AUTHOR : DARCY SHARMA

DATE: 1/11/23

In the modern digital age, payment processing [1]is a crucial component of any online business or e-commerce venture. Understanding the intricacies of payment processing[2] can be the key to ensuring smooth transactions[3] and a satisfied customer base. In this article, we’ll delve into the payment processing[4] flow, breaking it down into its various stages and shedding light on the behind-the-scenes operations that make your online purchases[5] possible.

Introduction

Payment processing is the backbone of the modern economy, enabling businesses to accept payments from customers. It involves a series of steps that ensure a successful and secure transaction. In this article, we will explore the payment processing flow, providing insights into its various aspects.

Authorization Phase

What is Authorization?

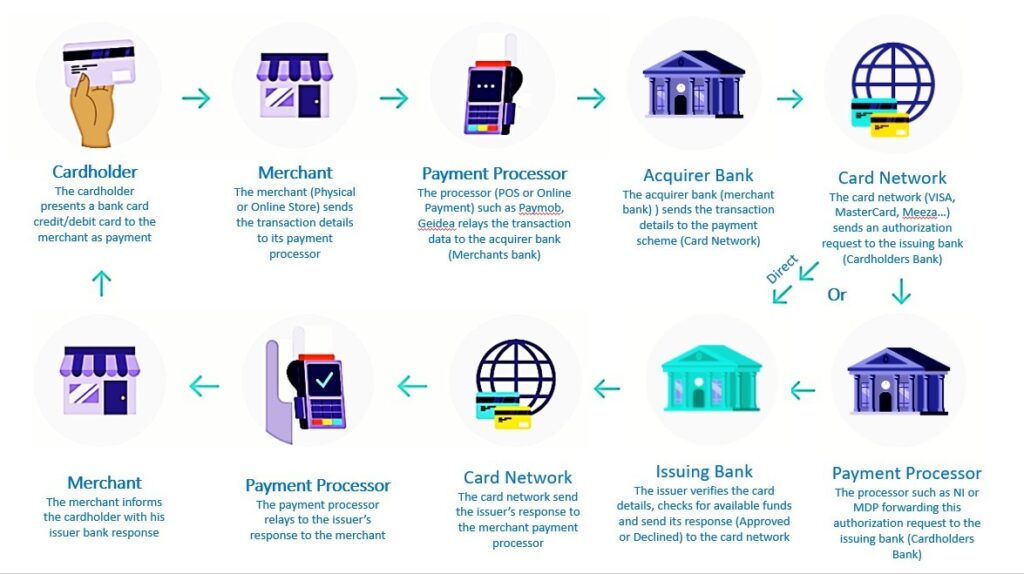

The first step in payment processing is authorization. During this phase, the customer’s payment[1] details are validated, and the merchant requests approval from the issuing bank[2] to proceed with the transaction.

How Does Authorization Work?

