AUTHOR : EMILY PATHAK

DATE : 30 / 10 / 2023

In today’s fast-paced digital landscape, businesses and consumers alike demand quick and secure payment solutions. Payment integration services[1] have emerged as a pivotal component of e-commerce[2], making it easier for organizations to manage financial transactions. This article explores the world of payment integration services[3], their benefits, and how they are shaping the future of online payments[4].

Introduction

Payment integration services play a crucial role in simplifying financial transactions in the digital age. As businesses and consumers increasingly rely on online payments, these services have become indispensable. This article will delve into the world of payment integration services, their significance, and how they are revolutionizing online transactions[5].

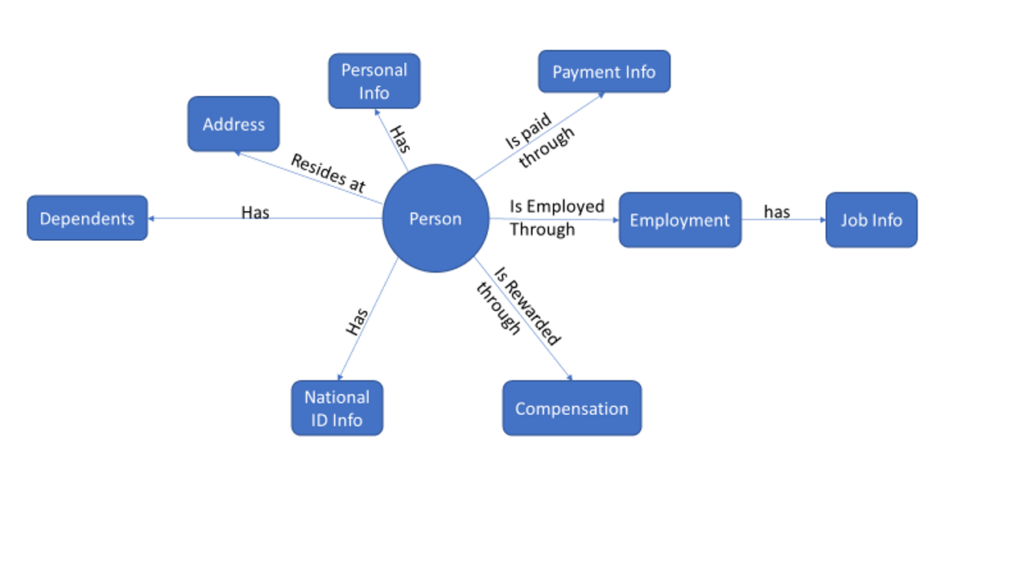

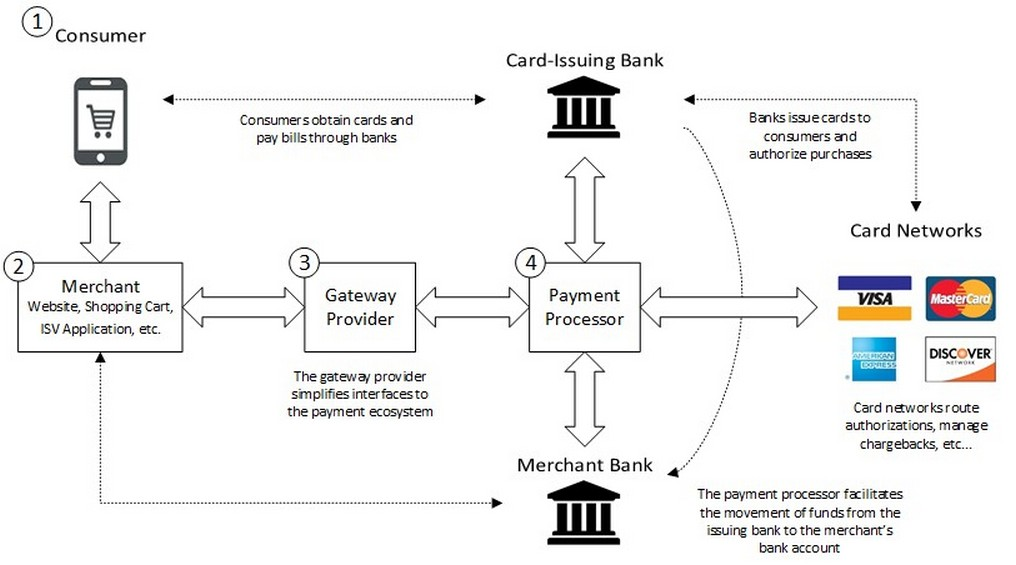

Understanding Payment Integration Services

At their core, they facilitate the connection between a business’s website or application and the payment processing networks. They enable the smooth transfer of funds between a customer’s bank account and the business. This integration ensures that payments are processed securely, efficiently, and conveniently.

