AUTHOR : SAYYED NUZAT

DATE : 18-10-2023

In the digital age, payment platforms have revolutionized the way we handle transactions.[1] Canada, being a technologically advanced and business-friendly[2] nation, is no exception to this trend. This article will guide you through the world of payment platforms in Canada, helping you understand the options available and how to make the best use of them.[3]

The Canadian Payment Landscape

Canada boasts[4] a diverse payment[5] landscape with a wide array of payment options. From traditional methods like cash and checks to modern, digital platforms, Canadians have numerous choices when it comes to making payments.

Benefits of Using Payment Platforms

Using payment platforms in Canada[1] offers various advantages. These platforms are fast, convenient, and secure. They facilitate online and in-store payments, making life easier for consumers and businesses alike.

Popular Payment Platforms in Canada

PayPal

PayPal[2] is a global giant in the world of online payments. It provides a secure and user-friendly platform for sending and also receiving money. With PayPal, Canadians can make international transactions with ease.

Square

Square is renowned for its point-of-sale solutions. It offers a range of hardware and also software options, making it an excellent choice for businesses. Its user-friendly interface is a big plus.

Interac

Interac is a Canadian interbank network that enables electronic[3] financial transactions. It is widely used for e-transfers and also online shopping, making it an essential part of the Canadian payment ecosystem.

Shopify Payments

Shopify Payments is integrated with the Shopify e-commerce platform, making it convenient for businesses[4] selling online. It offers a seamless shopping experience for customers and easy management for store owners.

PayBright

PayBright specializes in the “buy now, pay later” model. It allows consumers to split their payments into installments, providing flexibility and convenience.

Setting Up a Payment Platform Account

Getting started with a payment platform is relatively straightforward. Most platforms require users to sign up, link a bank account, and verify their identity for security purposes.

Payment Security and Regulations

Security[5] is paramount when it comes to payment platforms. The Canadian government and financial institutions have stringent regulations in place to protect consumers and their financial data.

Mobile Payment Apps in Canada

Mobile payment apps, like Apple Pay and Google Pay, are widely used in Canada. These apps allow users to make contactless payments using their smartphones, further enhancing the convenience of transactions.

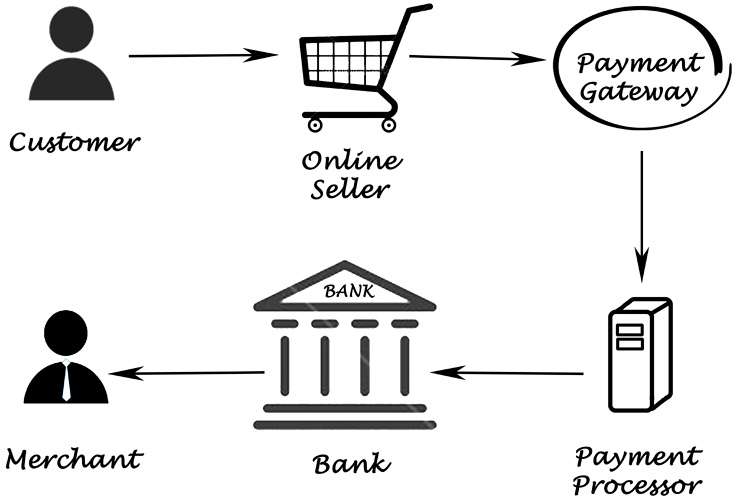

E-commerce and Payment Platforms

E-commerce businesses rely heavily on payment platforms to process online orders. Payment gateways are integrated into e-commerce websites to ensure a smooth and secure transaction process.

Payment Processing Fees

While many payment platforms offer free account setup, they do charge processing fees for transactions. It’s essential to understand these fees and compare them to choose the most cost-effective option for your needs.

Choosing the Right Payment Platform

Selecting the right payment platform depends on your unique requirements. Consider factors like transaction volume, the nature of your business, and the demographics of your customers.

Integrating Payment Platforms with Websites

Website owners can easily integrate payment platforms into their sites. Most platforms offer plugins and APIs that streamline the process, allowing businesses to accept payments seamlessly.

Future Trends in Payment Platforms

The payment industry is constantly evolving. Canadians can look forward to more innovative features and increased convenience in the future. Stay updated to take full advantage of these advancements.

The Importance of Customer Trust

Building trust with customers is essential for businesses using payment platforms. Transparent policies, strong security measures, and excellent customer service are keys to gaining and maintaining trust.

Conclusion

In conclusion, payment platforms in Canada have reshaped the way we handle financial transactions. With various options available, individuals and businesses can choose the platform that best suits their needs. It’s crucial to prioritize security, convenience, and cost-effectiveness when making your selection.

FAQs

- Are payment platforms in Canada safe to use?

- Yes, payment platforms in Canada are highly secure and regulated to protect users’ financial information.

- What fees can I expect when using payment platforms?

- Transaction fees and processing fees are common. The exact fees may vary depending on the platform.

- Can I use payment platforms for both online and in-store transactions?

- Yes, many payment platforms support both online and in-store payments.

- Which payment platform is best for small businesses in Canada?

- Square and Shopify Payments are popular choices for small businesses.

- How can I stay updated on the latest trends in payment platforms?

- Following industry news and keeping an eye on updates from your chosen payment platform is a good way to stay informed.