AUTHOR : SELENA GIL

DATE : 11/12/2023

Introduction

In the fast-paced landscape of the modern world, payment technology stands as the cornerstone of satisfaction and efficiency in financial transactions. Evolving from traditional cash-based exchanges, payment technology has undergone a radical transformation, reshaping the way we handle transactions.

The Evolution of Payment Methods

Payment methods have evolved significantly over time, transformation. from barter systems to physical currency and checks. With the advent of technology, digital payment methods emerged, enabling transactions through credit/debit cards, online banking, and electronic transfers.

Types of Payment Technologies

Contactless Payments

Contactless payments have gained immense popularity due to their clearness and speed. Using near-field communication (NFC) technology, transactions occur swiftly by waving or tapping cards or mobile devices on appropriate.

Mobile Wallets

Mobile wallets have restructure the way people make transactions. These digital platforms store payment information securely, allowing users to make separated, transfer money, and even manage loyalty cards through their telephone.

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum have caused a seismic shift in conventional financial structures Operating on blockchain technology, these segregated digital currencies offer secure and transparent transactions globally.

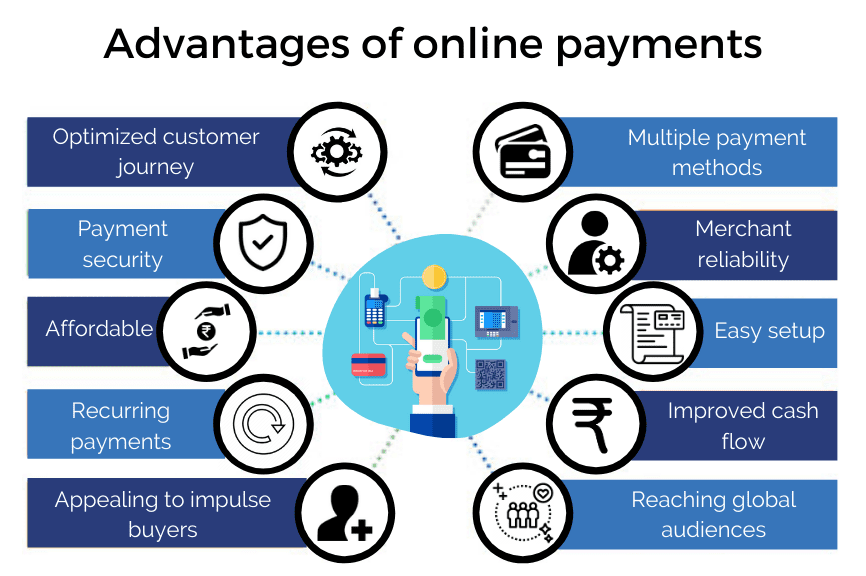

Advantages of Payment Technology

Convenience and Accessibility

Payment technology has obliterate the need for physical currency, providing extraordinary. in transactions. Whether it’s paying bills, shopping online, or transferring funds, technology has made it possible at our fingertips.

Enhanced Security Measures

Sophisticated encryption and testimony. methods bolster the security of payment technologies. Multi-factorconfirmation., tokenization, and biometric verification have significantly reduced fraudulent activities, assuring users of secure transactions.

Global Accessibility

With the advent of digital payment systems,geological barriers no longer limit financial transactions. People worldwide can seamlessly conduct business, making international trade and transactions more accessible.

Challenges and Concerns

Despite the numerous advantages, payment technology faces challenges. Security dereliction, data privacy concerns, and technological glitches pose risks that demand constant innovation and demanding measures.

Exploring Emerging Trends in Payment Technology

Biometric Authentication

Biometric authentication, using unique biological traits like fingerprints or facial recognition, is gaining traction in payment technology. This cutting-edge method offers heightened security and convenience[1], replacing traditional PINs or passwords.

AI-Powered Fraud Detection

Artificial intelligence plays a pivotal role in enhancing fraud detection mechanisms. AI algorithms analyze vast amounts of data in actual, swiftly identifying irregularities or suspicious activities, thereby bolstering security in transactions.

The Rise of Peer-to-Peer (P2P) Payments

Peer-to-peer payment platforms allow individuals to transfer funds directly between themselves using mobile applications. These services facilitate quick and effortless transactions among friends, family, or businesses without the need for broker

The Role of Blockchain Beyond Cryptocurrencies

Blockchain technology, the foundation of cryptocurrencies, extends its utility beyond digital currencies. Its decentralized and immutable nature finds applications in secure record-keeping, smart contracts[2], and enhancing transparency across various industries.

Augmented Reality (AR) in Shopping and Payments

Augmented reality is reshaping the shopping experience. Integrating AR into payment processes allows consumers to visualize products before purchase and facilitates prime transactions through interactive interfaces

The Future of Payment Technology: Potential Impact

Financial Inclusion and Global Accessibility

Advancements in payment technology[3] can bridge the gap between the banked and unbanked populations globally. With innovative solutions and mobile-based services, financial inclusion becomes more viable authorize individuals inon the poverty trap communities.

Evolving Regulatory Frameworks

Regulatory bodies continuously adapt to the discharge landscape of payment technology. Striking a balance between innovation and consumer[4] protection, these frameworks aim to foster a secure and trustworthy financial environment.

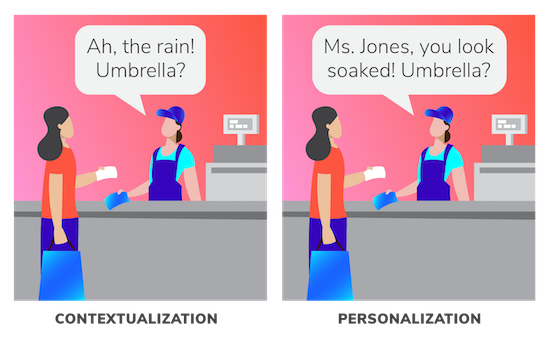

Personalized and Contextualized Payment Experiences

As technology progresses, payment experiences become more personify Tailored offers, custom-tailored payment plans, and contextualized recommendations[5] based on user behavior contribute to a more engaging and quality control payment ecosystem

Conclusion

Payment technology has redo the way we handle transactions, offering good, security, and global accessibility. Embracing these improvement while post the associated challenges will continue to shape the future of financial interactions.

FAQs

- How secure are mobile payment platforms?

Mobile payment platforms employ robust security measures like encryption and biometric authentication, ensuring high levels of security for transactions. - Aresegregated. moneywidely accepted for transactions?

While acceptance varies, an increasing number of businesses are beginning to accept cryptocurrencies as a form of payment. - What are the potential risks of contactless payments?

Contactless payments are generally secure, but potential risks include data theft via NFC scoop off or ban transactions if a device is lost or stolen. - How has payment technology impacted traditional banking?

Payment technology has pushed traditional banks to innovate, offering online and mobile banking services to meet the evolving needs of customers. - What’s the future of payment technology?

The future holds advancements in biometric testimony., AI-driven fraud detection, and the integration of Internet of Things (IoT) for ideal. transactions.