AUTHOR : ADINA XAVIER

DATE : 20/09/2023

In our modern, rapidly changing digital landscape, payment mechanisms[1] have undergone substantial transformations. Gone are the days of traditional cash transactions[2] and even physical credit cards[3]. The emergence of payment as a platform has not only streamlined financial transactions[4] but has also opened up new possibilities for businesses and consumers alike. In this article, we will delve into the concept of this also explore how it is shaping the future of commerce[5].

The Evolution of Payment Methods

Before we dive into the world of payment as a platform, let’s take a moment to reflect on the evolution of payment methods. From barter systems to cash, checks, and credit cards, each era brought its own set of challenges also conveniences. However, as technology advanced, so did the way we exchange value.

The Digital Payment Revolution

With the advent of the internet, digital payment methods started gaining traction. Online banking, electronic funds transfer, and digital wallets began to replace physical cash. While these innovations improved convenience, they were often tied to specific platforms and had limitations in terms of cross-border transactions also interoperability.

What Is Payment as a Platform?

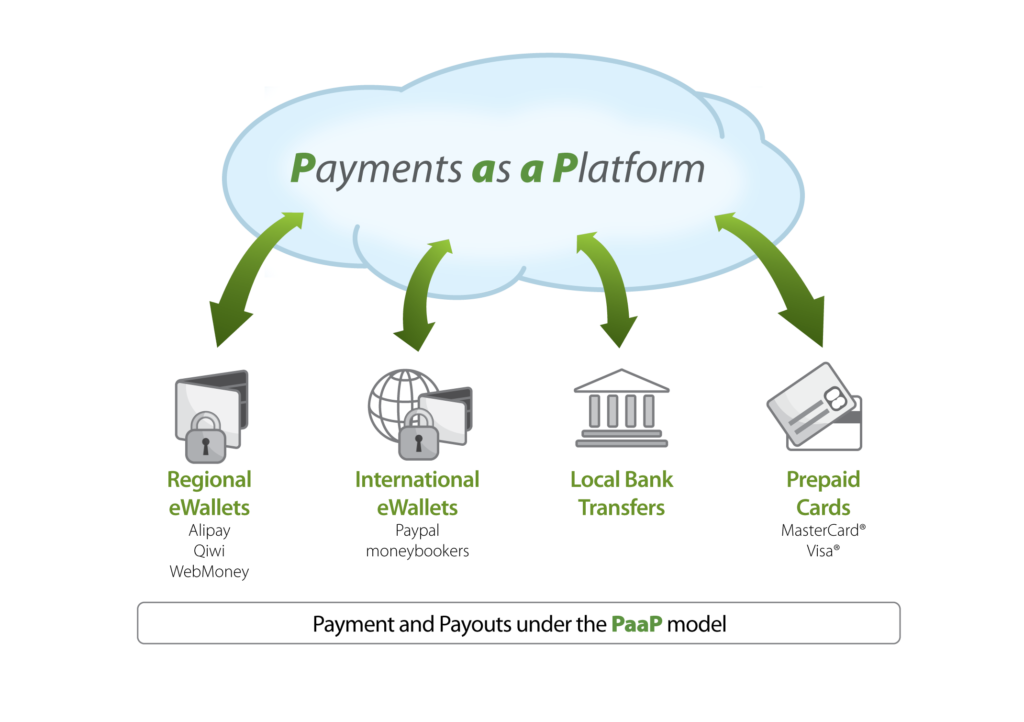

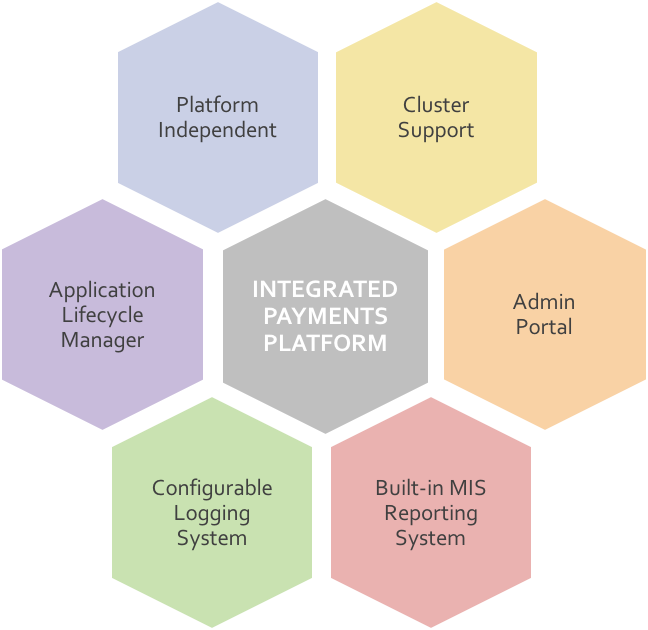

It represents a paradigm shift in the world of digital transactions. Instead of being a standalone service, payments are integrated into various platforms and ecosystems. This integration allows businesses and individuals to make payments seamlessly within the context of their activities, whether it’s shopping, gaming, or social networking[1].

