AUTHOR : SNOW WHITE

DATE : 01-11-2023

Introduction to UPI Payments

The Unified Payments Interface, commonly known as UPI, is a real-time payment system in India that facilitates inter-bank transactions instantly. “The National Payments Corporation of India (NPCI) introduced it to promote a cashless economy.“. UPI allows users to link their bank accounts to a mobile application and make transactions with ease.

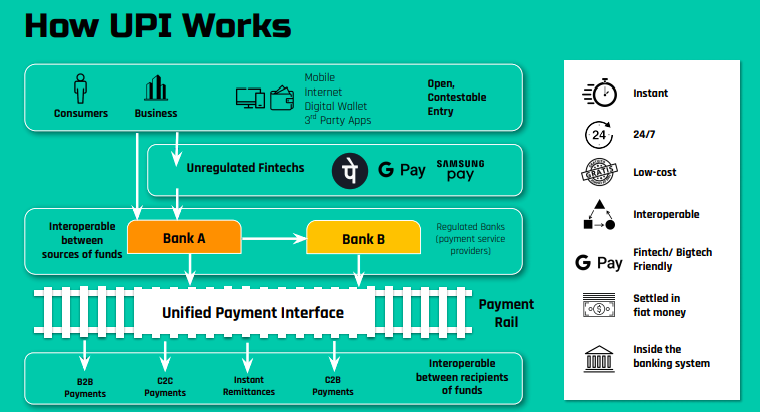

How UPI Works

UPI operates on a simple yet effective principle. Users need to download a UPI-enabled app and link their bank account to it. Once set up, they can use a Virtual Payment Address (VPA) to send or receive money. The VPA acts as a unique identifier, eliminating the need to share account details for each transaction.

Advantages of UPI Payments

- “Convenience: UPI allows users to transact at their convenience by enabling 24/7 payments.”

- “Instant Transfers: UPI ensures quick transactions by transferring money in real-time.”

- Security Measures: UPI prioritizes your safety by implementing multi-layered authentication protocols, ensuring the utmost protection for your transactions.

- Interoperability: UPI works with various banks and apps, offering flexibility to users.

- No Extra Charges: UPI transactions are generally free of charge.

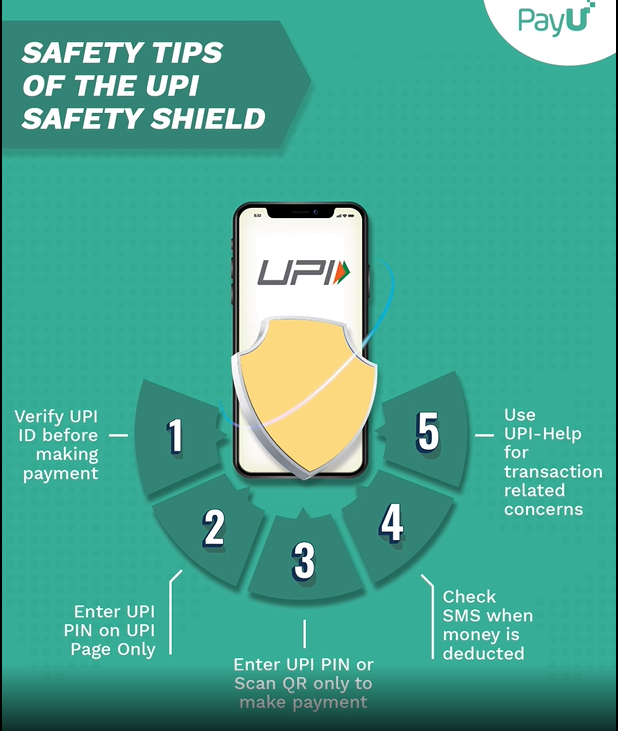

Security Measures in UPI

“UPI payments incorporate robust security features.”These include two-factor authentication (2FA), a secure PIN, and encryption of data.

“Consequently, UPI earns the reputation of being a secure payment method that protects users’ financial information.”

Setting Up UPI on Your Smartphone

“To begin with UPI payments, follow these steps:”

- Download a UPI-enabled app from your app store.

- Register using your mobile number linked to your bank account.

- Create a Virtual Payment Address (VPA).

- Link your bank account to the app.

- Set a secure UPI PIN for transactions.

Making Payments Using UPI

Sending money through UPI is as simple as entering the recipient’s VPA, amount, and a brief description. Users can also make payments using QR codes, making the process even more convenient.

