AUTHOR : ADINA XAVIER

DATE : 27/10/2023

In the contemporary era of digital technology[1], online transactions[2] have seamlessly integrated into our everyday routines. Whether it’s shopping online, paying bills, or transferring funds, we rely on payment gateway servers[3] to facilitate these transactions seamlessly. In this article, we’ll explore the world of payment gateway servers[4], how they work, their importance in e-commerce[5], and much more.

What is a Payment Gateway Server?

A payment gateway server is a technology that acts as an intermediary between a merchant’s website or application and the financial institutions involved in a transaction. It is responsible for securely transmitting payment data, authorizing transactions, also ensuring the funds are transferred from the customer’s account to the merchant’s account.

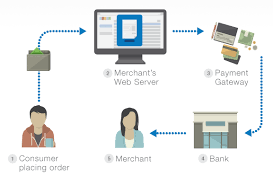

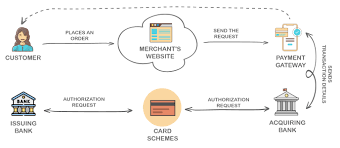

How Payment Gateway Servers Work

When a customer initiates a payment on an e-commerce[1] website, the payment gateway server performs several essential functions:

- Data Encryption: The payment data is encrypted to ensure its security during transmission.

- Authorization: The payment gateway verifies the customer’s payment details also checks if they have sufficient funds.

- Transaction Processing: If the authorization is successful, the server processes the transaction.

- Confirmation: The payment gateway provides a confirmation of the transaction’s success or failure to the customer and the merchant.

The Importance of Payment Gateway Servers in E-Commerce

Payment gateway servers play a crucial role in e-commerce for the following reasons:

- Security: They ensure the security of sensitive payment information.

- Convenience: They make online shopping also payment processes seamless.

- Global Reach: They enable businesses to accept payments from customers worldwide.

Types of Payment Gateway Servers

There are different types of payment gateway servers, each with its unique features:

5.1 Hosted Payment Gateways

Hosted payment gateways[2] redirect customers to a secure payment page hosted by a third party, ensuring simplicity and security.

5.2 Self-hosted Payment Gateways

Self-hosted gateways allow merchants to host the payment page on their own website, giving them more control over the checkout process.

5.3 API-based Payment Gateways

API-based gateways provide developers with the flexibility to integrate payment processing directly into their applications.

Choosing the Right Payment Gateway Server

Selecting the right payment gateway server is crucial for the success of your online business. Consider factors like transaction fees, supported payment methods, and security features when making your choice.

Security Measures in Payment Gateway Servers

Payment gateway servers implement multiple security layers, including data encryption, fraud detection[3], and compliance with industry standards like PCI DSS, to protect both merchants and customers.

Payment Gateway Server Integration

Integrating a payment gateway server with your website or application is a complex process that requires technical expertise.

Common Challenges in Payment Gateway Server Implementation

Some common challenges include technical issues, compatibility problems, also the need for ongoing maintenance and updates.

The Future of Payment Gateway Servers

As technology continues to evolve, payment gateway servers will adapt to offer even more security and convenience. Expect innovations like biometric authentication and faster transaction processing.

Case Study: Successful Payment Gateway Implementation

Explore a real-world example of a business that saw a significant increase in sales also customer satisfaction after implementing an efficient payment gateway server.

Advantages and Disadvantages of Payment Gateway Servers

Pros:

- Secure transactions

- Global reach

- Convenience for customers

Cons:

- Transaction[4] fees

- Technical complexities

- Integration challenges

Tips for Optimizing Payment Gateway Performance

To ensure a seamless payment experience, follow these tips:

- Monitor transaction speed.

- Optimize for mobile devices.

- Regularly update security measures.

Payment Gateway Server Best Practices

Adhering to best practices such as keeping software up to date, training staff, and monitoring transactions can help prevent issues and improve overall performance.

Conclusion

Payment gateway servers are the unsung heroes of online transactions, ensuring the security and efficiency of e-commerce. As technology advances, they will continue to play a pivotal role in shaping the future of online payments. By understanding their importance also implementing best practices, businesses can thrive in the world of digital commerce.

FAQs

1. Are payment gateway servers safe to use for online transactions? Yes, payment gateway servers are designed with robust security measures to protect both customers and merchants.

2. How do I choose the right payment gateway server for my business? Consider factors like transaction fees, supported payment methods, also security features. It’s essential to align the gateway with your specific business needs.

3. What are the common challenges in payment gateway implementation? Common challenges include technical issues, compatibility problems, also the need for ongoing maintenance and updates.

4. Can I use a payment gateway server for international transactions? Yes, many payment gateway servers support international transactions, allowing businesses to accept payments from customers worldwide.

5. What can I do to optimize the performance of my payment gateway server? Monitoring transaction speed, optimizing for mobile devices, and regularly updating security measures are key to ensuring optimal performance.