AUTHOR : SOFI PARK

DATE : 2/11/2023

Payment Of Service: Ensuring Efficiency and Reliability

In today’s fast-paced world, the payment of services plays a pivotal role in the service industry. Timely and secure payments are essential to maintaining a thriving business and satisfy both service providers and customers. In this article, we will explore the different payment methods, the advantages of digital payments, challenges faced in service payment, best practices, and future trends in the realm of service payment of services.

Traditional Payment Methods

Cash Payments

One of the most traditional methods of payment for services is cash. It involves the physical exchange of money from the customer to the service provider. While cash transactions are straightforward, they can be cumbersome and limit the customer’s ability to track expenses.

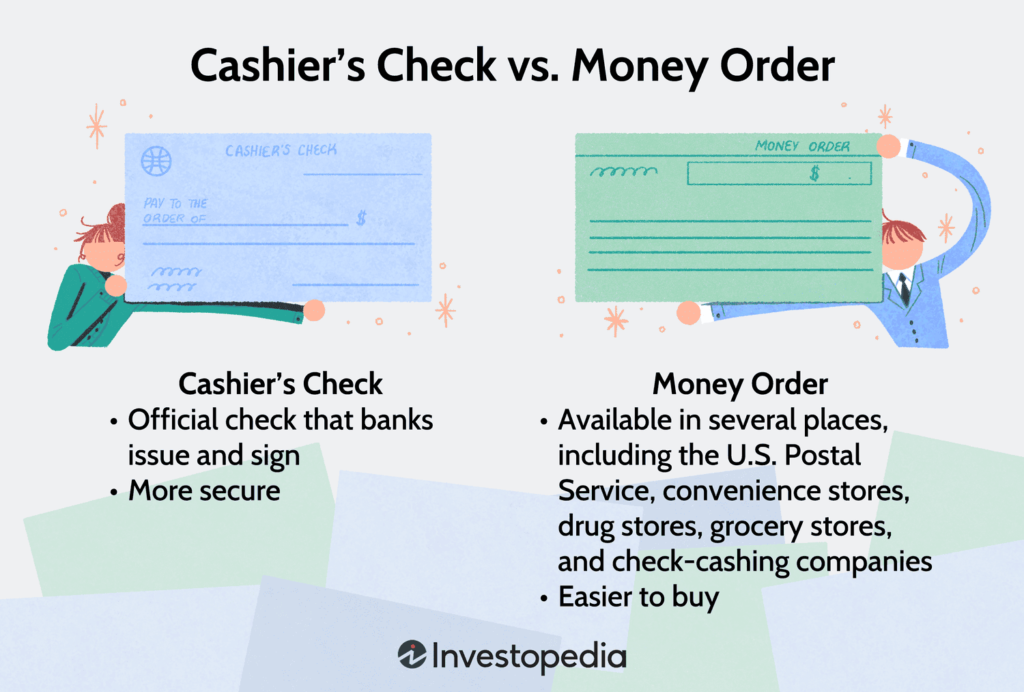

Checks and Money Orders

Checks and money orders are widely accepted for . These methods provide a written record of the transaction and can be convenient for both parties. However, they are susceptible to fraud, which can result in delayed payments.

Bank Transfers

Bank transfers are a reliable way to pay for services, particularly for larger transactions. They offer security and a clear transaction trail. However, they may not be the fastest method, and some customers may find them complicated.

Digital Payment Solutions

Credit and Debit Cards

Credit and debit cards are the most common digital payment methods. They provide convenience, and payments are processed quickly. Service providers[1] can accept card payments through point-of-sale terminals or online platforms.

Mobile Payment Apps

Mobile payment apps, such as Apple Pay and Google Pay, are gaining popularity. They enable customers to make payments using their smartphones. Mobile payments are secure[2], efficient, and ideal for contactless transactions.

Online Payment Gateways

Online payment gateways like PayPal and Stripe are essential for e-commerce businesses[3]. They offer a secure platform for customers to make payments, and they can integrate with various websites and apps.

Advantages of Digital Payments

Digital payments[4] come with several advantages, making them a preferable choice for service providers and customers.

- Speed and Convenience: Digital payments are processed rapidly, reducing wait times for both parties. Customers appreciate the convenience of paying from their smartphones or computers.

- Enhanced Security: Digital payments are more secure than traditional methods. Encryption and authentication measures protect financial information, reducing the risk of fraud.

- Cost-Effectiveness: Digital pay can be more cost-effective for service providers. They eliminate the need for manual handling of cash or checks and reduce the risk of errors.

Challenges in Service Payment

Late Payments

Late payments can be a significant issue in the industry. They disrupt cash flow and can strain relationships between service providers and customers[5]. Implementing clear payment terms and reminders can help address this challenge.

Disputes and Chargebacks

result in disputes and chargebacks, where customers request a refund. Proper documentation, transparent communication, and dispute resolution processes are crucial in such cases.

Payment Fraud

Payment fraud is a growing concern, particularly in the digital realm. Businesses must implement robust security measures to protect their financial data and customer information.

Best Practices for Payment of Services

To ensure efficient and reliable payment of services, businesses can adopt the following best practices:

- Clear Payment Terms: Define payment terms clearly in agreements and contracts. Make sure customers understand when payments are due and what methods are accepted.

- Invoicing and Payment Tracking: Provide detailed invoices that include a breakdown of services and costs. Implement a system to track payments and send reminders for overdue payments.

- Offering Multiple Payment Options: cater to the diverse preferences of customers by offering multiple payment options. Accept credit cards, digital wallets, and other convenient methods.

Case Studies

To illustrate the importance of efficient payment systems, let’s look at a few real-life examples of businesses that have benefited from adopting modern payment solutions.

(Insert case studies here.)

Future Trends in Service Payment

The landscape of service payments is continually evolving. Here are some exciting trends to watch out for:

Cryptocurrency and Blockchain

Cryptocurrency and blockchain technology are gaining traction in the payment industry. These innovations offer secure and efficient ways to conduct transactions.

Artificial Intelligence in Payment Processing

Artificial intelligence is being used to enhance payment processing. It can help detect and prevent fraud and streamline payment procedures.

Contactless Payments

The COVID-19 pandemic accelerated the adoption of contactless payments. This trend is likely to continue as customers seek touchless and convenient payment options.

Conclusion

The payment of services is a critical aspect of the service industry. Efficient and secure payment methods are essential for businesses to thrive and provide exceptional customer service. By embracing digital payment solutions, implementing best practices, and staying abreast of emerging payment trends, service providers can position themselves for success in a rapidly changing landscape.

FAQs

- What are the advantages of digital payment methods for service providers?

Digital payment methods offer speed, security, and cost-effectiveness, making them a preferred choice for service providers. - How can businesses address the challenge of late payments?

Businesses can address late payments by clearly defining payment terms, sending payment reminders, and offering flexible payment options. - What is the role of blockchain in service payments?

Blockchain technology provides a secure and transparent platform for service payments, reducing the risk of fraud and improving efficiency. - How has artificial intelligence impacted payment processing in the service industry?

Artificial intelligence is used to detect and prevent payment fraud and streamline payment procedures, enhancing security and efficiency. - Why are contactless payments gaining popularity in the service industry?

Contactless payments have become popular due to their convenience and the desire for touchless transactions, which have been accentuated by the COVID-19 pandemic.