AUTHOR :RUBBY PATEL

DATE :6/11/23

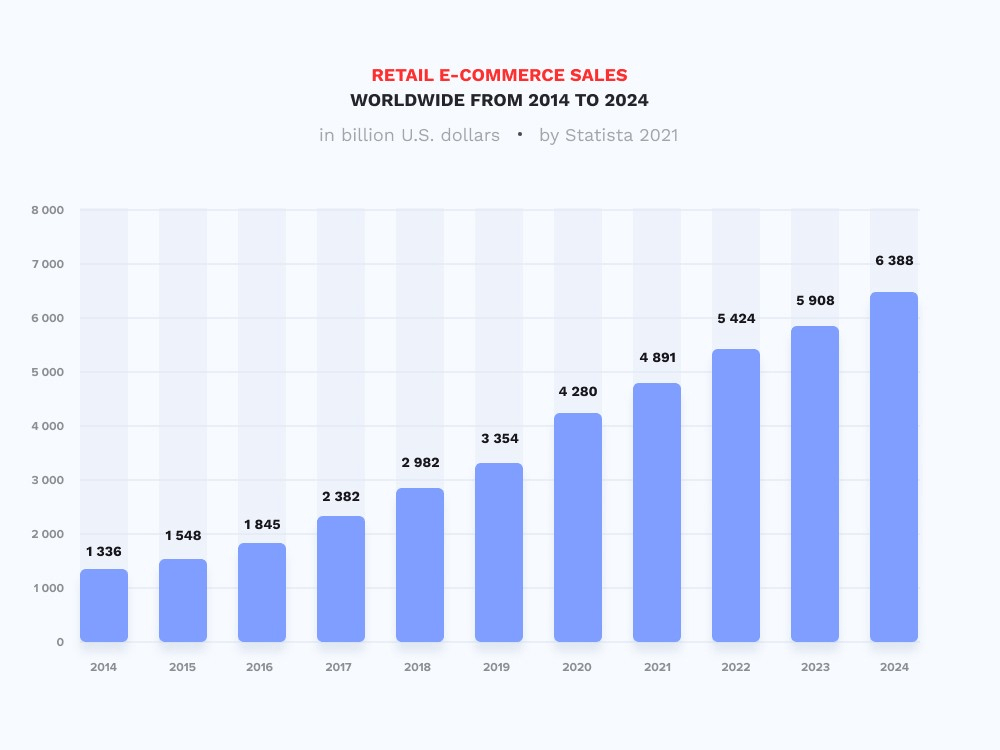

In today’s globalized world, businesses often deal with foreign currencies, whether they are e-commerce platforms, freelancers, or multinational corporations. Handling international transactions efficiently is a priority, and one of the key elements in this process is the choice of a payment processor for foreign currency. In this article, we will delve into the ins and outs of payment processors designed to handle foreign currencies.

Introduction

In a world where businesses are no longer confined to their home countries, international transactions are commonplace. This is where payment processors for foreign currency come into play. They enable businesses and individuals to send, receive, and convert foreign currencies efficiently and securely.

Understanding the Importance of a Payment Processor

A payment processor for foreign currency is a financial service that facilitates international transactions by converting one currency into another, managing exchange rates, and handling the intricacies of cross-border payments. It streamlines the process and reduces the complexities associated with global transactions.

Types of Payment Processors for Foreign Currency

There are various types of payment processors catering to foreign currency transactions, including dedicated forex platforms, traditional banks, and online payment gateways. Each comes with its own set of advantages and limitations, making it essential to choose the one that aligns with your specific needs.

Key Features to Look For

When selecting a payment processor, look for features such as multicurrency support, real-time exchange rate updates, and the ability to customize payment methods to suit your audience. The processor should also offer transparency in fees and pricing.

Comparing Popular Payment Processors

To make an informed choice, it’s crucial to compare popular payment processors in terms of user reviews, customer satisfaction, and expert opinions. PayPal, TransferWise, and Payoneer are some widely-used options, but there are many more to explore.

