AUTHOR :KHOKHO

DATE : 03/11/2023

Introduction

As the digital economy continues to thrive, online businesses [1]are always on the lookout for the best payment gateway to manage financial transactions. The right choice can improve user experience, enhance security, and boost revenue. Payment Gateway Options for Websites This article will guide you through the process of selecting[2] the ideal payment gateway for your website.

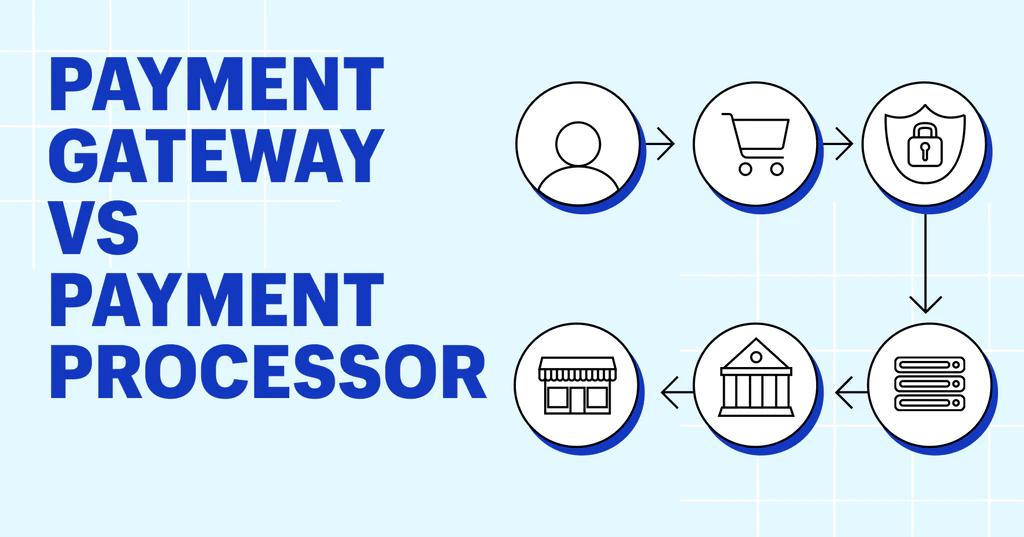

What is a Payment Gateway?

A payment gateway [3]is a technology that facilitates online Payment Gateway Options for Websites transactions by connecting your website to the financial networks. It authorizes and Payment Gateway Options for Websites processes credit card payments and ensures that sensitive information is securely transmitted.

Why Choosing the Right Payment Gateway Matters

The choice of a payment gateway can significantly impact your business[4]. A good one ensures your customers’ data is secure, minimizes fraud, and offers a seamless checkout experience, ultimately increasing your conversion rate.

Aspects to Evaluate When Choosing a Payment Gateway

When choosing [5]a payment gateway, consider the following factors:

Security and Fraud Prevention

Ensure the payment gateway provides robust security features like encryption, tokenization, and anti-fraud tools.

Payment Methods Supported

Check whether the gateway supports the payment methods relevant to your target audience, such as credit/debit cards, digital wallets, or bank transfers.

Integration and User Experience

The gateway should seamlessly integrate with your website, offering a user-friendly and consistent experience.

Fees and Pricing Models

Compare the fees and pricing structures of different gateways to find one that aligns with your budget and transaction volume.

Popular Payment Gateways

Let’s dive into some of the popular payment gateways:

PayPal

PayPal is a widely recognized and trusted option, offering a secure and easy-to-integrate payment solution.

Stripe

Stripe is known for its developer-friendly approach, providing a seamless payment experience with extensive customization options.

Square

Square is perfect for small businesses, offering an integrated payment system with no monthly fees.

Authorize.Net

Authorize.Net provides a range of features, making it suitable for businesses of all sizes.

Braintree

Braintree, owned by PayPal, is known for its excellent support for mobile and international payments.

2Checkout

2Checkout is a global payment processor offering various payment options and supporting multiple languages.

Niche Payment Gateways

For more specialized needs, consider these niche payment gateways:

Adyen

Adyen is ideal for international expansion, providing access to a wide range of payment methods.

Dwolla

Dwolla is a low-cost, ACH-based payment gateway with an emphasis on bank transfers.

Worldpay

Worldpay is known for its vast network, supporting various payment methods and currencies.

Setting Up Your Payment Gateway

To set up your payment gateway, consider the following steps:

Merchant Account

You’ll need a merchant account to accept payments. Choose one that suits your business type and size.

API Integration

Ensure seamless integration with your website through an API provided by the payment gateway.

Customization and Branding

Customize the payment gateway to match your branding and provide a consistent user experience.

Payment Gateway Best Practices

Follow these best practices to optimize your payment gateway:

- Provide a variety of payment options to meet the diverse needs of your customer base

- Regularly update your gateway for security enhancements.

- Keep checkout processes as simple and intuitive as possible.

Case Studies: Successful Payment Gateway Implementations

Explore real-world examples of businesses that have benefited from the right payment gateway choice.

Amazon Pay

Amazon Pay is a trusted payment solution that allows customers to make purchases using their Amazon accounts. It’s a convenient option for Amazon customers(1), offering a seamless checkout experience with stored payment information.

Google Pay

Google Pay stands as an innovative mobile (2) crafted by Google. It enables users to make payments through their Android devices, making it a suitable choice for businesses looking to cater to the mobile audience.

Apple Pay

Apple Pay(3) represents Apple’s digital wallet and mobile payment offering . It’s designed for iOS users and offers secure, contactless payment options both in-store and online.

Shopify Payments

If you run an e-commerce store on Shopify, Shopify Payments is an integrated solution that simplifies the payment(4) process for your customers. It offers competitive transaction fees and a straightforward setup process.

Emerging Payment Gateways

The world of online payments(5) is constantly evolving, and new players are entering the field.A few up-and-coming payment gateways merit careful consideration:

TransferWise (Wise)

Wise is an international money transfer service that now offers a borderless account with multi-currency support. This can be valuable for businesses dealing with international customers.

WePay

WePay is designed for platforms and marketplaces, making it an excellent choice for businesses with a network of sellers or freelancers. It provides a comprehensive API for easy integration.

Selecting the perfect payment gateway is a crucial decision that can significantly impact your online business. By considering factors such as security, payment methods, and user experience, you can ensure smooth transactions and customer satisfaction.

Frequently Asked Questions (FAQs)

1. What function does a payment gateway serve in internet-based transactions?

A payment gateway facilitates the secure transmission of payment data between the customer, the merchant, and the financial institution, ensuring a smooth online transaction process.

2. Are there any free payment gateways available for small businesses?

While some payment gateways offer free plans, they may come with limitations. It’s crucial to thoroughly assess your company’s requirements and financial plan

3. How can I ensure the security of my payment gateway?

To ensure security, choose a payment gateway with strong encryption, tokenization, and anti-fraud features. Regularly update the gateway address potential vulnerabilities.

4. Can I use multiple payment gateways on my website?

Yes, you can integrate multiple gateways, but it’s essential to provide a seamless and user-friendly experience for your customers.

5. What are the key considerations when selecting a payment gateway for international transactions?

When dealing with international transactions look for a payment gateway that supports multiple currencies, languages, and a wide range of payment methods to cater to a global audience.