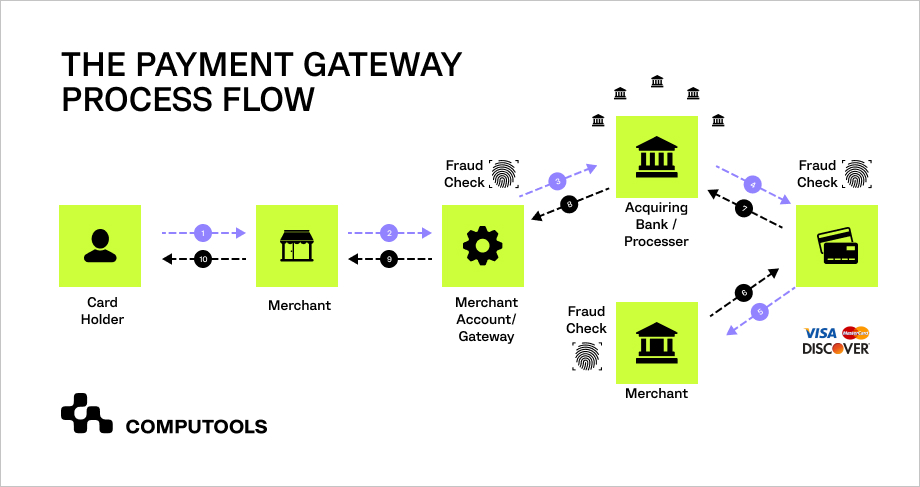

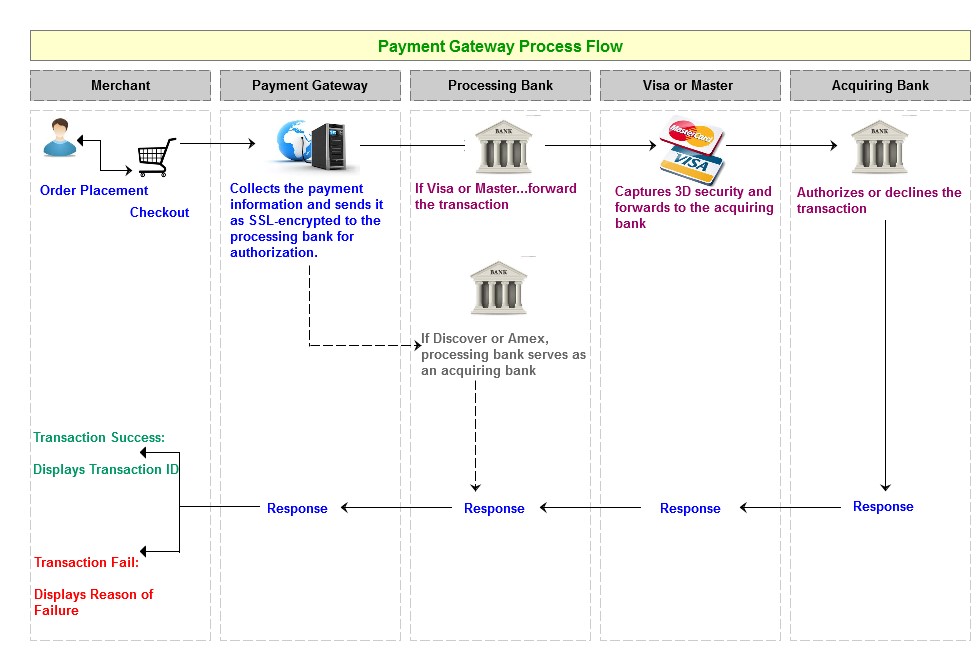

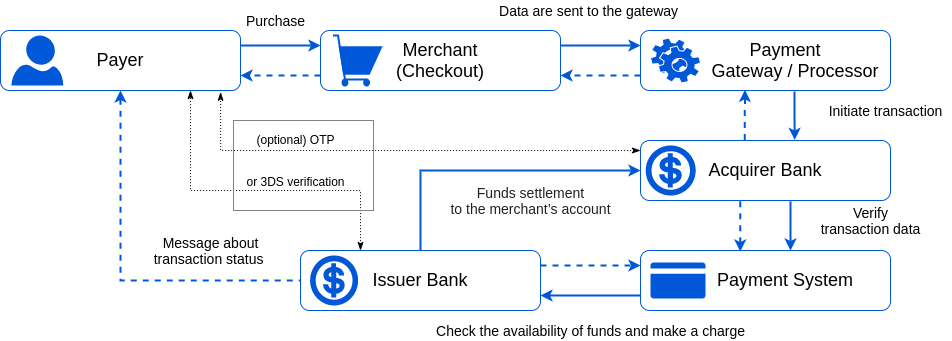

We will delve into the details of how authorization works, explaining the roles of the merchant, payment gateway[3], and issuing bank.

Authentication and Verification

Securing the Payment

In this section, we will discuss the importance of secure payment processing, covering topics like SSL encryption and tokenization.

