AUTHOR : HANIYA SMITH

DATE : 21/09/2023

In the fast-paced world of e-commerce and online businesses, payment aggregators play a pivotal role in ensuring seamless transactions. These financial intermediaries bridge the gap between businesses and their customers, making it easier for both parties to engage in online transactions. In this comprehensive guide, we will explore the world of their significance, Payment Aggregators listprovide you with a curated list of some of the top in the market.

Introduction

In the digital age, online payments have become an integral part of our lives. From purchasing products and also services to making donations, the ease of online transactions has reshaped the way businesses operate. Behind the scenes, payment aggregators are the unsung heroes that make these transactions[1] swift and secure also.

What Are Payment Aggregators?

Payment aggregators are financial intermediaries that simplify online transactions for businesses and also consumers. They act as a bridge between the merchant (seller) and the payment processor[2], ensuring that the transaction process is smooth and secure also.

How Payment Aggregators Work

When a customer makes a payment online, the payment aggregator collects the funds and then disburses them to the merchant. Payment Aggregators[3] list reduces the complexity of handling multiple payment methods and also streamlines[4] the settlement process.

Benefits of Using Payment Aggregators

- Streamlined Payments: Payment aggregators consolidate various payment methods[5], making it easier for businesses to accept payments.

- Security: They implement robust security measures to protect sensitive customer information.

- Convenience: Customers can choose their preferred payment method, enhancing the overall shopping experience.

List of Top

Now, let’s take a closer look at some of the top payment aggregators in the market:

PayPal

PayPal is a household name in the world of online payments.[1] Known for its user-friendly interface, it allows businesses and also individuals to send and receive money securely.

Stripe

Stripe is a developer-centric payment aggregator that offers a wide range of customization options for online businesses. It is highly regarded for its developer-friendly tools.

Square

Square is popular among small businesses and also entrepreneurs. It provides easy-to-use point-of-sale solutions and payment processing services.

Authorize.Net

Authorize.Net offers robust payment gateway services, enabling businesses to accept payments online.[2]“It has gained a reputation for its unwavering reliability and also top-notch security measures.”

Adyen

Adyen is a global payment aggregator that specializes in international transactions. It supports over 250 payment methods worldwide.

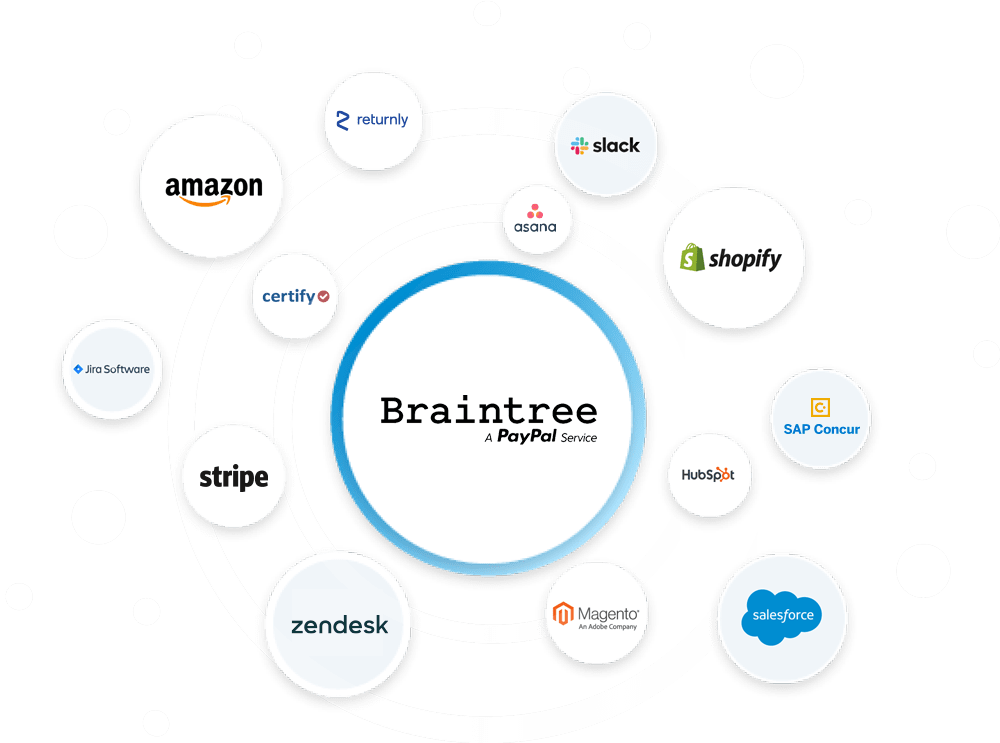

Braintree

Braintree, owned by PayPal, is a flexible payment aggregator known for its easy integration with various e-commerce platforms.

2Checkout

2Checkout is a user-friendly payment aggregator that focuses on global payments and subscription billing.

WePay

WePay offers integrated payment solutions for platforms and also marketplaces, making it easier for businesses to manage payments [3]from multiple sources.

Skrill

Skrill is a digital wallet and also payment aggregator that caters to both individuals and businesses. It is known for its low-cost international transfers.

PayU

PayU specializes in payment solutions for emerging markets, making it a valuable option for businesses expanding globally.

Choosing the Right Payment Aggregator

Selecting the right payment aggregator for your business is crucial. Consider factors like security, integration options, fees, and also customer support when making your decision.

Security Measures and Compliance also

Payment aggregators[4] must comply with industry standards and regulations to ensure the security of financial data.

Integration and User-Friendly Interfaces also

Choose an aggregator that seamlessly integrates with your website or app and also offers a user-friendly experience for your customers.

Fees and Pricing Models also

Evaluate the fee structure and pricing models of different aggregators to find the one that aligns with your budget.

Customer Support

Payment Aggregators list Responsive customer support is essential, especially during technical issues or disputes with payments.

Mobile Payments and In-App Purchases also

If your business relies heavily on mobile transactions, prioritize aggregators that excel in this area.

International Payment Solutions

For businesses with a global customer base, opt for aggregators that support international payment methods.

Future Trends in Payment Aggregation

As technology continues to evolve, payment aggregation is likely to witness innovations such as blockchain-based payments and also enhanced security features.

Conclusion

Payment aggregators are the backbone of online transactions, simplifying the payment process for businesses and also customers alike. Choosing the right aggregator can significantly impact the success of your online venture. Keep in mind the factors discussed here, and select an aggregator that aligns with your business goals and customer preferences.

FAQs

- What is a payment aggregator?

- A payment aggregator is a financial intermediary that simplifies online transactions by connecting merchants and also payment processors.

- Which payment aggregator is best for small businesses?

- Square and PayPal are popular choices for small businesses due to their user-friendly interfaces.

- Are payment aggregators safe to use?

- Yes, payment aggregators implement robust security measures to protect sensitive customer information.

- What factors should I consider when choosing a payment aggregator?

- Consider security, integration options, fees, customer support, and also the payment methods supported.