AUTHOR :HAANA TINE

DATE :3/11/23

Introduction

Payment merchant gateways[1] are the invisible heroes of online transaction[2]. These sophisticated systems enable businesses[3] to securely process payments from customers, making online shopping, donations, and transactions a seamless experience[4]. They act as the virtual cashiers[5], ensuring that your money is safely transferred from your bank account to the merchant.

The Importance of a Payment Merchant Gateway

In a world where online shopping and digital payments are the norm, payment merchant gateways are the lifeline of e-commerce. They provide trust and security to both buyers and sellers, making sure that transactions happen without a hitch. Without these gateways, the online business world would be chaotic and unreliable.

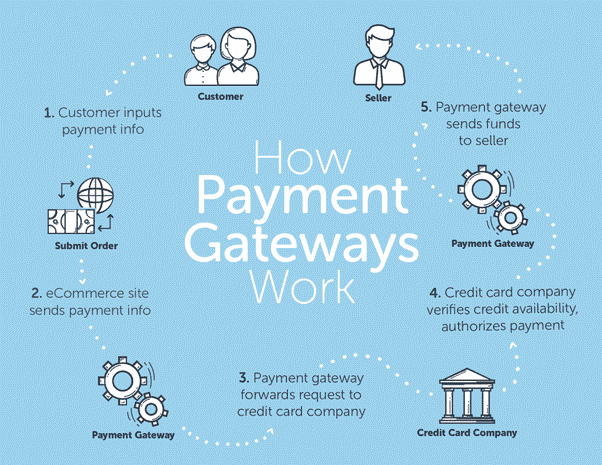

How Payment Merchant Gateways Work

To understand their importance, it’s vital to comprehend how payment merchant gateways work. When a customer makes a payment online, the gateway encrypts the payment information, sends it to the bank for verification, and then informs the merchant about the transaction‘s status. It acts as a bridge between the customer, the merchant, and the bank.

Payment Merchant Gateways come in various types

Hosted Payment Gateways

Hosted gateways direct customers to an external payment[1] page, which is hosted by the gateway provider. PayPal is an example. This type is ideal for small businesses.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to enter payment details directly on the merchant’s website. They offer more customization and control.

API-based Payment Gateways

API-based gateways are tailored for businesses that require a highly customized payment process. They offer flexibility and control over the entire payment experience.

Key Features to Look for in a Payment Merchant Gateway

When selecting a payment gateway for your business, consider key features such as ease of integration, compatibility[2] with your e-commerce platform, and the range of payment methods it supports. Choose a gateway that aligns with your business needs and growth.

Setting up a Payment Merchant Gateway

Setting up a payment gateway involves several steps, including creating an account with a gateway provider, configuring payment settings, and integrating it with your website or app. Make sure to follow a seamless setup process to ensure a hassle-free payment experience for your customers.

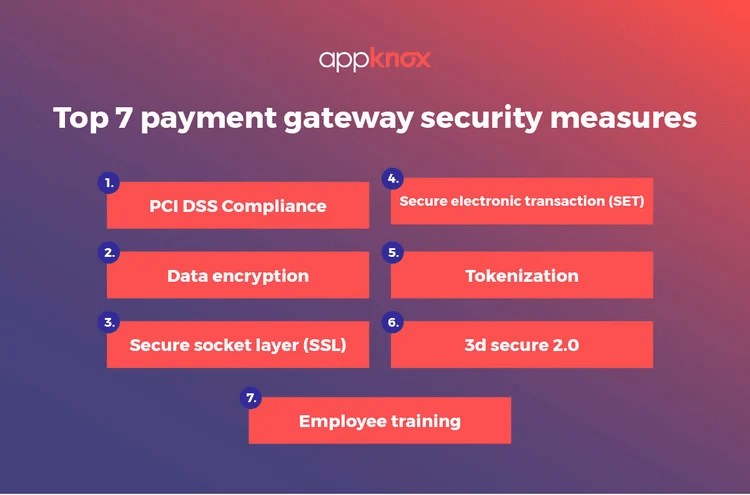

Security Measures in Payment Processing

Security is paramount in online transactions. Payment gateways implement robust security measures, including encryption, fraud detection, and compliance with industry standards, to protect sensitive customer information and prevent fraud.

Popular Payment Merchant Gateway Providers

Several payment gateway providers dominate the market, each offering unique advantages:

- PayPal: Known for its simplicity and widespread usage.

- Stripe: A developer-friendly gateway with powerful features.

- Square: Ideal for small businesses[3] and in-person payments.

- Authorize.Net: Offers a wide range of customization options.