Identity Verification

Authentication is vital in payment processing. We will explore methods such as two-factor authentication and biometric verification.

Transaction Settlement

Clearing the Funds

This section will explain how the actual transfer[4] of funds from the customer’s account to the merchant’s account takes place.

Reconciliation

Reconciliation ensures that transactions are accurately recorded, minimizing discrepancies. We will elaborate on this crucial process.

Payment Gateways

What Are Payment Gateways?

Payment gateways serve as the vital link connecting merchants with financial institutions, bridging the gap in online payment processes.. We will provide an in-depth look into their role and functionalities.

Popular Payment Gateway Providers

We will introduce you to some of the most popular payment gateway[5] providers, including PayPal, Stripe, and Square.

Types of Payment Methods

In this section, we will discuss various payment methods, such as credit and debit cards, digital wallets, and bank transfers, and explain their pros and cons.

The Role of Issuers and Acquirers

Issuing Banks

Issuing banks play a critical role in payment processing. We will explain how they issue cards and handle customer accounts.

Acquiring Banks

Acquiring banks work with merchants to facilitate transactions. We will clarify their responsibilities in the payment flow.

Fraud Detection and Prevention

The Importance of Security

Security is paramount in payment processing. We will discuss the challenges of fraud and the measures in place to combat it.

Anti-Fraud Measures

This section will outline the tools and strategies used to detect and prevent fraud, such as machine learning algorithms and risk scoring.

The Payment Ecosystem

We will paint a holistic picture of the payment ecosystem, including the key players: merchants, consumers, and payment processors.

International Payments

Currency Conversion

For businesses operating globally, currency conversion is a critical consideration. We will explain how it affects payment processing.

Cross-Border Transactions

Cross-border transactions have their challenges. We will address issues related to compliance and regulations.

Challenges in Payment Processing

Cybersecurity Threats

The digital realm is fraught with cybersecurity threats. We will explore the risks and how businesses can safeguard their payment processes.

Regulatory Compliance

Regulations and compliance standards are ever-evolving. We will provide insights into staying compliant with industry standards.

Advancements in Payment Technology

Contactless Payments

The payment landscape is evolving rapidly. We will discuss the rise of contactless payments and their impact.

Blockchain and Cryptocurrency

Blockchain and cryptocurrency are disrupting traditional payment methods. We will delve into their potential and challenges.

Customer Experience

User-Friendly Interfaces

A seamless user experience is essential. We will discuss the importance of user-friendly payment interfaces.

Instant Confirmation

Customers expect instant confirmation of their transactions. We will explore how this is achieved.

The Future of Payment Processing

AI and Machine Learning

The future of payment processing is driven by technology. We will discuss the role of AI and machine learning in shaping the industry.

Biometric Authentication

Biometrics are becoming a key player in payment security. We will delve into the potential and apprehensions surrounding this matter.

Conclusion

In conclusion, payment processing is a multifaceted process that ensures the smooth flow of funds between customers and businesses. Understanding this intricate system is essential for both merchants and consumers to navigate the digital economy effectively.

FAQs

1. What is payment processing?

Payment processing is the series of steps involved in completing a financial transaction, from the customer’s payment to the merchant’s receipt of funds.

2. How does a payment gateway work?

A payment gateway facilitates the transfer of payment information between the merchant, customer, and financial institutions, ensuring the secure processing of transactions.

3. What are some common fraud prevention measures in payment processing?

Common fraud prevention measures include encryption, tokenization, two-factor authentication, and machine learning algorithms.

4. How do cross-border transactions affect payment processing?

Cross-border transactions involve currency conversion and compliance with international regulations, making them more complex than domestic transactions.

5. What does the future hold for payment processing?

The future of payment processing is likely to be characterized by advancements in technology, including AI, machine learning, and biometric authentication, making transactions more efficient and secure.