AUTHOR : BILLIE EILISH

DATE : 23-10-2023

In today’s digital age[1], payment solutions are an integral part of daily life. As businesses[2] and also individuals strive for convenience[3] and efficiency in their financial transactions[4], Australia has emerged as a hub for innovative payment solutions. This article will explore the landscape of payment solutions in Australia, covering a wide range of topics, from traditional payment[5] methods to cutting-edge fintech solutions. So, let’s dive into the world of Payment Solutions Australia.

Introduction

Australia, known for its stunning landscapes and diverse wildlife, is also making its mark in the digital payment landscape. With a rapidly evolving economy, Australia has embraced various payment methods that cater to the needs of both consumers and businesses.

Traditional Payment Methods

Credit and Debit Cards

Credit and debit[1] cards are the backbone of modern transactions in Australia. Accepted virtually everywhere, they offer convenience and also security.

Cash

While the use of cash[2] is declining, it’s still widely accepted. Many Australians prefer cash for small, everyday purchases.

Checks

Although less common today, checks are still used for specific transactions[3], particularly in business settings.

E-Wallets and Mobile Payments

PayPal

PayPal is a global leader in e-wallets, enabling easy and secure online transactions.

Apple Pay

Apple Pay[4] allows users to make payments using their Apple devices at compatible merchants.

Google Pay

Similar to Apple Pay, Google Pay offers a streamlined mobile payment experience for Android users.

Online Banking

BPAY

BPAY[5] is an electronic bill payment system widely used in Australia for settling bills online.

Direct Bank Transfers

Direct bank transfers offer a secure way to move money directly between bank accounts.

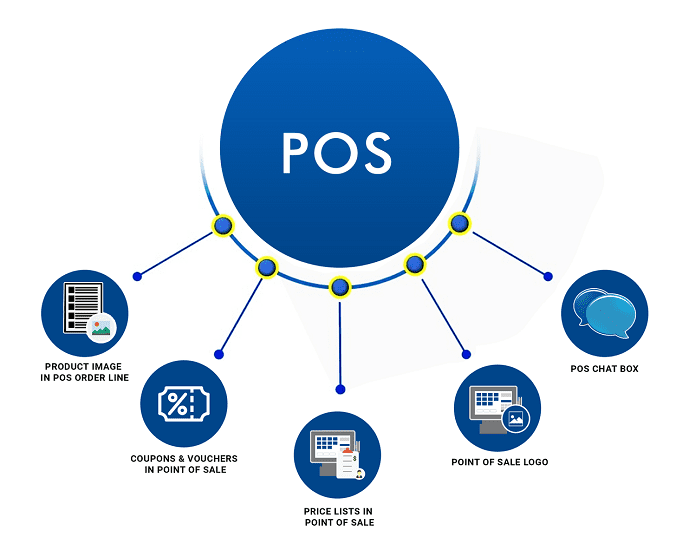

Point of Sale (POS) Systems

Businesses in Australia rely on point-of-sale systems to streamline transactions, manage inventory, and

also generate reports.

Cryptocurrency

Cryptocurrencies like Bitcoin and Ethereum are gaining traction, with some Australian businesses accepting them as a form of payment.

Fintech Revolution

Afterpay

Afterpay has transformed the way consumers pay for goods, allowing them to “buy now, pay later.”

Zip Pay

Zip Pay is another player in the “buy now, pay later” market, offering flexibility and convenience.

Government Initiatives

The Australian government has taken steps to modernize the payment industry, promoting financial inclusion and security.

Security and Regulation

With the increasing reliance on digital payments, security and regulation have become paramount, ensuring the safety of financial transactions.

Challenges in the Industry

While payment solutions have come a long way, challenges such as data breaches, cyber threats, and regulatory compliance remain.

The Future of Payment Solutions in Australia

The future looks promising, with more innovations expected to further simplify and secure transactions.

Expanding Payment Horizons

The payment solutions market in Australia is not only about convenience but also about expanding horizons. As technology advances and consumer preferences change, the landscape keeps evolving.

Contactless Payments

Contactless payments have gained immense popularity in Australia, especially after the global pandemic. Tap-and-go options with credit and debit cards, as well as mobile payment apps, have made transactions faster and more hygienic.

Digital Wallets

Digital wallets are becoming increasingly common, allowing users to store multiple cards and make payments with a simple tap on their smartphones. This technology has streamlined everyday transactions.

Peer-to-Peer Payments

Apps like Venmo and PayPal have revolutionized the way people exchange money with friends and family, making it easy to split bills and share expenses.

Cross-Border Payments

Australia’s international trade and tourism industry rely heavily on cross-border payments. The traditional methods have evolved into swift and secure international transfers.

Small Business Solutions

Small businesses benefit from a variety of payment solutions tailored to their specific needs. Mobile card readers and online payment gateways enable entrepreneurs to accept payments in various forms.

The Role of Big Banks

Australia’s major banks have played a significant role in shaping the payment landscape. They have introduced user-friendly apps and digital platforms to keep up with the growing demand for online services.

Financial Inclusion

The Australian government actively promotes financial inclusion by providing affordable and accessible banking options to all citizens. This initiative ensures that payment solutions are available to everyone, regardless of their economic status.

Sustainability and Payment

As the world becomes more environmentally conscious, the payment industry in Australia is exploring eco-friendly alternatives. Digital receipts, reduced paper usage, and sustainable practices are becoming increasingly popular.

The Rise of Buy Now, Pay Later

The “buy now, pay later” trend, popularized by companies like Afterpay and Zip Pay, continues to surge. This model appeals to consumers who seek flexibility in their payments and want to avoid credit card debt.

Cryptocurrency on the Horizon

Cryptocurrencies are becoming more mainstream in Australia. Many businesses now accept Bitcoin and other digital currencies, providing an alternative payment option for tech-savvy customers.

Innovation and Security

The future of payment solutions in Australia is all about innovation and enhanced security. Expect to see biometric authentication, AI-driven fraud prevention, and blockchain technology playing a more significant role.

Conclusion

Australia’s payment solutions landscape is diverse and evolving, catering to the ever-changing needs of consumers and businesses. Whether you prefer traditional methods or the latest fintech innovations, there is a payment solution for everyone.

FAQs

1. Are traditional payment methods still widely used in Australia?

- Yes, credit cards, cash, and checks are still commonly used for various transactions.

2. What is the “buy now, pay later” trend in Australia?

- It’s a popular payment model offered by companies like Afterpay and Zip Pay, allowing consumers to make purchases and pay for them in installments.

3. How secure are digital payment methods in Australia?

- Security measures and regulations have been implemented to ensure the safety of digital transactions.

4. What is the government’s role in shaping payment solutions in Australia?

- The government is actively promoting financial inclusion and implementing regulations to safeguard the payment industry.

5. What can we expect in the future of payment solutions in Australia?

- Continued innovation, increased security, and greater convenience for consumers and businesses.