AUTHOR : HAANA TINE

DATE : 02/11/23

Introduction

In today’s digital age, where online transactions[1] have become the norm, the choice of a payment gateway can significantly impact your business’s success. The cost associated[2] with a payment gateway is a crucial factor to consider. In this article, we will delve into the world of payment gateways, their importance, and how to make an informed decision[3] based on the pricing options available in India.

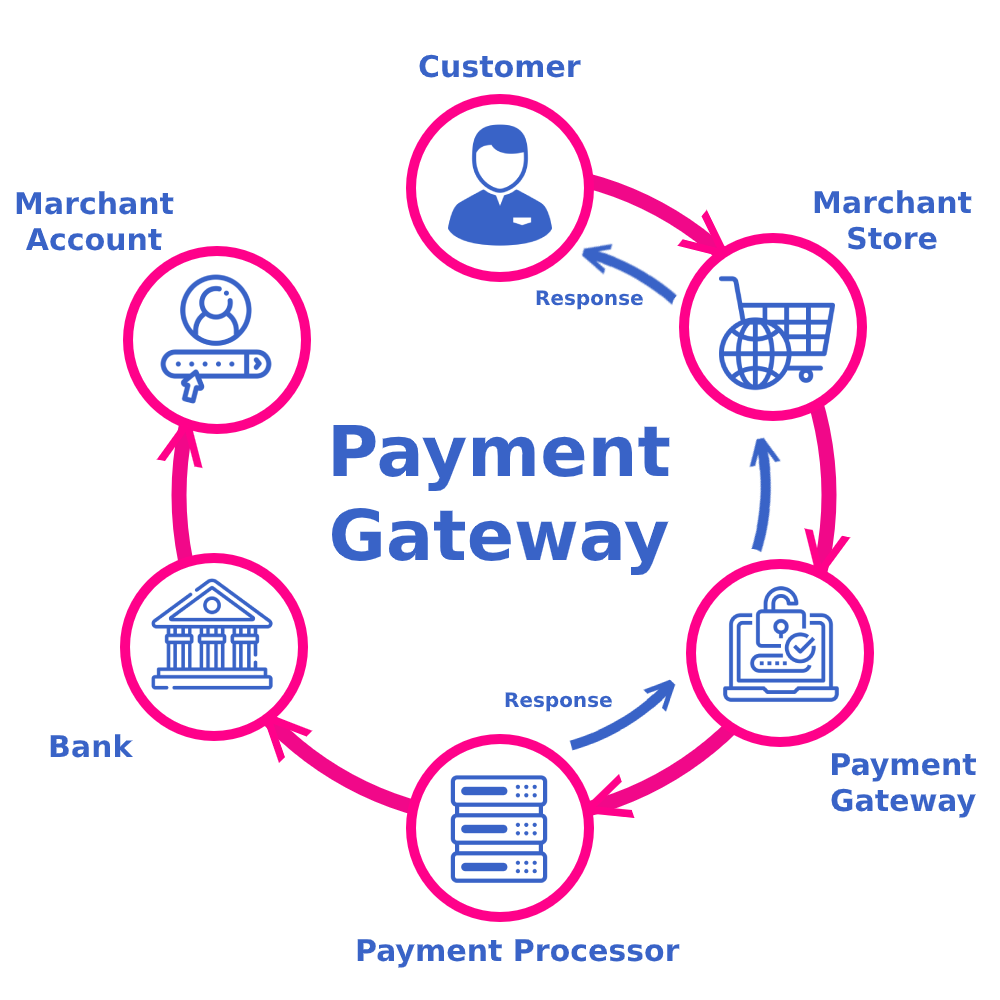

Understanding Payment Gateways

A payment gateway is a technology that facilitates[4] online transactions by securely transmitting sensitive payment information between customers, merchants, and banks. It acts as the intermediary that ensures your money is safely transferred from the customer’s account to yours.

Importance of a Payment Gateway

Having a reliable[5] and secure payment gateway is vital for any e-commerce business. It instills trust in your customers and ensures smooth, hassle-free transactions, leading to increased sales and customer satisfaction.

Factors Influencing Payment Gateway Prices

Several factors influence payment gateway prices in India. These include the type of business, transaction volume, the technology used, and additional features such as multi-currency support and fraud protection.

Top Payment Gateways in India

There are several payment gateways available in the Indian market. Some of the most popular ones include Razorpay, PayU, Instamojo, and Paytm. These gateways offer a range of pricing plans to suit different business needs.

