AUTHOR : ADINA XAVIER

DATE : 12/09/2023

In today’s fast-paced financial world[1], understanding the concept of it is crucial for both individuals and businesses. These financial institutions[2], often operating on the edge of the financial industry[3], come with their own set of challenges and opportunities. In this comprehensive guide, we will explore the world of it, discussing what they are, why they exist, and how to navigate the complex terrain they represent.

Introduction

In a world where financial opportunities[4] are abundant, they have emerged as unconventional yet potentially rewarding options. Understanding what these banks are, why they exist, and how they function is essential for anyone seeking to make informed financial decisions[5].

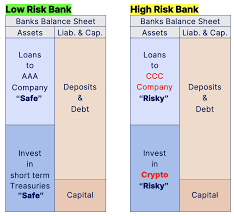

Defining High-Risk Banks

It is a financial institutions that operate in a riskier manner compared to traditional banks. They often cater to clients who are willing to take on higher levels of risk in exchange for the potential for greater returns.

The Factors Behind High Risk

Several factors contribute to the nature of these banks. These include volatile markets, unconventional investment strategies, and a client base that is comfortable with risk.

Types of High-Risk Banks

Investment Banks

Investment banks are known for their involvement in capital markets, mergers and acquisitions, and other high-stakes financial activities. They often deal with large sums of money and are considered high-risk due to their exposure to market fluctuations.

Online Banks

Online banks , which operate exclusively through digital platforms, offer convenience but can also pose related to cybersecurity and the absence of physical branches.

Foreign Banks

Operating in foreign jurisdictions often encounter unique regulatory challenges and currency risks, making them high-risk entities for investors.

Why Do People Choose High-Risk Banks?

Clients choose this for various reasons, including the potential for higher returns, diversification of their portfolios, and also access to specialized financial services.

The Pros and Cons of High-Risk Banks

Pros

- Higher Potential Returns: It offer the potential for substantial gains, attracting investors seeking above-average returns on their investments.

- Diversification: Investing in this can diversify a portfolio, spreading risk across different asset classes.

Cons

- Higher Risk: As the name suggests, these come with increased risk, making them unsuitable for risk-averse investors.

- Lack of Stability: It can be more susceptible to economic downturns and also market volatility.

How to Identify a High-Risk Bank

Identifying involves conducting thorough research, considering factors such as their investment strategies, client base, and regulatory history.

