AUTHOR : HANIYA SMITH

DATE : 15/09/2023

In the current era of digitalization, electronic transactions have seamlessly woven themselves into the fabric of our daily existence. From shopping to bill payments, we rely on the convenience of electronic transactions. However, not all transactions are created equal. Some fall under the category of high-risk payments. In this article, we will delve into the world of high-risk payments, exploring what they are, why they exist, and how businesses and consumers can navigate this complex landscape.

Defining High-Risk Payments

High-risk payments[1], also known as high-risk transactions, are financial transactions[2] that carry a higher probability of fraud, disputes, or chargebacks. These transactions often involve industries or businesses that are more susceptible to fraudulent activities. Examples include online gambling, adult entertainment, and also certain e-commerce niches[3].

Why Do High-Risk Payments Exist?

The existence of high-risk payments is primarily due to the nature of the businesses[4] involved. Industries that deal with a high volume of chargebacks or have a higher likelihood of customer disputes are categorized as high risk by payment processor[5]s and also financial institutions. This categorization helps protect both businesses and consumers from potential financial losses.

Challenges in High-Risk Payment Processing

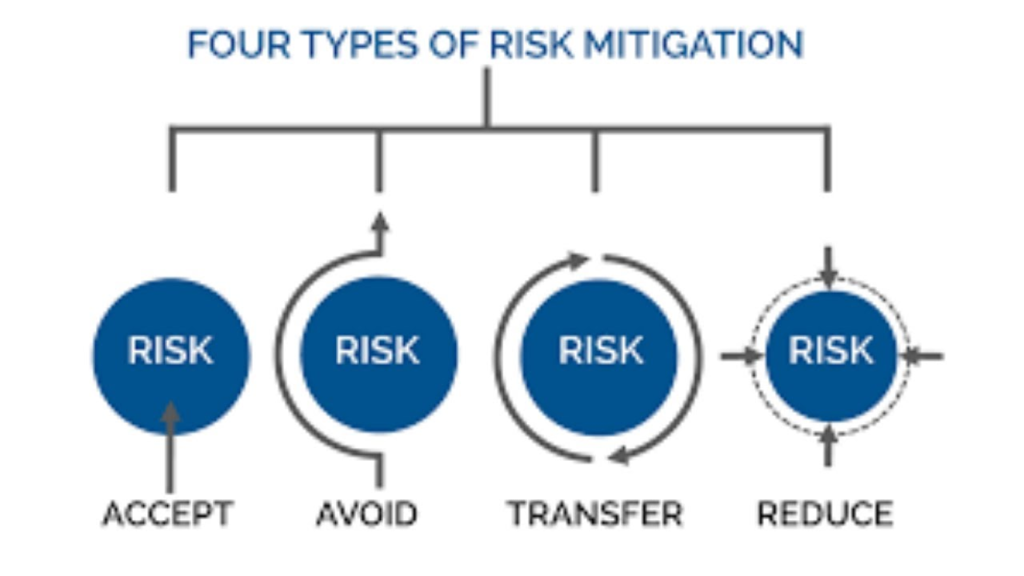

Risk Mitigation

For businesses operating in high-risk industries, risk mitigation is crucial. Payment processors implement stringent measures to reduce the risk associated with these transactions. This includes thorough identity verification, monitoring of transaction patterns, and also implementing fraud detection systems.

Higher Fees

One of the most significant challenges for businesses in high-risk industries is the higher processing fees[1] Payment processors charge higher fees to compensate for the increased risk they undertake when handling these transactions. This can impact a business’s profitability.

Regulatory Compliance

High-risk industries often face stricter regulatory requirements. Businesses must navigate complex compliance standards, which can vary from one region to another.In the modern digital landscape, online transactions have firmly entrenched themselves as an indispensable aspect of our daily routines. Non-compliance with these standards can result in legal ramifications and also monetary sanctions.

Solutions for Businesses

Choose the Right Payment Processor

Selecting a payment processor experienced in handling high-risk transactions is essential. These processors have the expertise and also tools to mitigate risk effectively. Research and compare processors to find the one that suits your business needs.

Implement Robust Fraud Prevention

Invest in advanced fraud prevention systems to protect your business and also customers. These systems can identify suspicious activities and prevent fraudulent transactions, reducing chargeback rates.

Stay Informed About Regulations

To ensure compliance, stay updated on the regulatory landscape in your industry. Consult legal experts[2] if needed to avoid costly legal issues.

Protecting Consumers

Vigilance in Online Shopping

Consumers should exercise caution when making online purchases, especially in high-risk industries. Check the credibility of the website, read reviews, and also use secure payment methods.

Reporting Suspicious Activities

If consumers suspect fraudulent transactions or activities, they should promptly report them to their financial institution. Timely reporting can prevent further losses.

Risk Factors in High-Risk Payments

Payment Fraud

One of the most significant risks in high-risk payments is payment fraud. Fraudsters often target these industries due to their perceived vulnerabilities. They may use stolen credit card information, conduct identity theft, or engage in other fraudulent activities to make unauthorized transactions.

Chargebacks

Chargebacks are a common concern for businesses in high-risk industries. A chargeback occurs when a customer disputes a transaction, leading to a refund. High chargeback rates can harm a business’s reputation and financial stability.

Legal Challenges

Navigating the legal landscape[3] in high-risk industries can be challenging. Laws and also regulations can change frequently, and businesses must adapt to remain compliant. Failure to do so can result in lawsuits and fines.

Payment Processing Solutions

High-Risk Merchant Accounts

Many payment processors offer specialized high-risk merchant accounts. These accounts are tailored to the unique needs of high-risk businesses, providing them with the tools and also flexibility to manage their transactions effectively.

Chargeback Prevention

To reduce chargeback rates, businesses can implement strategies such as clear refund policies, responsive customer service, and also thorough transaction documentation. These practices can help prevent disputes and build trust with customers.

Industry Associations

In some high-risk industries, joining industry associations or organizations can be beneficial. These groups often provide resources, best practices, and also advocacy on behalf of businesses within the sector.

The Role of Financial Institutions

Due Diligence

Financial institutions play a vital role in assessing the risk associated with high-risk payments. They conduct due diligence on businesses before approving their payment processing services. This includes reviewing the business’s financial history and also compliance with regulations.

Risk Management

Financial institutions employ risk management strategies to protect themselves from potential losses in high-risk transactions. This may include setting transaction limits, requiring reserves, or closely monitoring account activity.

Consumer Protection Measures

Secure Payment Methods

Consumers should opt for secure payment methods when making online purchases. Credit cards and also reputable third-party payment processors often offer additional layers of protection against fraud.

Conclusion

High-risk payments are an inherent part of the digital economy, serving industries that face unique challenges. Businesses and consumers alike must be proactive in safeguarding their interests. By choosing the right payment processor, implementing robust fraud prevention measures, and also staying informed about regulations, businesses can thrive in high-risk industries while consumers can enjoy safer online transactions.

FAQs

1. What are some common high-risk industries?

High-risk industries include online gambling, adult entertainment, nutraceuticals, and e-cigarette sales, among others.

2. How can businesses reduce chargeback rates?

Businesses can reduce chargeback rates by implementing advanced fraud prevention systems,[4] monitoring transactions, and also offering excellent customer service.

3. Are high-risk payment processors expensive?

Yes, high-risk payment processors typically charge higher fees due to the increased risk associated with these transactions.