AUTHOR : BABLI

DATE : 13/12/23

Introduction

In the fast-paced world of digital transactions, Payments as a Service (PaaS) companies have emerged as key players, reshaping the way businesses handle financial transactions. The increasing demand for seamless, secure, and scalable payment solutions has propelled the growth of PaaS providers, revolutionizing the payments landscape.

What are Payments as a Service Companies?

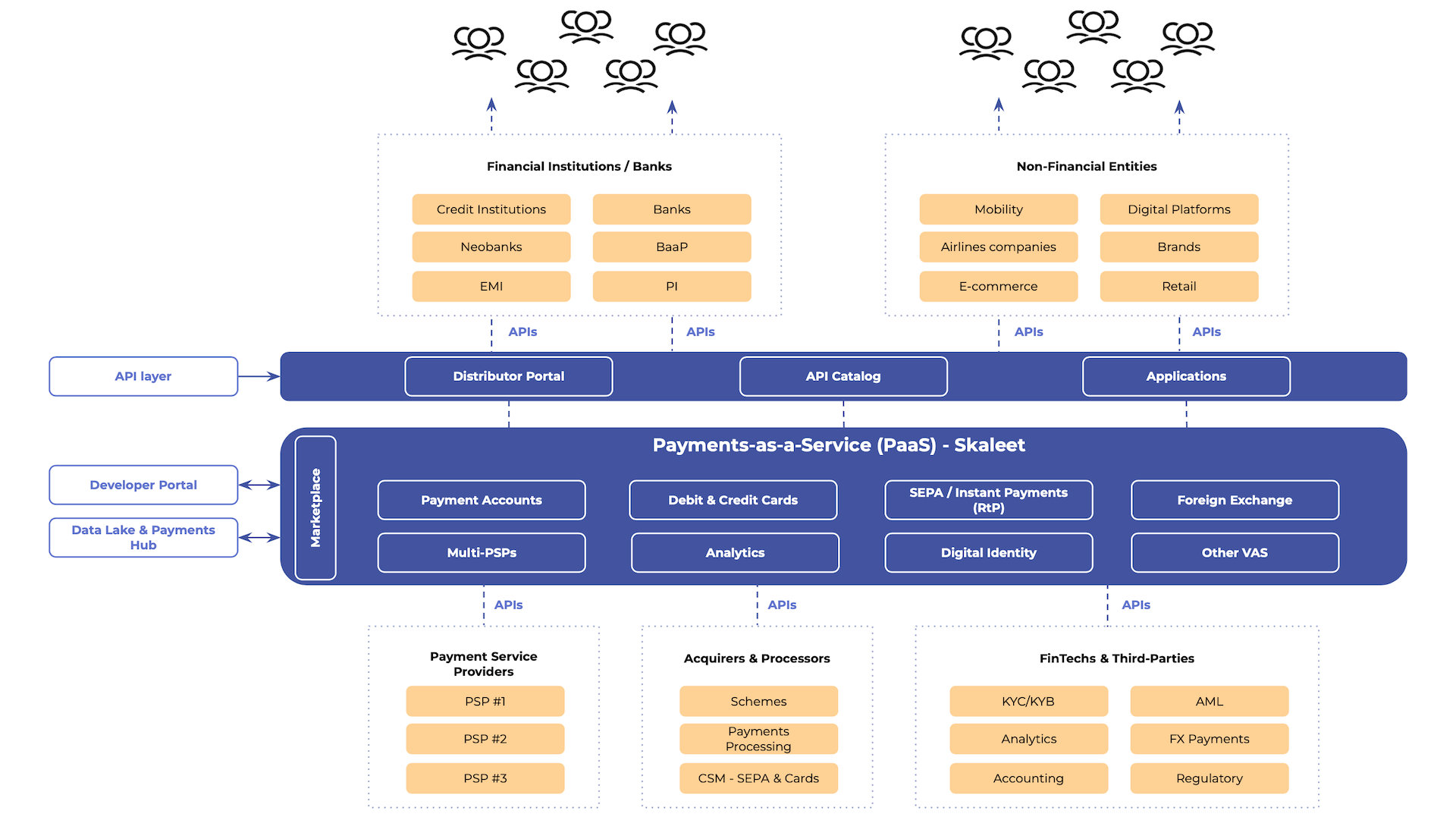

Payments as a Service refers to a comprehensive suite of financial services offered by specialized companies. These entities manage the end-to-end payment process, from authorization to settlement, providing businesses with a streamlined and efficient way to handle transactions. PaaS companies utilize advanced technologies to ensure secure and real-time payments.