Key Features

Streamlined Checkout Processes

Payment integration offers a streamlined checkout process, reducing cart abandonment rates and increasing sales. The convenience of one-click payments has become a standard in the e-commerce industry.

Multiple Payment Options

Customers today expect a variety of flexibility in accepting credit cards, digital wallets, and other forms of catering to diverse customer preferences.

Security Protocols

Security is paramount in online transactions. Payment integration implements advanced security measures, including encryption and fraud detection, to protect both businesses and customers from potential threats.

Popular Providers

Several renowned companies specialize in providing payment integration , each with its own unique features and benefits Let’s delve deeper into a handful of these renowned service providers

PayPal

PayPal is a household name for online payments. It offers seamless integration, a user-friendly interface, and a global presence.

Stripe

Stripe provides a developer-centric approach, making it a top choice for businesses seeking customizable integration solutions.

Square

Square is well-known for its ease of use and accessibility. It caters to small and medium-sized businesses with its straightforward integration options.

The Importance of Seamless Integration

Seamless integration of payment services is vital to ensuring that customers have a hassle-free experience when making purchases online. Any friction in the payment process can lead to cart abandonment and a decrease in customer satisfaction.

Advantages

Enhanced User Experience

Integration services enhance the user experience by making the payment process smooth and efficient, resulting in higher customer satisfaction.

Increased Conversions

Businesses that implement payment integration services often witness a significant increase in their conversion rates, ultimately boosting their revenue.

Global Reach

Payment integration services allow businesses to reach a global audience, transcending geographical boundaries and also expanding their market.

Challenges in Payment Integration

While payment integration services offer numerous benefits, they also come with their fair share of challenges.

Security Concerns

Security is a top concern, as data breaches and fraudulent activities can have severe consequences. Robust security measures are essential to protecting sensitive customer information.

Technical Integration

Integrating payment services into existing systems can be technically challenging, requiring a clear understanding of APIs and coding.

Regulatory Compliance

Businesses must adhere to various regulations and compliance standards, which can vary by region. Staying up-to-date with these standards is critical.

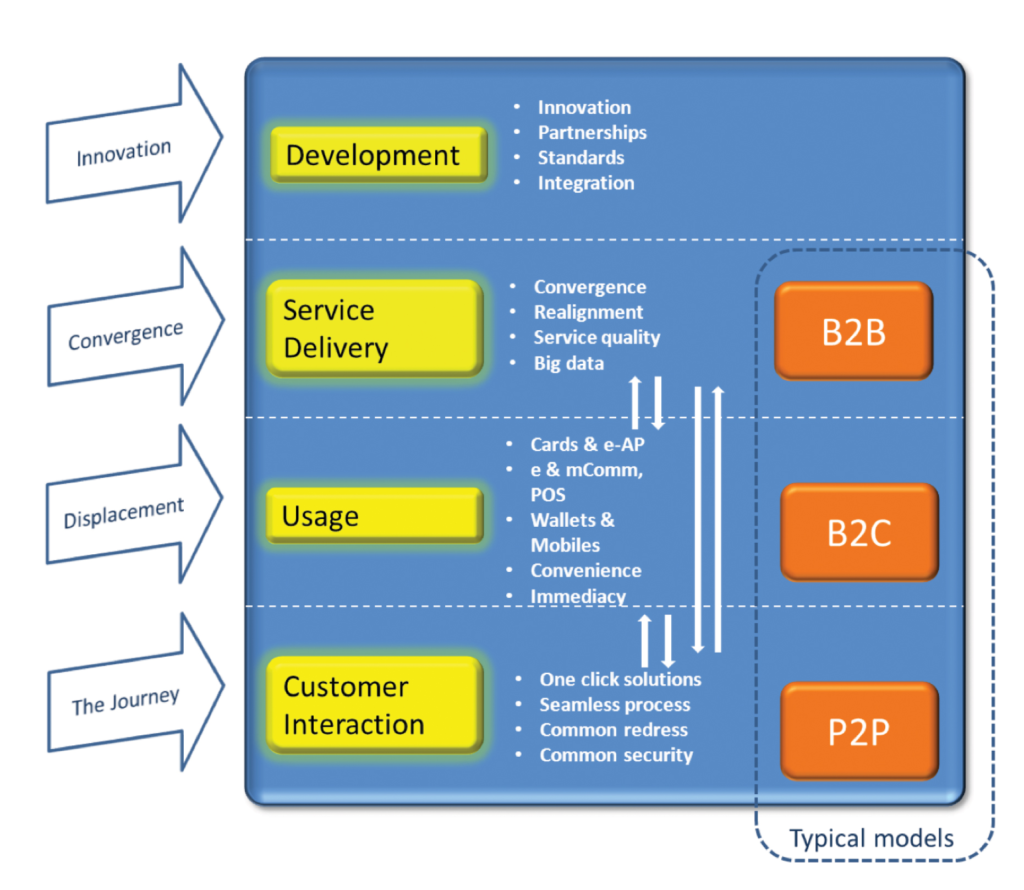

Emerging Trends

As technology advances, payment integration services continue to evolve. Some of the emerging trends in this industry include the following:

Contactless Payments

Contactless payments are gaining popularity with the rise of mobile wallets and NFC technology.