Choosing the Right Payment Merchant Gateway for Your Business

Selecting the right payment gateway can be a game-changer for your business. Consider factors like transaction fees, accepted payment methods, and ease of integration when making your decision. It’s not a one-size-fits-all scenario, so choose wisely.

Integrating Payment Gateway with E-commerce Platforms

Integrating a payment gateway with your chosen e-commerce platform is crucial. Most gateway providers offer plugins and APIs for popular platforms like Shopify, WooCommerce, and Magento, making integration relatively straightforward.

Challenges and Concerns in Payment Processing

Despite their efficiency, payment merchant[4] gateways come with their set of challenges. High transaction fees, chargebacks, and technical glitches can pose hurdles, making it essential for businesses to stay vigilant and address these issues proactively.

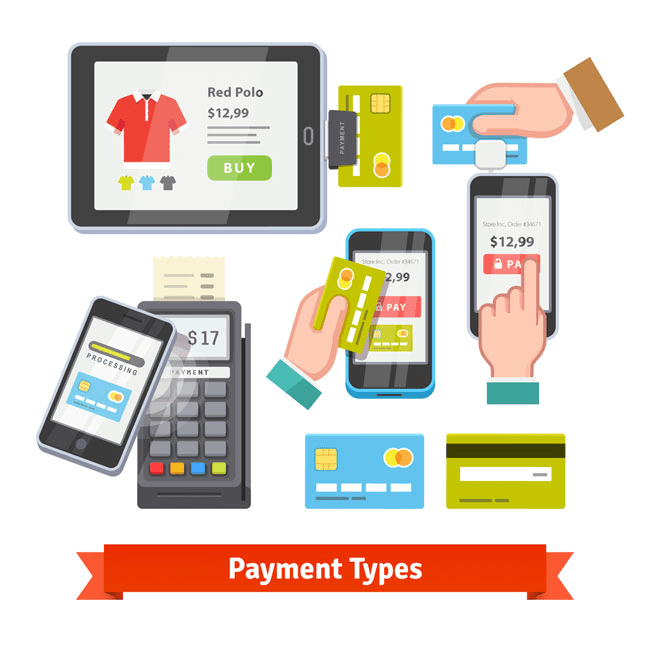

Mobile Payment Solutions and Their Role

The rise of mobile payments has revolutionized the way we shop. Payment gateways must be mobile-friendly to accommodate the increasing number of customers using smartphone[5] and tablets for transactions.

The Future of Payment Merchant Gateways

As technology continues to advance, payment gateways will evolve. We can expect more streamlined processes, enhanced security, and a broader range of payment methods to cater to the diverse needs of businesses and consumers.

Case Studies: Success Stories with Payment Gateways

Real-world success stories showcase the transformative power of payment merchant gateways. Businesses that have effectively implemented these gateways have witnessed increased sales, improved customer trust, and global expansion. These stories inspire others to take the leap into the world of seamless online payments.

Amazon – Global E-Commerce Powerhouse

Amazon, one of the world’s largest e-commerce platforms, has mastered the art of payment processing. The platform provides a range of payment options, including Amazon Pay, making it easy for customers to make purchases from around the world. Amazon’s commitment to payment security and variety has played a significant role in its journey to global e-commerce dominance.

Case Studies: Success Stories with Payment Gateways (Continued)

The success stories of businesses that have embraced payment merchant gateways are both inspiring and educational. Here are a few more examples:

Uber – Smooth, Cashless Rides

Uber, the ride-sharing giant, relies heavily on payment gateways to provide a frictionless experience for riders. Passengers can effortlessly pay for their rides without needing cash, thanks to integrated payment processing.

Conclusion

In the digital age, payment merchant gateways are the backbone of online transactions, ensuring the smooth flow of money in the e-commerce ecosystem. Their significance cannot be overstated, as they provide security, convenience, and reliability for businesses and consumers alike.

Whether you’re a small business owner or a large e-commerce enterprise, choosing the right payment gateway and understanding how it works is pivotal to your success in the online marketplace. With the right gateway, you can unlock the full potential of your online business and offer a hassle-free payment experience to your customers

FAQs

- Q: How do payment gateways ensure the security of financial information?

- A: Payment gateways employ encryption and tokenization to safeguard sensitive data, ensuring secure transactions.

- Q: What factors should businesses consider when choosing a payment gateway?

- A: Security features, ease of integration, and compatibility with e-commerce platforms are crucial factors to consider.

- Q: Can you provide examples of popular payment gateways in the market?

- A: Yes, popular payment gateways include PayPal, Stripe, and Square, each with its unique features and advantages.

- Q: How do payment gateways impact the customer experience for e-commerce businesses?

- A: Payment gateways streamline the customer experience