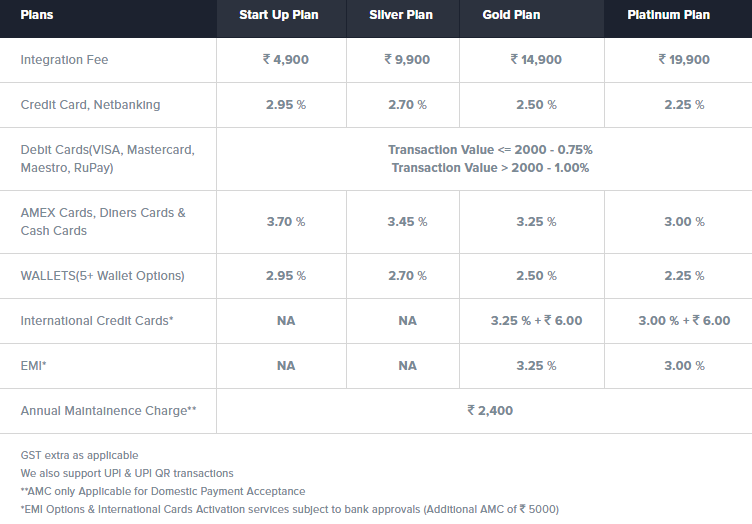

Pricing Comparison

To make an informed decision, it’s essential to compare the pricing structures of different payment gateways. Some gateways charge a one-time setup fee, while others have a monthly subscription fee. Transaction fees, both fixed and variable, also play a significant role in determining costs.

Hidden Costs

Be wary of hidden costs associated [1]with payment gateways. These may include charges for chargebacks, international transactions, and API integration. Understanding the complete fee structure is crucial to avoid any surprises.

Tips for Selecting the Right Payment Gateway

- Analyze your business needs and transaction volume.

- Consider the types of payment methods your customers prefer.

- Look for a payment gateway that offers seamless integration with your website or app.

- Check for security measures and compliance with industry standards.

Security and Compliance

Ensuring the security of your customer’s data is paramount. Opt for a payment gateway that is Payment Card Industry Data Security Standard (PCI DSS) compliant and offers robust fraud protection.

Integration and Support

The ease of integration with your website or app and the quality of customer [2]support are critical factors to consider. A responsive support team can resolve issues promptly.

Customer Reviews

Reading customer reviews and testimonials can provide valuable insights into the performance and reliability of a payment gateway. Make an informed decision based on user experiences.

Mobile Payments

Given the increasing use of mobile devices for online shopping, a payment gateway should be mobile-friendly. Mobile payments are a growing trend in India.

Emerging Trends

Stay updated with the latest trends in payment gateways, such as contactless payments [3]and digital wallets. Adapting to these trends can give your business a competitive edge.

Additional Considerations

When it comes to selecting the ideal payment gateway for your Indian business, don’t solely base your decision on cost. Consider other aspects, such as the reputation of the payment gateway provider, its uptime reliability, and the availability of customization options.

International Transactions

If your business caters to an international audience, you should also take into account the ability of the payment gateway to handle international transactions. [4]Some payment gateways may have higher fees for processing international payments, so factor this in when making your choice.

Scalability

As your business grows, your payment gateway needs may evolve. Ensure that the payment gateway you choose can scale with your business. This will prevent you from having to switch providers as your transaction volume increases.

User-Friendly Interface

Backup and Redundancy

A user-friendly interface[5] for both you and your customers is crucial. The payment gateway’s dashboard should be easy to navigate, and the payment process should be seamless for customers. A complex or cumbersome payment process can deter potential buyers.

Consider the payment gateway’s backup and redundancy systems. In case of technical issues or outages, a reliable backup system can ensure that your business remains operational. This is especially important for e-commerce businesses that can’t afford downtime.

Currency Support

If your business deals with multiple currencies, ensure that the payment gateway supports the currencies you need. Multi-currency support is essential for businesses with international customers.

Conclusion

Choosing the right payment gateway in India is crucial for the success of your online business. By carefully considering factors such as pricing, security, and customer support, you can ensure a seamless payment experience for your customers. Keep in mind that the best payment gateway for your business may not necessarily be the cheapest one. It should align with your specific needs and long-term goals.While some payment gateways offer free plans, they often come with limitations.

FAQs

Q1: Are there any free payment gateways in India?

While some payment gateways offer free plans, they often come with limitations. It’s important to carefully evaluate your business requirements before opting for a free plan.

Q2: How can I ensure the security of online payments for my customers?

Select a payment gateway that is PCI DSS compliant and offers robust fraud protection. Additionally, encrypt your website to secure sensitive data.

Q3: Can I change my payment gateway after initially setting one up?

Yes, you can switch payment gateways, but it may require some technical integration work. Plan the transition carefully to avoid disruptions.

Q4: What is the average transaction fee for payment gateways in India?

Transaction fees vary depending on the payment gateway and the type of transaction. On average, transaction fees can range from 1% to 3% per transaction.

Q5: Are there any hidden fees associated with payment gateways?

Yes, some payment gateways may have hidden fees, such as chargeback fees and international transaction fees. Always read the fine print of the terms and conditions.