AUTHOR : MICKEY JORDAN

DATE : 13/12/2023

Introduction

In the evolving landscape of digital transactions[1], the concept of Payment Without CVV is gaining traction. Traditionally, the Card Verification Value (CVV) served as an added layer of security for online transactions. However, many modern payment systems are bypassing this requirement to simplify the payment process[2] without compromising safety. This streamlined approach is designed to offer a seamless user experience, particularly for recurring transactions, app-based payments, or secure digital wallets[3]. Understanding how Payment Without CVV works can help businesses and consumers make informed decisions about adopting these innovative solutions.

Understanding CVV

Before we explore payment without CVV, let’s grasp the concept of CVV. CVV, or Card Verification Value, is a crucial security feature[4] found on credit and debit cards. It consists of a three- or four-digit code, typically located on the back of the card. CVV serves[5] as an additional layer of protection, ensuring that the person making the transaction physically possesses the card.

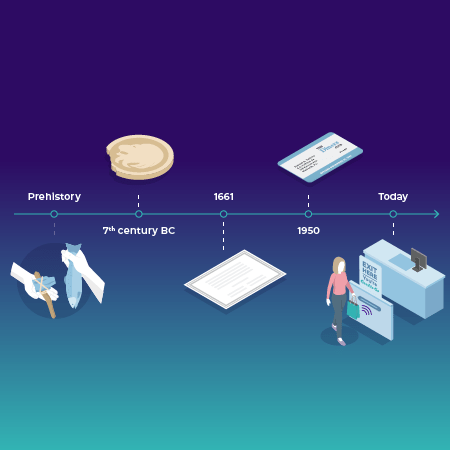

The Evolution of Payment Methods

Traditional Payment Methods

In the not-so-distant past, traditional payment methods required the manual input of CVV for online transactions. This added layer of security was effective, but not without its inconveniences.

Modern Alternatives

With advancements in technology, new payment methods have emerged, allowing for transactions without the need for CVV. Digital wallets, one-click payments, and tokenization are reshaping the landscape, offering a seamless user experience.

Benefits of Payment Without CVV

Enhanced User Experience

One of the primary advantages is the enhanced user experience. Removing the CVV requirement streamlines the payment process, making it quicker and more user-friendly.

Convenience in Recurring Payments

For subscription-based services or monthly subscriptions, the absence of CVV input simplifies recurring transactions, contributing to a hassle-free experience for users.

Improved Conversion Rates

Businesses adopting payment without CVV often witness improved conversion rates. The streamlined checkout process encourages users to complete transactions without unnecessary hurdles.

Security Concerns

Addressing Security Apprehensions

While the convenience is undeniable, concerns about security persist. In this section, we’ll explore how the industry addresses these anxieties, ensuring the safety of online transactions.

Advanced Encryption Measures

Payment portals employ advanced encryption measures to safeguard user data, ensuring that sensitive information remains private during the transaction process.

Multi-Factor Authentication

To compensate for the absence of CVV, many platforms implement two-step verification, adding an extra layer of security through alternate means like SMS verification or biometrics.

Navigating Risks

Educating Users

Ensuring a secure payment environment involves teaching users about potential risks and best practices. Platforms providing transactions without CVV often emphasize user awareness to minimize potential vulnerabilities.

Continuous Monitoring

Implementing robust monitoring systems allows businesses to detect and respond swiftly to any suspicious activities, further protecting the payment ecosystem.

Future Trends in Digital Transactions

Blockchain Technology

The rise of blockchain technology introduces decentralized and highly secure transaction methods, potentially revolutionizing the landscape of payment security.

Biometric Authentication

Biometric authentication, such as fingerprint recognition and facial examination, is gaining impact as a secure alternative to traditional CVV.

Conclusion

The shift toward Payment Without CVV reflects the Transactions industry’s efforts to balance security with convenience. While the omission of the security code in certain transactions may raise concerns, advanced encryption, tokenization, and fraud detection systems ensure the integrity of such payments. As this trend grows, it has the potential to reshape how individuals and businesses engage in digital commerce. Embracing Payment Without Security Code can lead to faster checkouts and improved customer satisfaction, making it a viable option in our increasingly cashless economy.

FAQs

- What does Payment Without CVV mean?

Payment without CVV refers to transactions where the card verification value (CVV) is not required for transaction processing. This is often seen in recurring billing, digital wallets, or pre-authorized platforms that prioritize user convenience. - Is payment without CVV secure?

Yes, these payments remain secure despite the absence of a CVV because methods like tokenization, encryption, and real-time fraud monitoring actively protect the transaction. - Why do some platforms allow payment without CVV?

Certain platforms enable Payment Without CVV to provide faster and more user-friendly transactions, particularly for trusted users or pre-verified accounts. - Where is Payment Without CVV commonly used?

You’ll typically encounter Payment Without CVV in membership services, app-based purchases, and trusted digital payment gateways that rely on secure data storage. - Are there risks associated with payment without CVV?

While Payment Without CVV is generally safe, users should ensure they transact only on trusted platforms with robust security protocols to mitigate any potential risks.