Key Components of Payment as a Platform

To understand it better, let’s break down its key components:

1. Interoperability

Payment as a platform fosters interoperability, enabling users to make transactions across different applications and platforms. This means you can make a payment within a social media app[2], buy products in an e-commerce store, also pay for your favorite game all without leaving the respective platforms.

2. Security

Security is paramount in the digital payment[3] landscape. This prioritizes robust security measures, such as encryption and multi-factor authentication, to ensure that your financial data remains safe and secure.

3. User Experience

A seamless user experience is a hallmark of it. It eliminates the need for users to switch between multiple apps or websites to complete a transaction. This streamlined experience enhances convenience also encourages more frequent use.

4. Global Reach

This transcends geographical boundaries, making it easier for businesses to expand their customer base globally. Users from different parts of the world can make payments in their local currencies without hassle.

How Payment as a Platform Benefits Businesses

Businesses are quick to recognize the advantages of payment as a platform.

1. Increased Conversion Rates

The ease of making payments directly within the platform increases conversion rates. Customers are more likely to make impulsive purchases when the payment process[4] is frictionless.

2. Enhanced Customer Loyalty

Seamless payment experiences contribute to higher customer satisfaction and loyalty. Users are more likely to return to a platform that offers hassle-free transactions.

3. Access to Valuable Data

Payment platforms gather a wealth of transaction data. Analyzing this information provides valuable insights into customer behavior and preferences, empowering businesses to make well-informed choices.

Payment as a Platform in Action

To illustrate the concept, let’s take a look at a practical example.

Imagine you are using a ride-sharing app to book a ride. With this, you can not only book the ride but also pay for it within the same app. No need to switch to a different payment app or enter your credit card details again.

The Future of Payment

As technology continues to advance, it is set to evolve even further. We can expect to see innovations such as decentralized finance (DeFi)[5], cryptocurrencies, and blockchain technology playing a significant role in shaping the future of digital transactions.

The Role of Cryptocurrencies in Payment Platforms

Cryptocurrencies have garnered significant attention in the realm of digital transactions. They offer unique advantages that align well with the principles of it.

1. Decentralization

Cryptocurrencies function within decentralized networks, eliminating the requirement for intermediaries such as financial institutions. This decentralized nature aligns with the philosophy of payment as a platform, where transactions occur directly between users.

2. Cross-Border Transactions

One of the challenges of traditional payment methods is the complexity and cost associated with cross-border transactions. Cryptocurrencies simplify this process, enabling users to send and receive funds across borders with ease.

3. Security and Transparency

Blockchain technology, which underpins cryptocurrencies, offers robust security and transparency. Transactions are recorded on a public ledger, making it nearly impossible to alter or manipulate payment data.

4. Lower Transaction Fees

Traditional financial institutions often charge fees for transactions. Cryptocurrencies, on the other hand, can significantly reduce these fees, making transactions more cost-effective for both businesses and consumers.

Conclusion

Payment as a platform is revolutionizing the way we conduct digital transactions. Its emphasis on interoperability, security, and user experience is transforming the payment landscape, benefiting both businesses and consumers. As we look to the future, the possibilities are endless, and payment as a platform is at the forefront of this exciting journey.

FAQs

- Is payment as a platform safe for online transactions?

Yes, payment as a platform prioritizes security with encryption and multi-factor authentication to ensure the safety of online transactions. - Can I use payment as a platform for international transactions?

Absolutely. Payment as a platform allows for seamless cross-border transactions, making it convenient for global users. - How does payment as a platform benefit businesses?

Payment as a platform increases conversion rates, enhances customer loyalty, and provides valuable transaction data for businesses to leverage. - What role will cryptocurrencies play in payments as a platform?

Cryptocurrencies are expected to play a significant role in the future of payment as a platform, offering new possibilities for decentralized transactions.