Cryptocurrency Integration

The integration of cryptocurrencies into payment services is on the rise, offering an alternative form of payment.

AI-driven Fraud Detection

Artificial intelligence is being used to enhance fraud detection and prevention, safeguarding businesses from financial losses.

Selecting the Right Payment Integration for Your Business

Choosing the right payment integration is a crucial decision for businesses. Factors like the type of business, target audience, and budget should all be considered when making this choice.

Case Studies

To better understand the impact of payment integration, let’s explore a couple of case studies:

E-commerce Success Story

Discover how a small e-commerce business experienced exponential growth after implementing a payment integration

Local Business Transformation

Learn how a local brick-and-mortar business transformed its operations by embracing online payments and integration services.

Integration for Mobile Apps

With the increasing use of mobile devices, integrating payment services into mobile apps is essential for businesses looking to stay competitive in the digital landscape.

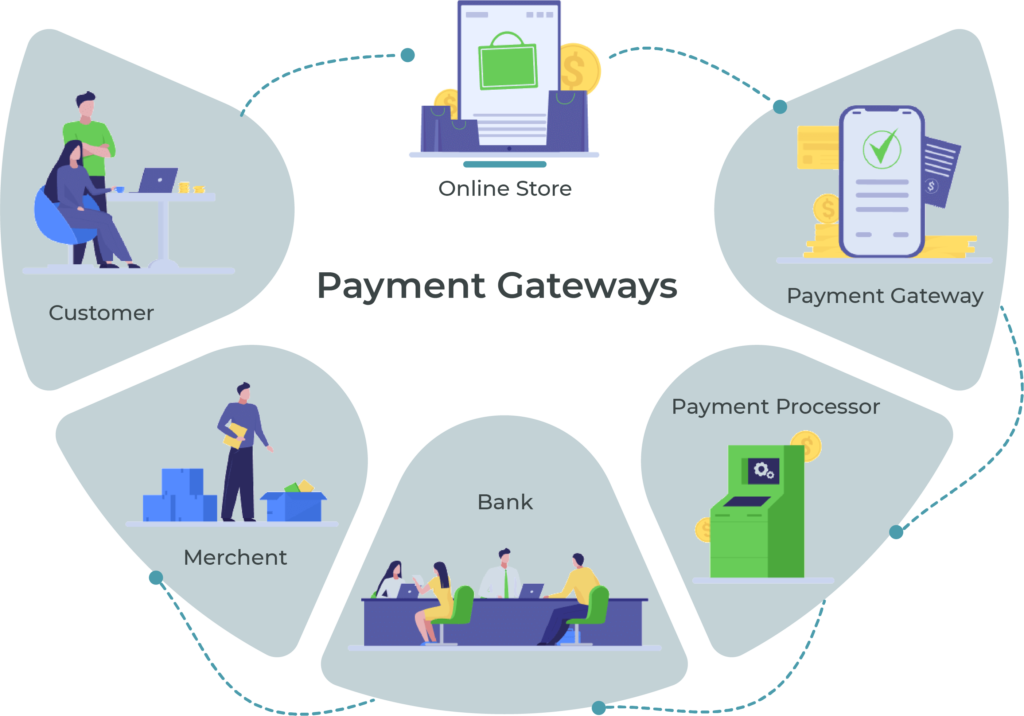

The Role of Payment Gateways

Payment gateways serve as intermediaries between businesses and financial institutions, ensuring the secure transfer of funds.

The Future of Payment Integration Services

The future of payment integration holds exciting possibilities, including increased security, innovative payment methods, and improved user experiences.

Conclusion

They have become an integral part of modern commerce. Their ability to enhance user experiences, boost conversions, and also ensure security makes them indispensable in the world of online payments. As technology continues to advance, these services will evolve, further simplifying and securing the way we pay for goods and services online.

FAQs

- What are payment integrations?

- Payment integration services connect businesses’ websites or apps with payment processing networks to facilitate secure and convenient online transactions.

- How does payment integration improve the user experience?

- Payment integration services streamline the payment process, reducing friction and making it more convenient for customers to complete their purchases.

- Are payment integration and services secure?

- Yes, payment integration services prioritize security, implementing encryption and fraud detection measures to protect both businesses and customers.

- What are some popular payment integration providers?

- Renowned providers include PayPal, Stripe, and Square, each offering unique features and benefits.

- What does the future hold for payment integration?

- The future promises increased security, innovative payment methods, and improved user experiences as technology continues to advance in this field.