AUTHOR : ADINA XAVIER

DATE : 27/10/2023

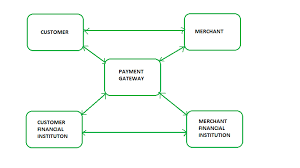

In the rapidly evolving world of e-commerce[1] and digital payments[2], ensuring the security of financial transactions[3] is paramount. Payment gateways[4] serve as the linchpin between consumers, businesses, and financial institutions[5], making them an attractive target for cybercriminals. To maintain the trust and integrity of online transactions, it’s imperative to adhere to robust payment gateway security standards. In this comprehensive guide, we’ll delve into the intricacies of payment gateway security, providing you with invaluable insights to protect your online financial activities.

Introduction

Payment gateways are the digital bridges that facilitate online transactions, ensuring the smooth flow of funds between customers and businesses. These gateways are the digital equivalents of traditional point-of-sale terminals, allowing businesses to accept payments via credit cards, debit cards, also various other electronic payment methods.

What Are Payment Gateways?

Payment gateways are specialized software or applications that securely transmit payment information from the customer to the merchant also the payment processor. They play a pivotal role in the e-commerce[1] ecosystem by enabling safe and efficient electronic transactions.

The Evolution of Payment Gateways

Payment gateways have come a long way since the early days of e-commerce. In the past, businesses relied on manual processing also cumbersome paperwork to accept payments. However, the digital age brought with it a transformation in the way transactions are conducted.

Staying Ahead: The Future of Payment Gateway Security

The world of technology never stands still, and the same holds true for payment gateway security. Here, we explore the emerging technologies also trends that promise to shape the future of payment gateway security.

Biometric Authentication

Biometric authentication, which uses unique physical traits like fingerprints also facial recognition, is gaining prominence in payment security. These technologies[2] offer an unparalleled level of security, as they are virtually impossible to replicate.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are being harnessed to detect and prevent fraudulent activities. These technologies can analyze vast amounts of data to identify unusual patterns and potential threats in real-time, making them invaluable for security.

Quantum Computing Resistance

Payment gateway[3] providers are researching quantum-resistant encryption to protect transactions from this emerging threat.

Enhanced Mobile Security

With the increasing use of smartphones for payments, mobile security is a top priority. Expect to see advancements in mobile payment security, including better app security also biometric authentication.

Behavioural Biometrics

Behavioural biometrics focus on how a user interacts with a device, such as typing speed and touch patterns. This can be used to enhance authentication and detect unauthorized access.

Blockchain Innovations

Blockchain, famous for its security advantages, continues to evolve. Look out for blockchain-based payment gateways[4] that offer unparalleled transparency and security.

Conclusion

In the fast-paced world of digital transactions, safeguarding financial data and maintaining customer trust are non-negotiable. Payment gateway security standards, as outlined in this article, are your fortress against the growing threats in the digital realm. By staying informed, following best practices, and selecting a reputable payment gateway provider, you can ensure the safety of your financial transactions.

Frequently Asked Questions

1. How often should I conduct security audits for my payment gateway?

Regular security audits should be conducted at least once a year. However, it’s advisable to perform more frequent audits, especially if you process a high volume of transactions.

2. What is tokenization, and how does it enhance payment gateway security?

Tokenization is the process of replacing sensitive payment data with a unique token. This token is useless to cybercriminals, as it cannot be reverse-engineered to obtain the original data. It is a powerful security measure.

3. Are mobile payment gateways as secure as traditional ones?

Mobile payment gateways can be secure, provided they implement strong security measures such as biometric authentication and encryption. It’s crucial to choose a reputable mobile payment gateway provider.

4. What is the significance of EMV chip cards in payment security?

EMV chip cards are highly secure because they generate a unique transaction code for each purchase. This makes it extremely difficult for fraudsters to counterfeit cards and conduct unauthorized transactions.

5. How can blockchain technology improve payment gateway security?

Blockchain’s decentralized and immutable ledger provides an extra layer of security for transactions. It enhances transparency and makes it challenging for cybercriminals to manipulate payment data.