AUTHOR : BABLI

DATE : 11/12/23

Introduction

In the fast-paced digital era, the evolution of payment systems has become a cornerstone of economic growth and convenience. This article delves into the landscape of payment systems in the UK, exploring their evolution, types, key players, security measures, challenges, and future trends.

Evolution of Payment Systems

Historical Perspective Payment systems in the UK have come a long way from traditional cash transactions to the current era of digital dominance. The journey involves technological advancements and societal shifts.

Digital Transformation and Its Impact The advent of the internet and smartphones has revolutionized how individuals and businesses handle transactions. The impact of this digital transformation on payment systems cannot be overstated.

Types of Payment Systems

Cash Transactions Despite the rise of digital transactions, cash remains a significant player in the payment landscape. We explore its role and relevance in today’s society.

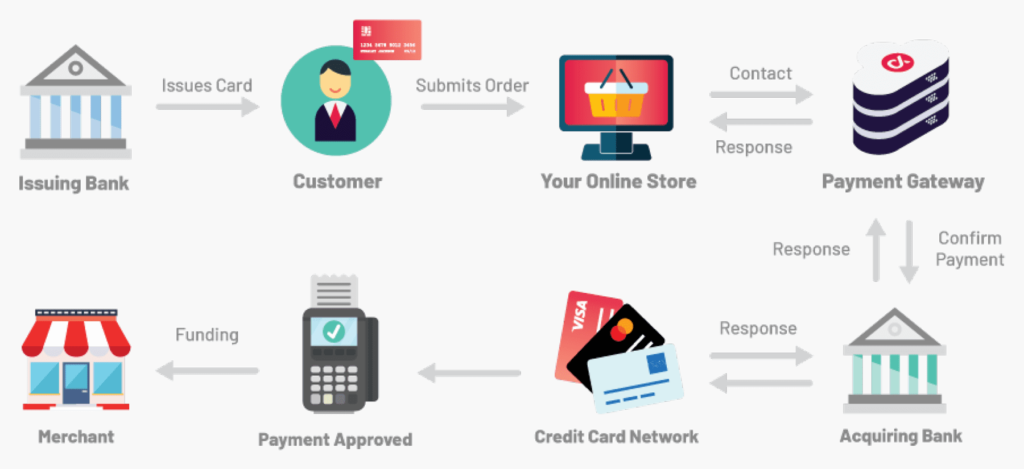

Card Payments Debit and credit cards have become ubiquitous in the UK. Understanding the nuances of card payments is crucial for consumers and businesses alike.

Online Payment Methods The ease and speed of online payments have changed the way we shop and conduct business. We dissect the various online payment methods available.

Key Players in the UK Payment System

Major Banks Traditional[1] banks play a vital role in the UK payment system. [2]We analyze their contributions and challenges in the evolving digital landscape.

Fintech Companies [4]The rise of fintech has introduced innovative payment solutions[3]. We explore how these companies are shaping the future of transactions.[5]

Security Measures in Payment Systems

Encryption Technologies As digital transactions become more prevalent, ensuring the security of financial information is paramount. We discuss the role of encryption technologies in safeguarding payment systems.

Two-Factor Authentication An extra layer of security is essential in today’s cyber threat landscape. Two-factor authentication adds an additional shield against unauthorized access.

Future Trends in Payment Systems

Contactless Payments The rise of contactless payments is reshaping how we make everyday transactions. We explore the convenience and security aspects of this emerging trend.

Blockchain Technology Blockchain is more than just the backbone of cryptocurrencies. We examine how this technology is influencing the future of payment systems.

Impact of Payment Systems on Businesses

Improved Efficiency Businesses, big and small, benefit from efficient payment systems. We discuss how streamlined transactions contribute to overall business success.

Global Transactions The international nature of business requires seamless global transactions. We explore how payment systems facilitate cross-border trade.

Consumer Perspectives on Payment Systems

Convenience and Speed Consumers value convenience and speed in payment processes. We explore how payment systems meet these expectations.

Trust in Digital Transactions Building trust in digital transactions is crucial. We discuss how payment systems contribute to the growing trust in online and mobile transactions.

How to Choose the Right Payment System

Factors to Consider Choosing the right payment system [1]is essential for businesses [2]and individuals alike. We provide a comprehensive guide to the factors that should influence your decision.

