AUTHOR : ANNU CHAUHAN

DATE : 28-10-2023

In the world of business[1], staying ahead often means embracing technological advancements; furthermore, this includes payment solutions. Today, we will explore the realm of payment solutions providers and how they play a pivotal role in facilitating[2] seamless deals for businesses of all sizes.

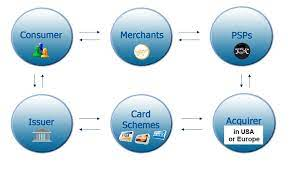

Understanding Payment Solutions Providers

Payment solutions[3] Suppliers are companies or tools that offer businesses a range of tools and services to process deals. These services encompass a variety of payment methods[4], from credit and debit cards to digital wallets and mobile payments[5]

.

Types of Payment Solutions Providers

- Traditional banks: These are banks that offer merchant services and payment processing solutions. They are often the first choice for established businesses.

- Payment Processors: Companies like PayPal and Square fall into this category, providing easy-to-integrate payment solutions for e-commerce businesses.

- Fintech Startups: Innovative startups, such as Stripe and Adyen, focus on simplifying payment processes through technology.

- Payment Gateways: These are software applications that connect e-commerce websites to payment processors, ensuring secure deals.

Why Your Business Needs a Payment Solutions Provider

Payment solution providers offer a multitude of benefits, such as increased sales, an improved customer experience, and streamlined operations. They enhance security and enable businesses to reach a global customer base.

Key Features to Look for in a Payment Solutions Provider

When choosing a payment solutions[1] provider [1], consider factors like transaction fees, security, and scalability. Ensure they support the payment methods relevant to your customer base.

Comparing Payment Solutions Providers

It’s essential to compare providers to find the best fit for your business. Look at their offerings, fees, and customer support.

The Benefits of Using Payment Solutions Providers

Businesses enjoy benefits like faster deals, fraud protection[2], and access to valuable deal data for marketing and financial analysis.

Security Measures in Payment Solutions

Security is paramount in the world of payments. PSP employs encryption and fraud detection tools to safeguard deals.

Challenges in Payment Solutions

While payment solution providers offer numerous advantages[3], they also present challenges such as managing fees and staying compliant with changing regulations.

Trends in Payment Solutions

Stay updated with industry trends like contactless payments, blockchain, and biometric authentication to remain competitive.

How to Choose the Right Payment Solutions Provider

Consider your business’s unique needs and customer preferences[4] when selecting a provider. Look for transparent pricing and the ability to scale as your business grows.

Integration with E-commerce tools

Ensure seamless integration[5] with your e-commerce platform of choice, as this will streamline the purchasing process for your customers.

Cost of Payment Solutions

Different providers have varying fee structures. Understand the costs involved, including setup fees, transaction fees, and monthly charges.

Case Studies of Successful Payment Solutions Implementation

Explore real-world examples of businesses that have successfully leveraged payment solution providers to expand their operations and increase revenue.

Conclusion

Payment solution providers have revolutionized the way businesses handle deals. They offer convenience, security, and efficiency, making them an indispensable part of the modern business landscape. As the payment industry continues to evolve, choosing the right provider will be essential for business success.

FAQs

1. What is a payment solution provider?

A payment solutions provider is a company or platform that offers tools and services to facilitate secure and efficient deals for businesses.

2. How do I choose the right payment solution provider for my business?

To choose the right provider, consider factors like your business’s unique needs, customer preferences, pricing, and scalability.

3. What are the benefits of using a payment solution provider?

Payment solution providers offer benefits such as increased sales, an enhanced customer experience, and enhanced security.

4. Are payment solution providers suitable for small businesses?

Yes, payment solution providers cater to businesses of all sizes, including small enterprises.

5. How can I stay updated on the latest payment solution trends?

Stay informed by following industry news, attending conferences, and connecting with professionals in the payment industry.