AUTHOR : EMILY PATHAK

DATE : 25 / 10 / 2023

In the ever-evolving landscape of e-commerce[1] and online business, payment gateways[2] play a crucial role. These digital intermediaries have become the cornerstone of secure, convenient, and efficient online transactions. This article aims to shed light on the intricate world of payment gateways[3], from their basic definition to their multifaceted functionalities. So, let’s dive into this virtual realm and also explore how payment gateways simplify online transactions[4].

Introduction

In today’s digital age, where online shopping[5], bill payments, and fund transfers have become routine, the term ‘payment gateway’ is frequently heard but not always understood. In essence, a payment gateway is the virtual bridge that securely connects online merchants and also customers, ensuring the smooth flow of financial transactions.

What is a Payment Gateway Description?

A Brief Overview

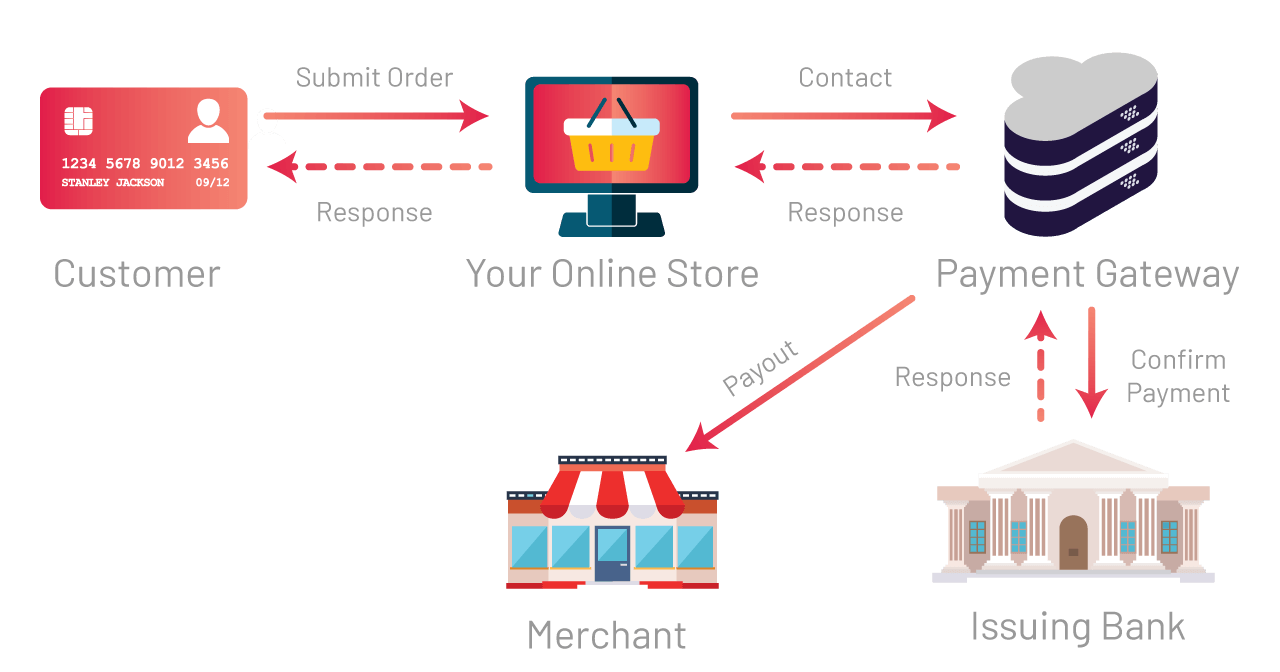

A payment gateway is a software application that facilitates the transmission of payment data from a customer’s chosen method of payment to the merchant’s bank and back. It acts as the middleman between the customer, the merchant’s website, and the financial institutions involved in the transaction.

How Does It Work?

Payment gateways work seamlessly to encrypt and also transmit the payment data from the customer’s end to the merchant’s server. It verifies the payment information, processes the transaction, and also notifies both the customer and also the merchant of the transaction’s success or failure.[1]

Types of Payment Gateways

There exist two primary categories of payment gateways.

Hosted Payment Gateways

Hosted payment gateways redirect customers to a third-party page to complete the transaction securely. This type of gateway is known for its simplicity and is a popular choice for small businesses.