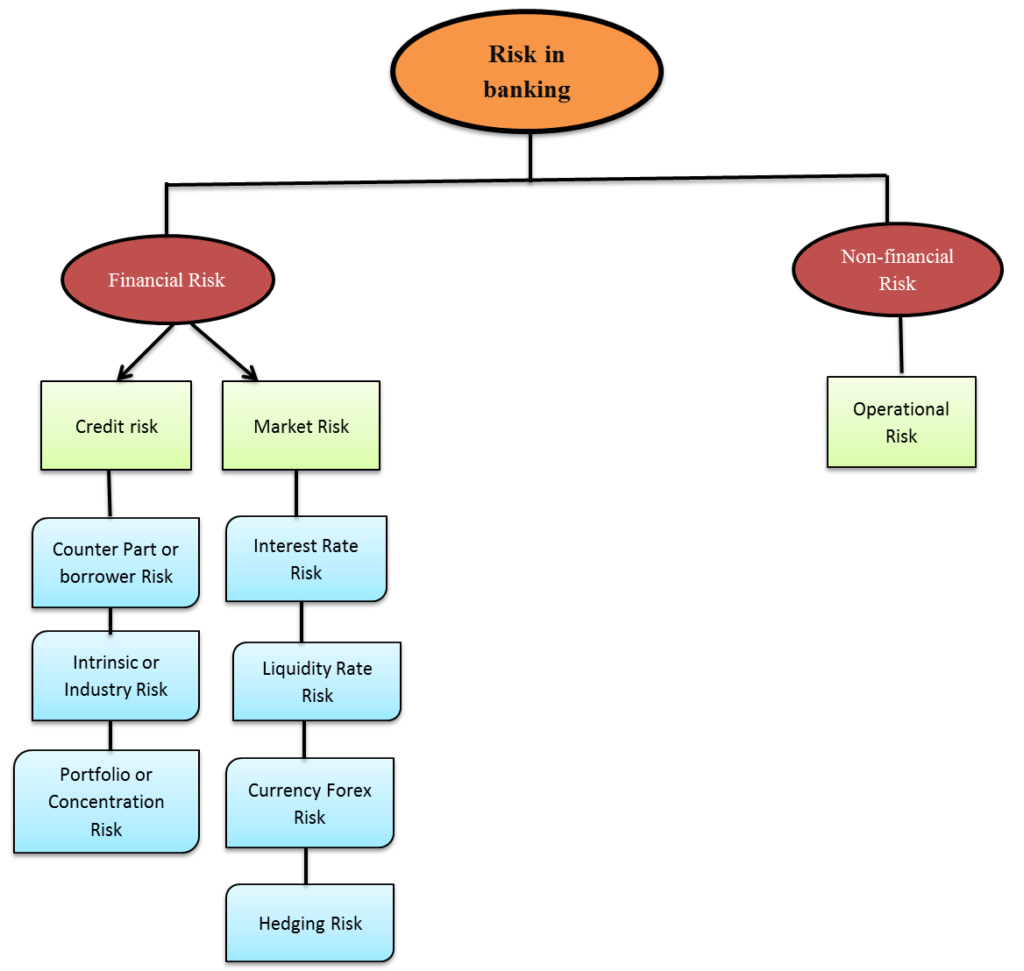

Regulations and Oversight

This are subject to regulatory oversight to mitigate risks and protect investors. Understanding the regulatory framework is crucial when considering investments[1] in these banks.

Managing Risk with High-Risk Banks

Investors can manage risk by diversifying their portfolios, staying informed about market trends, and working with experienced financial advisors.

Investing with High-Risk Banks

Before investing, individuals and businesses should assess their risk tolerance and financial goals to determine if align with their investment objectives.

High-Risk Banks in the Global Economy

These banks play a significant role in the global economy, influencing financial markets[2] and also providing opportunities for growth and innovation.

Case Studies: High-Risk Bank Success Stories

Explore real-world examples of individuals and organizations that have thrived by strategically engaging with high-risk banks.

The Future of High-Risk Banks

As financial landscapes evolve, they are likely to adapt and innovate, presenting new opportunities and challenges for investors.

Risk Mitigation Strategies

When considering investments in this it’s essential to have a well-thought-out risk mitigation strategy[3]. Here are some strategies to help you manage the inherent risks:

Diversification

Diversifying your investment portfolio is a fundamental risk mitigation technique. By spreading your investments across various asset classes, including this stocks, bonds, and real estate, you can reduce the impact of a poor-performing investment on your overall portfolio.

Due Diligence

Before committing your funds in it , conduct thorough due diligence. This involves researching the bank’s financial health, historical performance, and regulatory compliance[4]. Reviewing the bank’s annual reports and seeking advice from financial experts can provide valuable insights.

Risk Tolerance Assessment

Understanding your own risk tolerance is crucial. High-risk investments may not be suitable for everyone, and also it’s essential to align your investments.

Conclusion

It offer unique opportunities for those willing to navigate the complexities of the financial world. Understanding the risks and rewards is essential for making informed investment decisions.

Frequently Asked Questions (FAQs)

- Are high-risk banks suitable for conservative investors? They are generally not suitable for conservative investors, as they involve a higher degree of risk.

- What are the key factors to consider when investing in high-risk banks? Key factors to consider include your risk tolerance, investment goals, and the bank’s track record.

- Do They provide higher returns compared to traditional banks? They have the potential for higher returns, but they also come with higher risks.

- How can I assess the stability of It ? Assess stability by examining its financial statements, regulatory history, and client reviews.

- What role do regulations play in this sector? Regulations are crucial for mitigating risks and protecting investors in this sector.