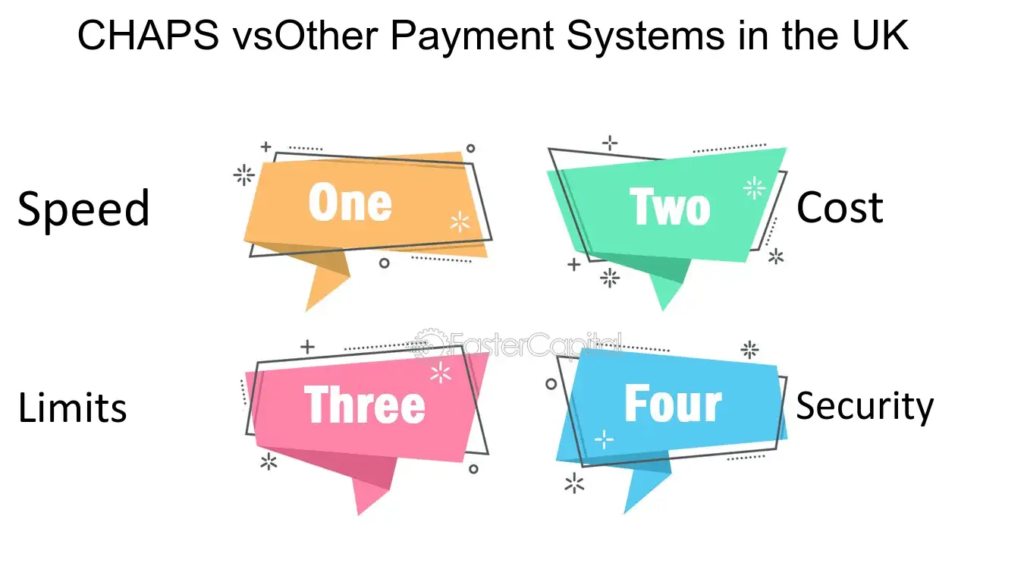

Comparing Options With numerous payment[3] options available, we offer a comparative[4] analysis to help you make an informed choice.[5]

The Role of Mobile Wallets

Rise in Popularity Mobile wallets are gaining popularity globally. We explore the factors contributing to their widespread adoption.

Benefits and Drawbacks While mobile wallets offer convenience, it’s essential to understand their benefits and drawbacks. We provide insights to help you make an informed decision.

Case Studies

Successful Implementation Stories Examining successful implementation stories provides valuable insights. We showcase cases where payment systems have positively impacted businesses and consumers.

Lessons Learned from Failures Learning from failures is equally important. We analyze cases where payment systems faced challenges and the lessons we can glean from them.

Government Initiatives in the Payment Sector

Regulatory Frameworks Governments play a crucial role in shaping the payment landscape. We explore the regulatory frameworks that govern the UK payment sector.

Financial Inclusion Efforts Financial inclusion is a global goal. We highlight government initiatives aimed at making payment systems accessible to all.

The International Landscape of Payment Systems

A Comparison with Other Countries Comparing the UK payment system with those of other countries provides a broader perspective. We explore the similarities and differences.

Collaborative Efforts In an interconnected world, collaborative efforts between countries are becoming more common. We discuss the benefits of such collaborations.

Conclusion

In conclusion, the UK payment system is undergoing a transformative journey, embracing digital innovation while addressing challenges. As technology continues to advance, the importance of secure and efficient payment systems cannot be overstated. Businesses and individuals alike must stay informed and adapt to the evolving landscape.

FAQs

- Is it safe to use online payment methods in the UK?

- Yes, online payment methods in the UK employ advanced security measures such as encryption and two-factor authentication to ensure user safety.

- What is the future of contactless payments in the UK?

- Contactless payments are expected to become even more prevalent, offering increased convenience and speed for everyday transactions.

- How do mobile wallets contribute to financial inclusion?

- Mobile wallets provide a convenient way for individuals without traditional banking access to participate in the financial ecosystem.

- What role do fintech companies play in shaping the payment landscape?

- Fintech companies introduce innovative solutions, driving competition and pushing traditional financial institutions to adapt and improve.

- How can businesses choose the right payment system for their needs?

- Businesses should consider factors such as transaction volume, target audience, and international transactions when selecting a payment system.