AUTHOR : SOPHIYA

DATE : 04/11/23

In today’s fast-paced digital landscape, conducting business online has become the norm rather than the exception. With this shift, ensuring secure and seamless payment processing is Predominant. This is where payment gateway systems[1] step in, acting as the vital link between online merchants and financial institutions. In this article, we will delve into the intricacies of payment gateway systems, understanding how they function, their significance in the realm of Digital commerce[2], and the benefits they offer to both businesses and consumers[3].

Understanding Payment Gateway Systems

What is a Payment Gateway?

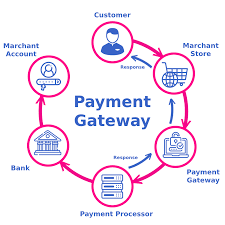

A payment gateway[4] can be best described as a technology-driven[5] service that facilitates the secure and efficient transfer of funds from a customer’s bank account to the merchant’s account. It plays a pivotal role in the final stages of an Digital commerce transaction, ensuring that the financial aspect is executed smoothly.

How Does it Work?

- Initiating the Transaction

- The process commences when a customer, having selected their desired product or service, proceeds to the checkout page of an online store.

- Here, the customer enters their payment details, including card information or other relevant data, and submits the payment request.

- Encryption and Authorization

- The payment gateway immediately steps in to encrypt this sensitive information, employing advanced security protocols.

- The encrypted data is then transmitted to the relevant financial institution, typically the issuing bank, for authorization.

- Authorization and Response

- At this juncture, the issuing bank evaluates the transaction. Key factors include verifying if the customer’s account has sufficient funds and validating the authenticity of the transaction.

- Based on these evaluations, the issuing bank sends a response back to the payment gateway, indicating whether the transaction is approved or declined.

- Completion of Transaction

- If the authorization is successful, the payment gateway promptly notifies both the merchant and the customer.

- Subsequently, the funds are securely transferred from the customer’s account to the merchant’s account, completing the transaction.

Significance in E-commerce

Trust and Security

One of the Predominant aspects of any online transaction is trust. Customers must have the assurance that their financial information is safeguarded and secure. Payment gateways employ sophisticated encryption techniques and security measures to ensure that sensitive data remains confidential and protected from potential cyber threats.

Global Accessibility

The beauty of payment gateway systems lies in their ability to transcend geographical boundaries. They enable businesses to cater to a diverse, global audience. By accepting various currencies and accommodating different payment methods, businesses can expand their reach far beyond their immediate vicinity.

Reduced Cart Abandonment

A seamless payment process can make all the difference between a completed sale and a lost opportunity. Complex or lengthy payment procedures can lead to cart abandonment, where potential customers abandon their shopping carts before completing the purchase. Payment gateways streamline this process, providing a user-friendly experience that encourages customers to follow through with their purchases.

Benefits for Merchants

Efficient Transactions

Effectiveness lies at the heart of every thriving business endeavor. Payment Openings ensure swift and hassle-free transactions, contributing to improved customer satisfaction and higher conversion rates. This efficiency extends to both online and offline transactions, providing a seamless experience for customers across all channels.

Detailed Reporting and Analytics

Knowledge[1] is power, and this holds true in the world of digital commerce. Payment openings offer merchants access to comprehensive reports and analytics. These insights provide valuable information about customer behavior, transaction trends, and sales performance. Armed with this data, merchants can make informed decisions to refine their strategies and enhance their offerings.

Fraud Prevention

In an era where cyber threats and fraudulent activities are ever-present, safeguarding[2] against unauthorized transactions is of paramount importance. Payment openings incorporate advanced security features and fraud detection tools. These measures help in detecting and preventing fraudulent transactions, protecting the interests of the merchant, and instilling confidence in customers.

Benefits for Customers

Convenience

The modern consumer[3] values convenience above many other factors. Payment openings provide just that. Customers can make payments from the comfort of their homes, without the need for physical cash or cards. This convenience extends to mobile devices, allowing for seamless transactions on the go.

Multiple Payment Options

Customers exhibit a wide array of inclinations when it comes to payment methods. Some prefer credit or debit cards, while others may opt for digital wallets[4] or alternative payment solutions. Payment gateways offer a range of options, allowing customers to choose the method that aligns with their preferences and comfort level.

Quick and Transparent Transactions

Speed and transparency are key elements of a positive customer experience. Transactions conducted through payment gateways are swift, with customers receiving instant notifications confirming the completion of their purchase. This transparency builds trust and confidence, solidifying the customer’s relationship with the merchant[5].

Conclusion

In conclusion, a reliable payment gateway system is the backbone of any successful online business. It ensures secure and efficient transactions, builds trust among customers, and provides a seamless shopping experience. Embracing this technology is imperative for businesses aiming to flourish in the cutthroat realm of Digital commerce. By prioritizing trust, security, and efficiency, payment gateways contribute significantly to the growth and success of online enterprises.

FAQs

- Is it safe to use a payment gateway for online transactions?

- Yes, reputable payment gateways employ advanced encryption and security measures to protect customer data.

- Can I use a payment gateway for international transactions?

- Absolutely, payment gateways support various currencies and cater to a global audience.

- Are fees associated with the use of a payment gateway?

- Yes, most payment gateways charge a small transaction fee, which may vary based on the service provider.

- If the issuing bank declines a transaction, the customer will need to either review their account balance or contact their bank for further assistance.

- In such cases, the customer may need to check their account balance or contact their bank for further assistance.

- How long does it take for funds to reach the merchant’s account?

- Typically, funds are transferred within 1-3 business days, depending on the payment gateway and the banks involved.