AUTHOR : JASMINE

DATE :2/11/2023

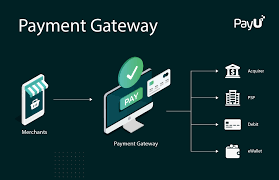

In this digital age, the seamless flow of money is essential for businesses, organizations, and individuals. Enter the world of payment , a technology that has revolutionized the way we handle transactions. A payment portal: what’s its essence, and how does it function? In this article, we’ll explore the ins and outs of payment gateways, demystify their functions, and shed light on their importance in our everyday lives.

Understanding the Basics

- Introduction to Payment Gateways

Payment gateways are online services that facilitate and secure financial transactions over the internet. Think of them as virtual cashiers who ensure that your online purchases and payments are conducted smoothly and securely. - How do payment gateways work?

Payment acts act as intermediaries between a customer, a merchant, and the financial institutions involved. They encrypt and transmit sensitivefinancial data, ensuring that it remains confidential. - The Role of Encryption

Security is paramount in the world of payments. Encrypted connections safeguard your financial information from potential threats, making online payments safer than ever. - Different Types of Payment Gateways

There are various paymentavailable[1] today, ranging from simple hosted solutions to complex, integrated systems. Each serves a specific purpose[2], depending on the needs of the business or individual[3] .

The Significance of Payment Gateways

- Enhancing E-commerce

For online businesses[4], payments are the lifeblood of their operations. They enable businesses to accept payments from customers[5] all around the world, expanding their reach and boosting sales. - A Global Perspective

Payment gateways make it possible for international transactions to occur seamlessly. They convert different currencies, making it easier for businesses to tap into global markets. - Consumer Confidence

When customers see a trusted payment on the checkout page, it instills confidence. Knowing their payment information is secure encourages them to complete the transaction. - Reducing Fraud

Payments have advanced fraud detection systems that flag suspicious activities, helping businesses minimize fraudulent transactions and chargebacks.

How to Choose the Right Payment Gateway

- Assessing Your Needs

Before selecting a payment, you should evaluate your specific requirements. Different businesses need different features, so choose one that aligns with your goals. - Integration Options

Delve into the intricacies of seamlessly incorporating a payment into your website or platform. - Costs and Fees

Payment gateways come with various pricing models. Analyze the costs and fees associated with the gateway to ensure it fits your budget. - Security Measures

Prioritize security. A reliable payment gateway should have robust security measures in place to protect both your business and your customers.

The Future of Payment Gateways

- Advancements in Technology

The payment gateway industry is continually evolving. We can expect to see more innovations, such as biometric authentication and blockchain technology, in the future. - Expanding Use Cases

Payments are not limited to e-commerce; they are also used in mobile apps, subscription services, and even at physical point-of-sale locations. - Final Thoughts

In a world driven by convenience and security, payments play a vital role in shaping our financial interactions. They have become the unsung heroes of the digital economy, ensuring that our money flows seamlessly and securely.

Conclusion

In conclusion, payments are the digital guardians of our financial transactions. They have transformed the way we conduct business and have made online shopping a secure and straightforward experience. As technology continues to advance, payments will only become more efficient and versatile.

FAQs (Frequently Asked Questions)

What is a payment gateway?

A payment is an online service that facilitates secure financial transactions over the internet.

How do payment gateways work?

Payments act as intermediaries between customers, merchants, and financial institutions, ensuring the secure transmission of financial data.

Why is security important in payment gateways?

Security is crucial to protect sensitive financial information and prevent fraud or data breaches.

How can I choose the right payment for my business?

Consider your business needs, integration options, costs, and security measures when selecting.

What does the future hold for payment gateways?

The future includes advancements in technology, expanding use cases, and an ever-growing role in our digital economy.