AUTHOR : MICKEY JORDAN

DATE : 13/12/2023

Introduction

In today’s fast-paced digital economy, ensuring seamless payment transactions has become a critical aspect of consumer satisfaction and business success. However, many individuals and businesses occasionally encounter the phrase “payment was processing” during transactions. This seemingly simple term holds significant implications for financial operations, ranging from the verification of funds to ensuring transaction security. Understanding why and how “payment was processing” appears during your payment journey can empower you to navigate these situations more effectively. Let’s explore the nuances of this essential aspect of payment systems and what it means for both consumers and businesses.

Key Components of Payment Processing

Payment processing involves several key components, namely the payment gateway, merchant account, and processor. Each plays a unique role in ensuring that transactions are carried out seamlessly. The payment gateway acts as a bridge between the customer and the merchant, securely transmitting payment information. The merchant account is where funds are held before being deposited into the business’s bank account, and the processor is responsible for authorizing the transaction.

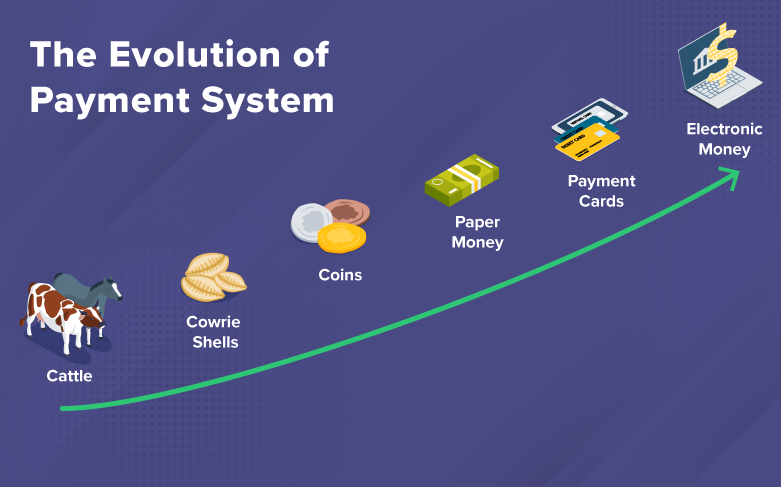

The Evolution of Payment Processing

The journey of payment processing has evolved significantly over the years. From traditional methods involving cash and checks to the introduction of digital payments, the landscape continues to transform. Emerging technologies, such as blockchain and decentralized finance (DeFi), are now paving the way for even more innovative payment solutions.

Security Measures in Payment Processing

Ensuring the security of payment transactions is paramount. Encryption, tokenization, and two-factor authentication are among the robust security measures in place. These technologies work together to protect sensitive information and thwart unauthorized access, instilling confidence in both businesses and consumers.

Challenges in Payment Processing

Despite the advancements, challenges persist in the realm of payment processing. Fraud prevention, chargebacks, and integration issues pose ongoing concerns. Businesses must navigate these challenges effectively to maintain a trustworthy and reliable payment system.

Impact of Payment Processing on Businesses

A streamlined payment process directly impacts a business’s success. Enhanced customer satisfaction, operational efficiency, and the ability to reach a global audience are just a few benefits. Businesses that prioritize a smooth payment experience often find themselves ahead in the competitive market.

Choosing the Right Payment Processor

Opting for the correct payment processor stands as a vital choice for businesses, carrying substantial importance in shaping their financial transactions and overall operational effectiveness.Considerations such as transaction fees, security features, and scalability should guide this choice. Popular payment processors like PayPal, Stripe, and Square offer diverse solutions tailored to different business needs.

Trends in Payment Processing

The payment landscape is continually evolving, with trends shaping the future. Contactless payments, integration of cryptocurrencies, and biometric authentication are gaining prominence. Adapting to these trends ensures businesses stay at the forefront of technology.

User-Friendly Payment Experiences

User experience is a focal point in payment processing[1]. Mobile , seamless online checkout , and personalized payment options contribute to a positive user experience, fostering customer loyalty.

AI’s Impact on Streamlining Modern Payment Transaction Processes

Artificial intelligence (AI) plays a pivotal role in enhancing From fraud detection to predictive analytics and customer support, AI-driven solutions contribute to the efficiency and security of transactions[2].

Regulatory Compliance in Payment Processing

Adhering to regulatory standards is crucial in . The Payment Card[3] Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR), and other compliance measures pose challenges but are essential for maintaining trust and legality.

Future of Payment Processing

Looking ahead, the future of holds exciting possibilities. Innovations on the horizon include enhanced security measures, simplified processes[4], and a more interconnected global ecosystem.

Successful Payment Processing Implementations

Real-world case studies highlight the success stories of businesses[5] implementing robust solutions. These examples provide insights into overcoming challenges and positive outcomes.

Conclusion

The phrase “payment was processing” may initially seem like a small hiccup in the transaction process, but it represents an intricate system of checks and balances designed to ensure accuracy, security, and efficiency. From verifying account details to complying with anti-fraud measures, every step in the processing phase serves a purpose. By understanding the mechanics of why a Transaction Pending, individuals and businesses can manage expectations and respond proactively. Ultimately, embracing the dynamics of this process helps foster trust and reliability in Transaction systems, paving the way for smoother financial transactions in the future.

FAQs

1. Why does my transaction show “Payment Was Processing”?

This message indicates that your payment is being verified and authenticated. It may involve steps like bank approval, fraud checks, or network delays. It’s a normal part of ensuring secure and accurate transactions.

2. How long does it take when “Payment Was Processing” appears?

The duration can vary based on factors such as Transaction method, bank policies, and the processing system’s efficiency. Most transactions complete within seconds to a few minutes, though some may take hours or even a day in rare cases.

3. Can I cancel my transaction while “Payment Was Processing”?

In most cases, cancellations during the processing phase aren’t possible as the payment is already in the system. You may reach out to the service provider or merchant for support if required..

4. Is it safe when my payment shows “Payment Was Processing”?

Yes, the “Transaction Pending” stage is a secure step where payment gateways and banks validate your details to prevent unauthorized transactions. It boosts security and helps reduce potential risks effectively.

5. What should I do if “Payment Was Processing” takes too long?

If the processing time exceeds typical durations, reach out to your bank or the merchant for updates. Network issues, incorrect details, or technical errors might be causing delays, which can often be resolved with assistance.