risk of financial loss.

Costs and Fees

Understanding Pricing Models

Payment gateway providers offer various pricing models, including flat-rate fees, tiered pricing, and also pay-as-you-go options. Understanding these models is essential to manage costs effectively.

Hidden Costs to Watch Out For

In addition to standard fees, some payment gateways may have hidden charges. It’s essential to thoroughly review pricing agreements to avoid unexpected expenses.

Case Studies

Success Stories of Businesses Leveraging Payment Gateways

Explore real-life success stories of Australian businesses that have harnessed the power of payment gateways to streamline their operations and drive growth.

Lessons Learned from Failures

Learning from failures is equally important. Analyze cases where businesses faced challenges in choosing the right payment gateway and also the lessons they offer.

Future Trends

The Evolution of Payment Gateways

As technology continues to advance, payment gateways are likely to evolve. Explore the upcoming trends and innovations that will shape the future of online payments in Australia.

What Lies Ahead for Australian E-commerce

In the ever-changing landscape of e-commerce, staying ahead of the curve is crucial. Discover what the future holds for Australian businesses in the e-commerce realm.

Conclusion

The Vital Role of Payment Gateways

In the digital age, payment gateways are the unsung heroes of e-commerce, ensuring that online transactions are secure, efficient, and user-friendly. They empower Australian businesses to thrive in the competitive world of online commerce.

FAQs (Frequently Asked Questions)

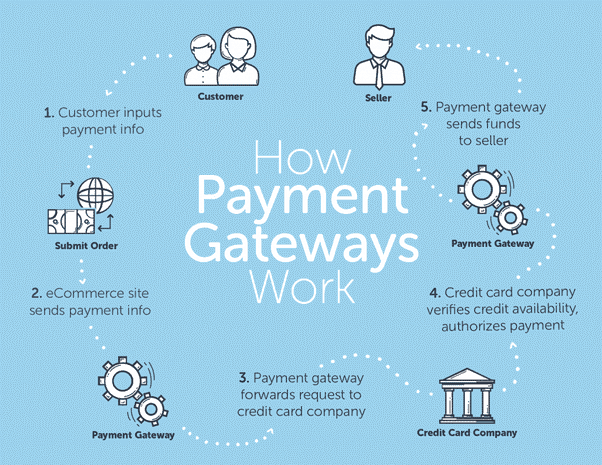

- Q: How do payment gateways work?

- A: Payment gateways facilitate online transactions by securely transmitting payment data between the customer, merchant, and financial institutions.

- Q: What is the average transaction fee for payment gateways in Australia?

- A: Transaction fees vary, but they typically range from 1.5% to 3% per transaction, plus a fixed fee.

- Q: Can I use multiple payment gateways for my online store?

- A: Yes, it’s possible to integrate multiple gateways, but it can be complex. Consider your business needs carefully.

- Q: How can I protect my business from chargebacks?

- A: Clear refund policies, excellent customer service, and transparent communication can help reduce chargeback incidents.

- Q: What is the future of payment gateways?

- A: The future holds innovations like mobile payment solutions, cryptocurrency acceptance, and advanced fraud detection to enhance security and convenience.