How Payments as a Service Works

At the core of Payments as a Service is a sophisticated infrastructure that facilitates quick and secure transactions. These companies leverage cutting-edge technology to connect various stakeholders in the payment ecosystem, including merchants, financial institutions, and consumers. The process involves authentication, authorization, and settlement, all seamlessly integrated for a frictionless experience.

Advantages of Using Payments as a Service Companies

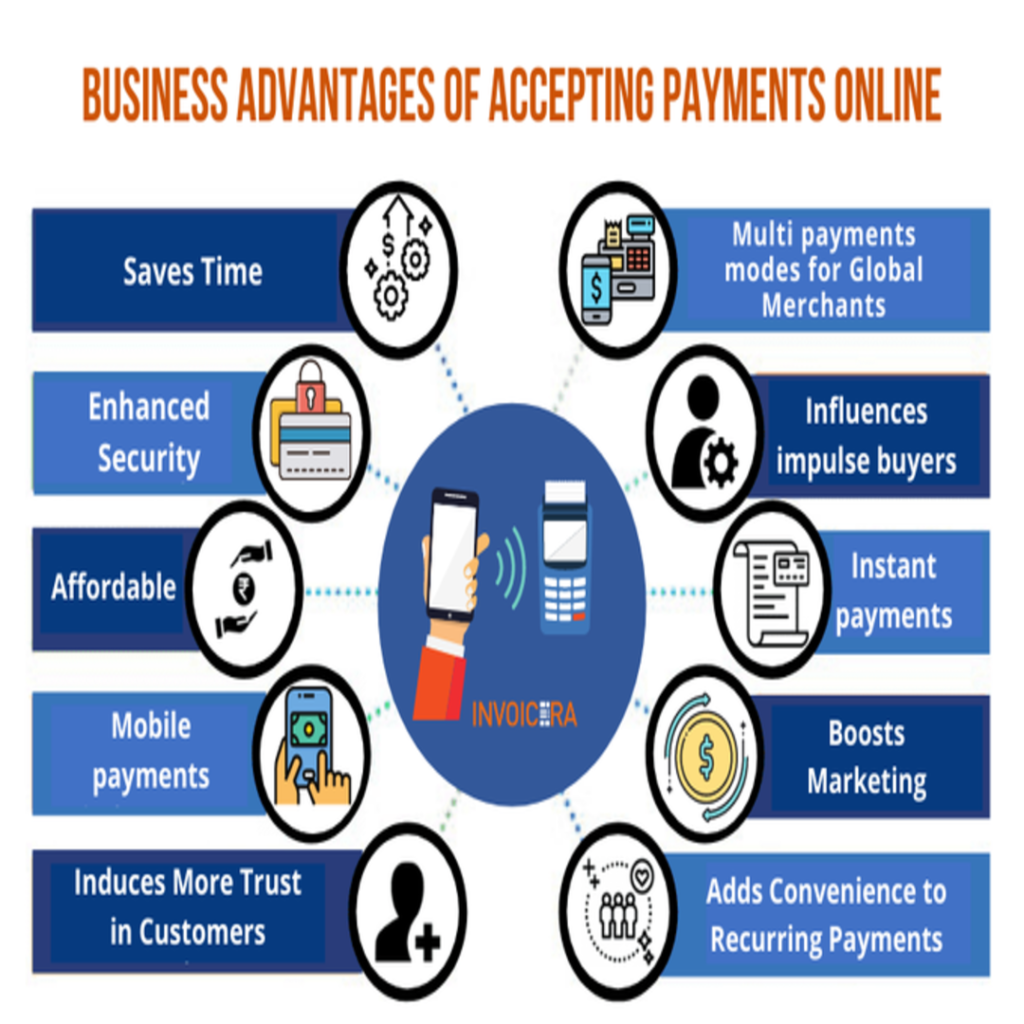

One of the primary advantages of adopting Payments as a Service is cost-effectiveness. Businesses can reduce infrastructure costs, maintenance, and staffing, allowing them to allocate resources more efficiently. Enhanced security measures, including encryption and fraud detection, contribute to a more secure environment for financial transactions. The scalability and flexibility of PaaS solutions further empower businesses to adapt to changing demands.