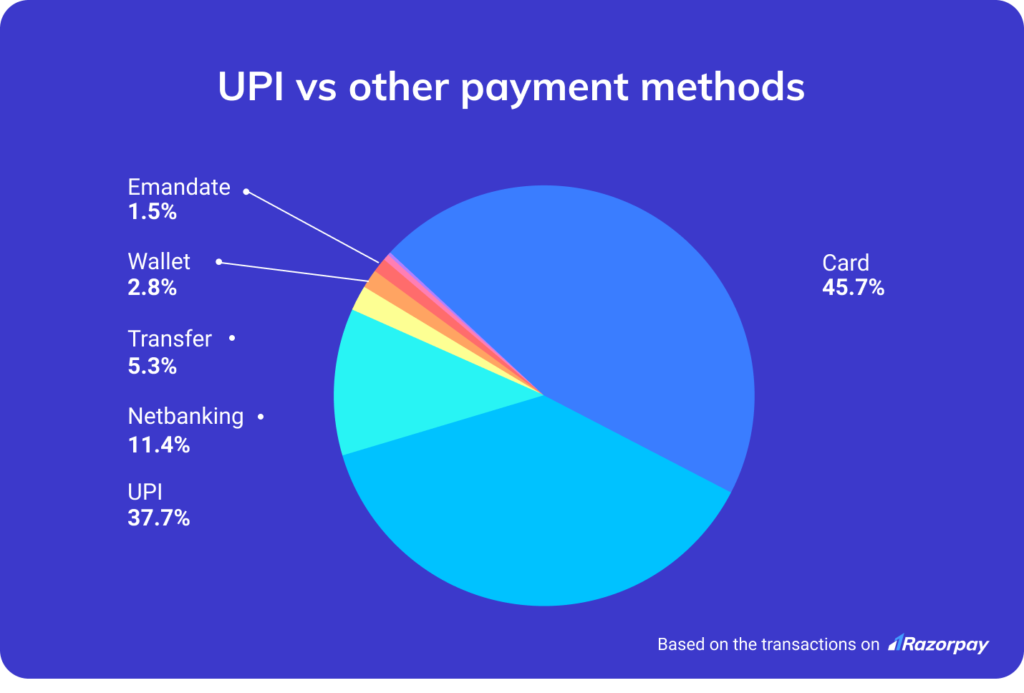

UPI vs. Other Payment Methods

Comparing UPI with traditional methods like cash and checks, or even other digital payment methods, UPI stands out due to its speed, ease of use, and availability.

Popular UPI Apps in the Market

Several banks[1] and third-party apps offer UPI services. Some of the most popular UPI apps include Google Pay, PhonePe, Paytm, and BHIM (Bharat Interface for Money)[2].

UPI Transaction Limits

UPI imposes transaction limits for both individual transactions[3] and daily limits. These limits vary from bank to bank, so it’s essential to be aware of them when transacting.

UPI and E-commerce

Many e-commerce platforms[4] have integrated UPI as a payment option, providing a seamless shopping experience for customers. This includes making payments for online purchases and availing of cashback offers.

UPI for Bill Payments

You can pay various utility bills, such as electricity, water, and phone bills, using UPI apps. It simplifies the process and eliminates the need to visit physical payment centers[5].

UPI for Investments

UPI also offers a hassle-free way to invest in mutual funds and stocks. Users can make investments directly from their bank accounts through UPI, making it accessible to all.

The Future of UPI

With the increasing digitization of financial services, UPI is expected to play a crucial role in shaping the future of payments in India. Its user-friendly interface and widespread acceptance indicate a bright future.

Troubleshooting UPI Issues

While UPI is a robust system, users may encounter occasional issues. Common problems include transaction failures, app glitches, or incorrect VPAs. In such cases, users can reach out to their bank’s customer support for assistance.

Conclusion

The Unified Payments Interface (UPI) has transformed the way we handle financial transactions, offering a secure, convenient, and versatile payment method. As UPI continues to evolve, its role in India’s digital economy is set to grow even further. Embrace this innovative payment method to experience hassle-free transactions in the modern era.

5 Unique FAQs

- Is UPI safe to use for online payments?

- Yes, UPI is considered one of the safest digital payment methods, with strong security features and multi-factor authentication.

- Can I link multiple bank accounts to a single UPI app?

- Yes, many UPI apps allow users to link and manage multiple bank accounts for transactions.

- Are there any transaction fees associated with UPI payments?

- Most UPI transactions are free, but it’s advisable to check with your bank or UPI app for any specific charges.

- How should I proceed if my UPI transaction fails?

- Is UPI limited to India, or can it be used for international transactions?

- UPI is primarily designed for domestic transactions within India and is not intended for international payments.