Self-hosted Payment Gateways

Self-hosted payment gateways enable customers to finalize transactions directly on the seller’s site. While they offer more control, they also demand also additional security measures.

Key Features of Payment Gateways

Payment gateways come with a range of features designed to simplify and also secure online transactions. These features often include payment processing, fraud prevention,[2] and also currency conversion.

The Importance of Payment Gateway Description

Payment gateways are vital for ensuring a positive user experience. They offer convenience and also security, reducing cart abandonment rates and building trust with customers.

Choosing the Right Payment Gateway

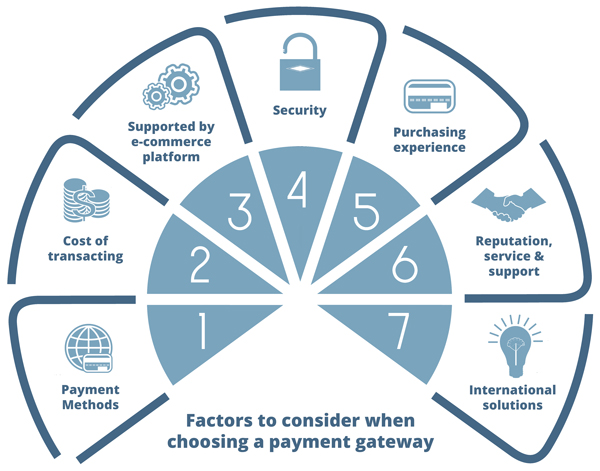

Selecting the appropriate payment gateway is crucial for any online business. Merchants must consider factors such as transaction fees, ease of integration, and also the gateway’s compatibility with their e-commerce platform.

Factors to Consider

- Transaction Fees

- Security Features

- Integration Options

- Accepted Payment Methods

Setting Up a Payment Gateway Description

Setting up a payment gateway involves a series of steps. From creating a merchant account to integrating the gateway into your website, each step is vital to ensure smooth transactions.

Step-by-Step Guide

- Create a Merchant Account

- Choose the Right Payment Gateway

- Integrate the Gateway into Your Website

- Test the Payment Process

- Go Live

Security Measures

Security is a top priority in online transactions. Payment gateways employ several measures to ensure the safety of sensitive data.

SSL Encryption

Secure Socket Layer (SSL) encryption is used to protect data transmission, making it unreadable to unauthorized users.

Fraud Detection

Advanced fraud detection tools help identify and prevent suspicious transactions, protecting both the customer and also the merchant.

Integration with E-commerce Platforms

Payment gateways must seamlessly integrate with various e-commerce platforms, including Shopify, WooCommerce, and also Magento, to offer a seamless shopping experience.

Mobile Payment Solutions

With the increasing use of mobile devices, payment gateways have adapted to provide mobile-friendly payment options, enhancing the user experience.

International Transactions

Cross-border transactions are made easier through payment gateways that support multiple currencies and international payment methods.[3]

Transaction Fees

Understanding transaction fees and also their structure is crucial for businesses to make informed decisions when selecting a payment gateway.

Challenges Faced by Payment Gateways

Payment gateways are not without their challenges, including downtime, technical issues, and raudulent activities. Businesses should be prepared to address these issues promptly.

The Future of Payment Gateways

As technology continues to evolve, payment gateways will adapt to meet the changing needs of online businesses. Future developments may include enhanced security measures and also more user-friendly interfaces.

Conclusion

Payment gateways are the unsung heroes of online commerce, ensuring that our [4]digital transactions are secure, efficient, and also convenient. Understanding how they work and also how to choose the right one for your business is paramount in today’s interconnected world.

Frequently Asked Questions

- Are payment gateways secure?

- Yes, payment gateways use encryption and also fraud detection measures to ensure secure transactions.

- How do I choose the right payment gateway for my online store?

- Consider factors like transaction fees, security features, and also compatibility with your e-commerce platform.

- What obstacles do payment gateways typically encounter?

- Downtime, technical issues, and also fraudulent activities are some of the common challenges.

- Do payment gateways support international transactions?

- Many payment gateways do support international transactions, offering multi-currency and international payment options.

- What lies on the horizon for the evolution of payment gateways?

- The future may bring enhanced security measures and more user-friendly interfaces to further streamline online transactions.