Top Payments as a Service Companies in the Market

In the competitive landscape of PaaS, several companies stand out for their innovative solutions. Leaders such as XYZ Payments, ABC FinTech, and PQR Transactions offer diverse services tailored to the needs of different industries. A comparative analysis of their features, pricing, and customer reviews can guide businesses in selecting the right partner.

Challenges and Concerns in Payments as a Service

While PaaS brings numerous benefits, challenges exist, including security and privacy concerns. The reliance on digital platforms also raises regulatory challenges that PaaS companies must navigate. Potential disruptions, such as system outages or cyberattacks, underscore the importance of robust risk management strategies.

Integration of Payments as a Service into Businesses

Businesses can leverage Payments as a Service to streamline their financial operations, enhance customer experiences, and gain a competitive edge. Success stories of companies seamlessly integrating PaaS solutions highlight the positive impact on efficiency and revenue growth.

Future Trends in Payments as a Service

The dynamic nature[1] of technology ensures continuous evolution in the PaaS landscape. Emerging technologies like blockchain, artificial intelligence, and machine learning are expected to play a pivotal role in shaping the future of Payments as a Service.[2] Predictions suggest increased collaboration between PaaS providers and traditional financial institutions.[3]

Case Studies: Successful Implementations

Real-world examples of companies adopting PaaS provide valuable insights into the benefits and challenges of such transformations[4]. Case studies reveal the diverse applications of Payments as a Service across industries and offer lessons for other businesses considering similar transitions.[5]

Comparison with Traditional Payment Models

Contrasting Payments as a Service with traditional payment systems highlights the advantages and disadvantages of each. While traditional models may offer familiarity, PaaS excels in terms of speed, efficiency, and adaptability to evolving technological landscapes.

Choosing the Most Suitable Payments as a Service Partner

Choosing the right PaaS provider is a critical decision for businesses. Factors such as reliability, security measures, integration capabilities, and scalability should be considered. A comprehensive evaluation ensures that the selected PaaS company aligns with the specific needs and goals of the business.

The Role of Technology in Shaping Payments as a Service

Technological advancements, including AI and blockchain, play a crucial role in the evolution of Payments as a Service. Innovations driven by these technologies contribute to enhanced security, transparency, and efficiency in financial transactions.

Security Measures in Payments as a Service

Security is paramount in the digital payment landscape. PaaS companies employ robust security protocols, including data encryption, multi-factor authentication, and compliance with industry regulations. These protocols collaboratively establish a protected atmosphere for users.

Customer Experiences and Feedback

Gauging customer experiences and feedback provides valuable insights into the effectiveness of PaaS solutions. Positive testimonials highlight the success stories, while addressing any negative feedback allows PaaS providers to refine their services and address concerns promptly.

Conclusion

In conclusion, Payments as a Service companies have become integral to the modern business ecosystem, offering efficient, secure, and scalable solutions for financial transactions. As technology continues to advance, the role of PaaS in shaping the future of payments is undeniable. Businesses must carefully evaluate their options and embrace the transformative potential of Payments as a Service to stay competitive in the digital age.

FAQs

- Are Payments as a Service companies suitable for all types of businesses?

- PaaS companies cater to a wide range of businesses, but the suitability depends on the specific needs and requirements of each business.

- How do PaaS companies ensure the security of transactions?

- PaaS companies employ advanced security measures such as data encryption, multi-factor authentication, and compliance with industry regulations to ensure the security of transactions.

- What factors should businesses consider when selecting a PaaS provider?

- Businesses should consider factors such as reliability, security measures, integration capabilities, scalability, and pricing when choosing a PaaS provider.

- Can Payments as a Service be integrated into existing business systems?

- Yes, PaaS solutions are designed to be adaptable and can often be integrated into existing business systems for a seamless transition.

- How do Payments as a Service companies contribute to cost-effectiveness?

- PaaS companies help businesses save costs by reducing infrastructure expenses, maintenance, and staffing, allowing for more efficient resource allocation.