AUTHOR : SOFI PARK

DATE : 1-11-2023

Payment network providers play a pivotal role in today’s digital world, facilitating secure and convenient financial transactions. They have evolved significantly over the years, offering advanced technologies and contributing to the global economy. In this article, we will delve into the world of payment network providers, their evolution, key players, technologies, benefits, challenges, innovations, and what the future holds for this dynamic industry.

Introduction

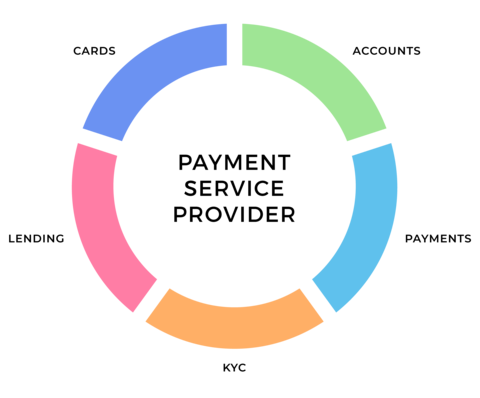

What are PNPs?

Payment network providers are organizations that offer the infrastructure and services for transferring funds electronically. They connect various parties involved in a transaction, ensuring the seamless flow of money from one entity to another. These providers enable us to make online purchases, transfer money to friends and family, and even pay for goods and services using our smartphones.

Their Vital Role in the Modern Economy

In today’s fast-paced world, payment network providers are the backbone of the digital economy. They bridge the gap between customers, merchants, and financial institutions, ensuring the secure and efficient exchange of funds. Without payment network providers, online commerce and global trade as we know it would be virtually impossible.

The Evolution of Payment Networks

Early Payment Methods

Before the advent of modern payment network providers[1], people relied on cash and barter systems for trade. As societies advanced, the need for more efficient payment methods became evident.

Emergence of Payment Network Providers

With the rise of technology, payment network providers emerged to meet the demand for faster and more reliable payment solutions. These providers established electronic networks[2] that allowed individuals and businesses to conduct transactions without the physical exchange of money.

Key Players in the Industry

Leading Payment Network Providers

Several major players dominate the payment network industry, each offering its own set of services and solutions. Companies like Visa, MasterCard[3], and American Express have established themselves as household names, facilitating transactions on a global scale.

Their Global Impact

The influence of payment network providers extends beyond borders. They enable cross-border transactions, making international trade[4] more accessible. These providers have shaped the global economy by connecting businesses and consumers from different corners of the world.

Payment Network Technologies

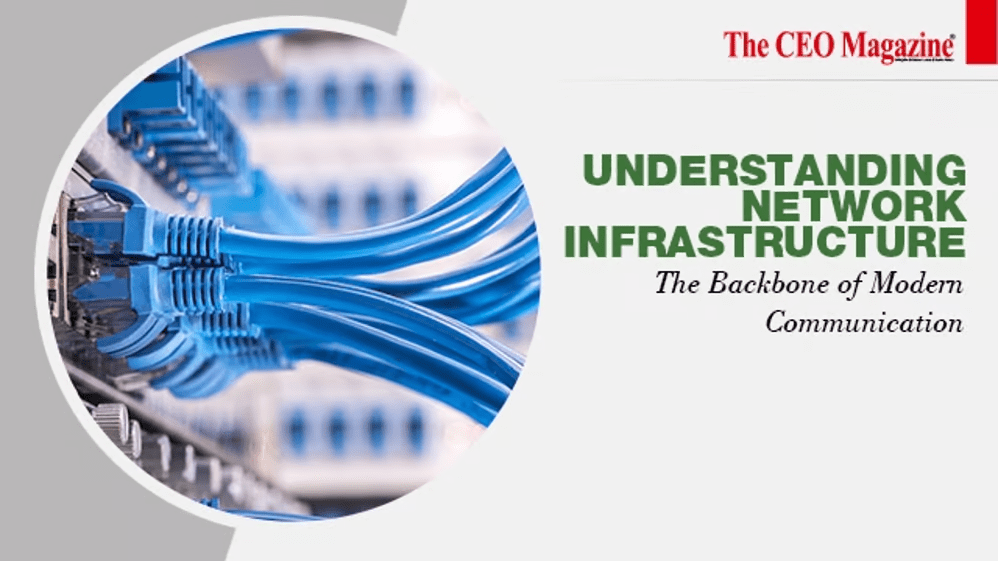

Understanding Payment Network Infrastructure

Payment network providers utilize complex infrastructures to ensure the seamless flow of money. Their networks connect banks, merchants[5], and consumers, allowing funds to move securely from one party to another.

Security and Encryption

One of the critical aspects of payment networks is security. These providers invest heavily in encryption and cybersecurity measures to protect sensitive financial information, ensuring that transactions are safe from fraudulent activities.

Benefits of Payment Network Providers

Convenience and Accessibility

Payment network providers offer the convenience of cashless transactions, reducing the need to carry physical currency. Consumers can make payments using various methods, including credit cards, mobile wallets, and online banking.

Global Transactions Made Easy

These providers make global transactions accessible and straightforward. Whether you’re traveling or doing business internationally, PNP ensures that your funds are transferable across borders with ease.

Challenges and Competition

Rivalry Among Payment Network Providers

Competition is fierce in the payment network industry. Companies continuously strive to offer better services and lower fees, leading to innovation and improved customer experiences.

Regulatory Challenges

Payment network providers often face regulatory challenges as governments seek to ensure the industry operates securely and ethically. Navigating these regulations is a constant endeavor.

Innovations and Future Trends

Contactless Payments

The payment industry is moving towards contactless payments, where transactions can be completed by simply tapping a card or smartphone. This technology enhances the speed and convenience of payments.

Blockchain and Cryptocurrency

The rise of blockchain and cryptocurrency presents new opportunities for PNP. They are exploring ways to integrate these technologies to offer more secure and decentralized payment solutions.

Conclusion

(PNP) has revolutionized finance and transactions. Their innovations and global presence shape the modern economy. As technology advances, they’ll provide secure and convenient payment solutions for the future.

FAQs

- What are PNPs?

PNPs are organizations that facilitate electronic fund transfers and transactions, connecting various parties involved in financial exchanges. - How do PNP ensure security?

PNP invest in advanced security measures, including encryption, to protect financial information and prevent fraudulent activities. - What are some leading PNPs?

Major players in the industry include Visa, MasterCard, and American Express, offering a range of payment solutions and services. - What is the future of PNP?

The future of PNP involves further innovations, such as contactless payments and integration with blockchain and cryptocurrency technologies. - How does PNP impact the global economy?

PNP facilitates cross-border transactions, making international trade and global commerce more accessible and efficient.