AUTHOR: DARCY SHARMA

DATE: 2/11/23

Payment processors are integral components of the modern financial ecosystem. They facilitate electronic transactions, allowing businesses and individuals to send and receive payments securely and efficiently. Understanding the intricacies of payment processors is crucial in today’s digital age. In this article, we will explore the definition, types, advantages, challenges, and roles in various sectors.

Understanding the Basics

Payment processors, also known as merchant service providers, are intermediaries that handle payment transactions between buyers and sellers. When a customer makes a purchase online or in a physical store using a credit card, debit card, or other electronic payment methods, the payment processor ensures that the funds are transferred from the customer’s financial institution to the merchant’s designated account. This process involves multiple steps to ensure security and accuracy.

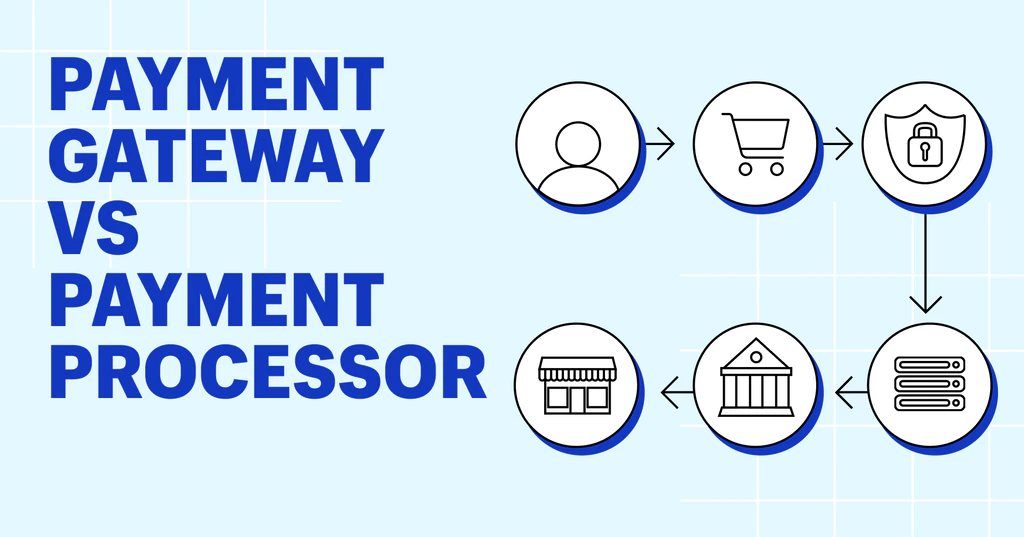

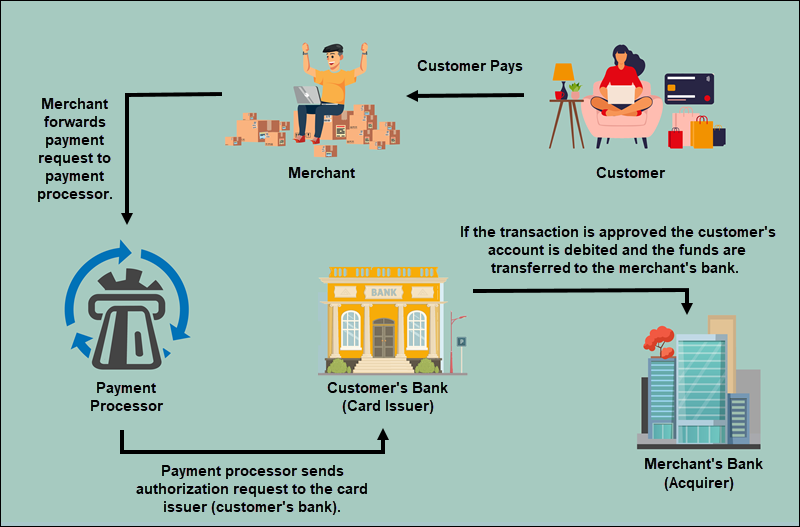

How Payment Processors Work

Payment processors use a combination of hardware and software to complete transactions. When a customer initiates a payment, the payment processor communicates[1] with the payment gateway, which encrypts the transaction data for security[3]. The processor then verifies the transaction details, checks for available funds, and sends a request to the customer’s bank for approval. If the transaction is approved, the payment processor completes the transaction, and the funds are transferred to the merchant.

Types of Payment Processors

Payment processors[4] come in various forms to cater to different industries and customer preferences. In this section, we will delve into the two primary categories:

Traditional Payment Processors

Traditional[5] payment processors have been around for decades and are also commonly used by brick-and-mortar businesses. They enable in-person transactions using credit cards, checks, and cash. Traditional processors provide point-of-sale (POS) systems and card readers to facilitate these transactions.

Online Payment Processors

Online payment processors specialize in facilitating e-commerce and online transactions. They provide tools for businesses to accept payments on their websites as well.

mobile apps, making online shopping convenient and secure.

Key Features of Payment Processors

Payment processors offer several essential features that contribute to their functionality and reliability:

Security

Security is paramount in payment processing. Payment processors use encryption and fraud detection mechanisms to protect sensitive customer data and prevent fraudulent activities.