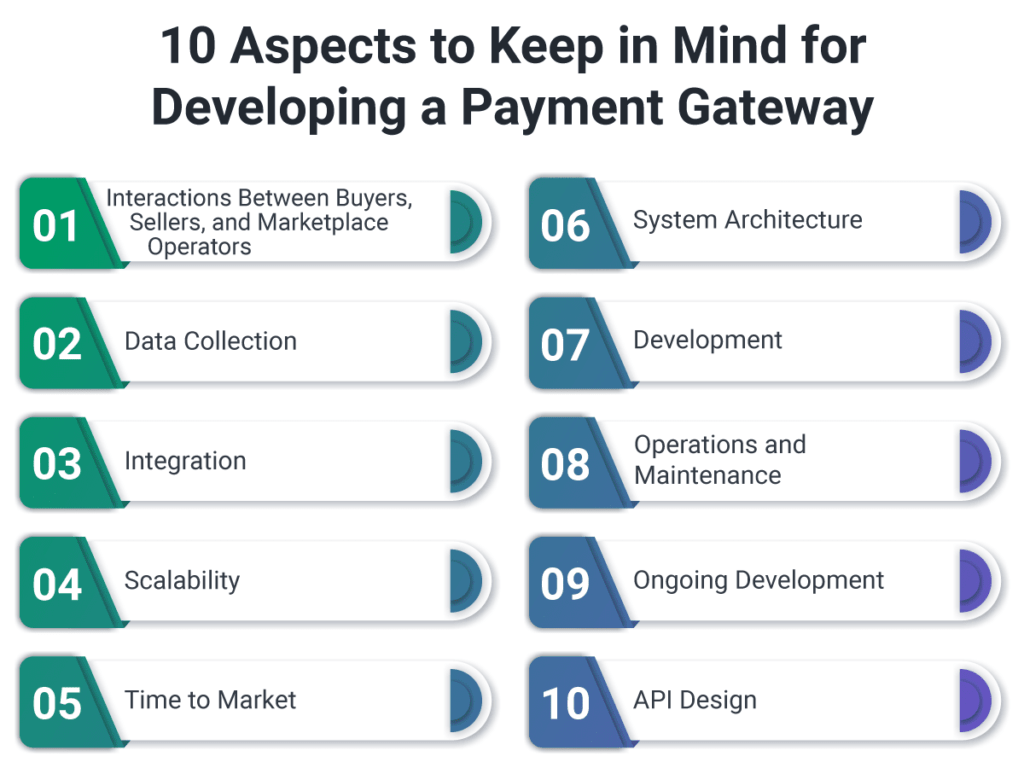

Setting Up a Payment Processor

The setup process should be straightforward. We’ll guide you through the steps of setting up your preferred payment processor, ensuring that you can start processing foreign currency payments without a hitch.

Currency Conversion and Exchange Rates

One of the core functions of a payment processor is currency conversion. Understanding exchange rates, how they impact your transactions, and strategies to mitigate risks are key elements to consider.

Fees and Costs

Different payment processors have varying fee structures. We’ll help you grasp these costs, including transaction fees, currency conversion fees, and any hidden charges that might affect your bottom line.

Security and Compliance

Security is a top concern when dealing with international payments. We’ll discuss the importance of data protection, regulatory compliance, and steps to safeguard your transactions.

User Experience

A seamless user experience is essential. Find out how to offer a smooth payment experience for your customers, leading to increased trust and repeat business.

Integration with E-commerce Platforms

If you operate an online store, integrating your chosen payment processor with your e-commerce platform is crucial. We’ll provide insights into this process [1] and the most compatible solutions.

Customer Support

Having access to reliable customer support is invaluable, especially when dealing with international [2] transactions. We’ll guide you on how to choose [3] a payment processor with excellent customer service.

Benefits of Using a Payment Processor for Foreign Currency

Discover the numerous advantages of using a payment processor for foreign [4]currency, such as expanding your customer base, minimizing risks, and optimizing currency conversion.

Challenges and Risks

While payment processors offer many benefits, it’s crucial to be aware of the potential challenges and risks associated with foreign currency transactions. We’ll discuss fraud prevention, fluctuating Exchange [5] rates, and more.

Streamlining Your Financial Operations

Efficiency is a paramount consideration when it comes to payment processors for foreign currency. These platforms are designed to simplify and expedite international transactions, ensuring that you can focus on your core business activities rather than getting bogged down by the complexities of currency conversion and cross-border payments.

Achieving Cost-Effectiveness

Costs associated with foreign currency transactions can add up quickly if you’re not careful. Payment processors typically have fee structures that vary, so it’s important to choose one that aligns with your budget. Keep an eye on transaction fees, currency conversion costs, and any additional charges that may be levied by the processor. Understanding the fee structure is essential to ensure that you’re not losing revenue unnecessarily.

Leveraging Transparency

Transparency is key when it comes to payment processors. It’s important to have a clear understanding of the fees and costs involved in your international transactions. Reputable processors provide detailed breakdowns of fees, so you can easily account for these costs. This transparency is not only beneficial for your financial planning but also fosters trust with your clients.

Conclusion

FAQs

- What is the primary function of a payment processor for foreign currency?

- A payment processor for foreign currency facilitates international transactions by converting one currency into another and then managing exchange rates.

- How can I choose the right payment processor for my business?

- The choice depends on your specific needs, such as multicurrency support, transparent fees, and then user experience. Research and also compare popular options.

- What are the key risks associated with foreign currency transactions ?

- Risks include fluctuating exchange rates, hidden fees, and also the potential for fraud.

- Is it essential to integrate a payment processor with my e-commerce platform?

- For online businesses, integration is crucial for a seamless payment experience and then efficient order processing.

- How can I ensure the security of my international transactions?

- Prioritize a payment processor with strong Security measures and then regulatory compliance to protect your data and transactions.