Payment Gateway Integration

Seamless integration with payment gateways ensures smooth transactions. Payment processors collaborate with various payment gateways to expand their service capabilities.

Reporting and Analytics

Payment processors offer reporting tools that allow merchants to track transactions, identify sales trends, and also make informed decisions to improve their businesses.

Advantages of Using a Payment Processor

Utilizing a payment processor comes with several advantages:

Convenience

Payment processors simplify payment acceptance, making it easier for businesses to receive payments from customers.This added convenience significantly improves the overall customer journey.

Global Reach

Payment processors support multiple currencies, enabling businesses to expand their reach to international markets and serve a broader customer base.

Enhanced Security

With advanced security measures in place, payment processors protect both merchants and customers from potential fraud and data breaches.

Challenges in Payment Processing

While payment processors offer numerous benefits, there are also challenges associated with their use:

Fees and Costs

Payment processors charge fees for their services, including transaction fees and monthly subscription fees. These costs can add up for businesses, especially small enterprises.

Chargebacks

Chargebacks occur when customers dispute a transaction. Payment processors must navigate these disputes, which can result in financial losses for merchants.

Selecting the Right Payment Processor

Choosing the right payment processor is crucial for businesses. Take into account the following aspects when making your choice:

Factors to Consider

- Transaction fees

- Security features

- Payment gateway compatibility

- Customer support

- Reporting and analytics

Popular Payment Processors

Some well-known payment processors include PayPal, Stripe, Square, and Authorize.net. Each has its strengths and may be better suited for specific business needs.

How to Integrate a Payment Processor

Integrating a payment processor can be achieved in two main ways:

E-commerce Platforms

Many e-commerce platforms, such as Shopify and WooCommerce, offer built-in integrations with popular payment processors, making setup straightforward.

Custom Integration

For businesses with unique requirements, custom integration with a payment processor may be necessary. This method provides increased adaptability and personalized options.

The Role of Payment Processors in E-commerce

In e-commerce, payment processors play a pivotal role. They ensure smooth and secure transactions, helping online businesses build trust with customers. E-commerce websites rely on payment processors to process orders and receive payments swiftly.

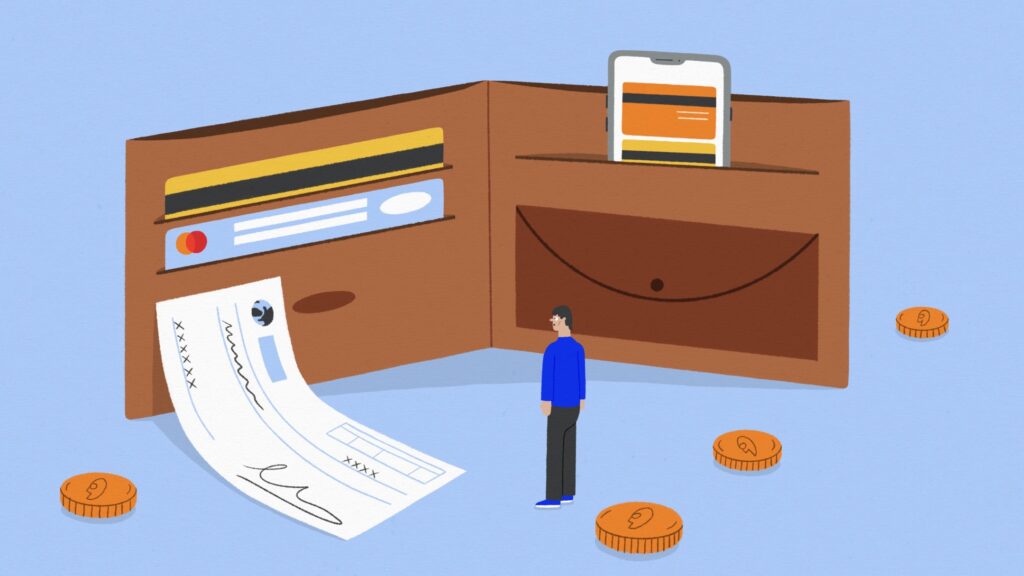

Mobile Payment Processing

With the rise of smartphones, mobile payment processing has become increasingly important. Payment processors have adapted to this trend, allowing businesses to accept payments via mobile apps and contactless methods.

Future Trends in Payment Processing

The payment processing industry continues to evolve. Future trends may include enhanced security measures, expanded support for cryptocurrencies, and an increased focus on the user experience.

Conclusion

Payment processors have revolutionized the way we handle transactions. They offer convenience, security, and global reach, making them indispensable in our increasingly digital world. As technology continues to advance, payment processors will play a vital role in shaping the future of commerce.

FAQs

- How does a payment processor differ from a payment gateway?

A payment processor facilitates the actual transfer of funds between banks, while a payment gateway encrypts and securely transmits transaction data. - Can a business use multiple payment processors?

Yes, businesses can integrate multiple payment processors to offer customers more payment options and redundancy. - How do payment processors handle currency conversion?

Payment processors can automatically convert currencies at competitive exchange rates for international transactions. - What are the main security measures of payment processors?

Payment processors employ encryption, fraud detection, and strict data protection protocols to ensure secure transactions. - Are there any legal regulations for payment processors?