AUTHOR : JAYOKI

DATE : 09/12/2023

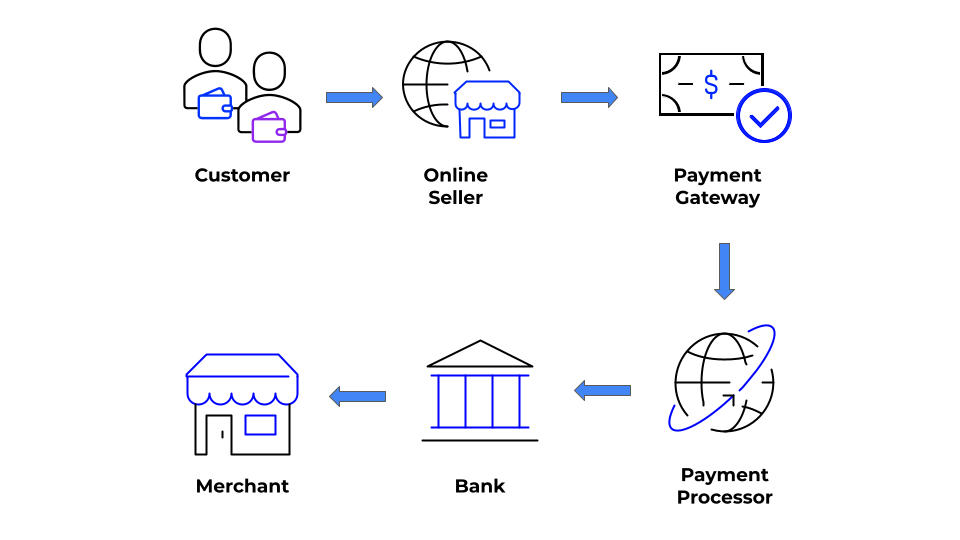

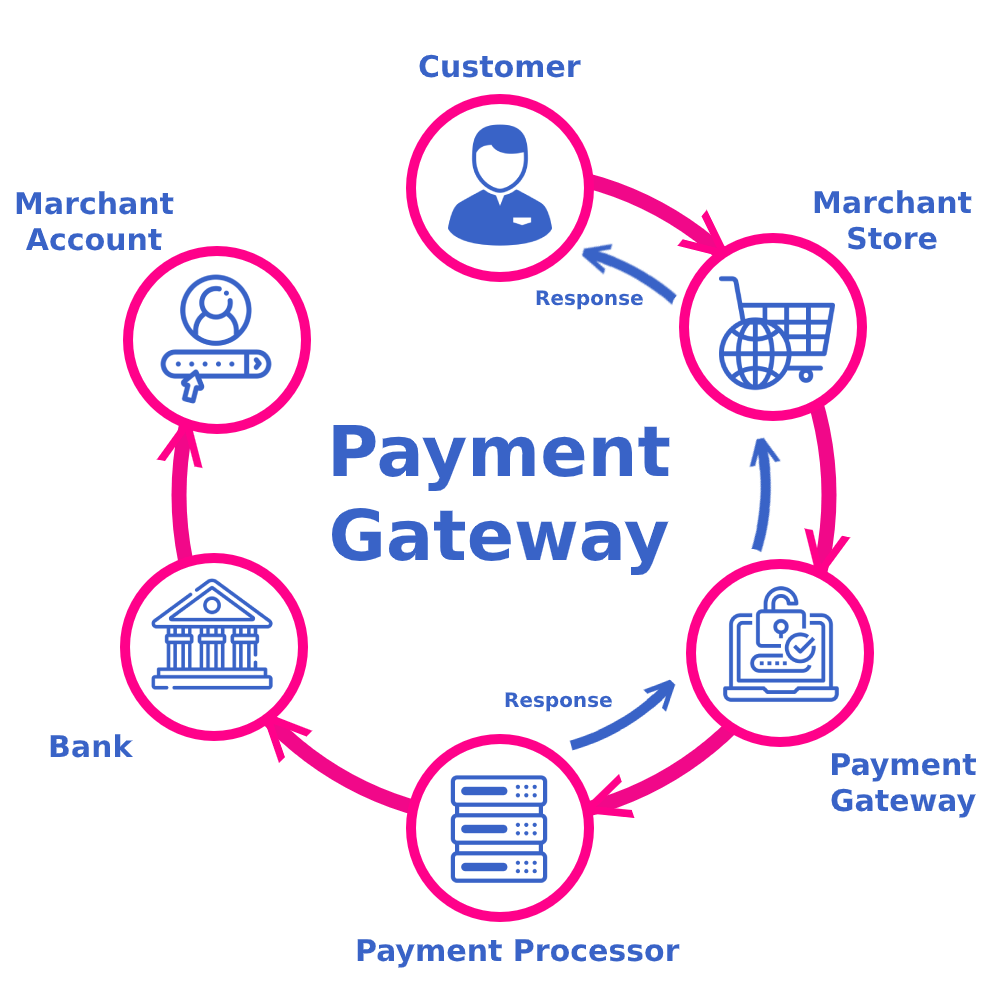

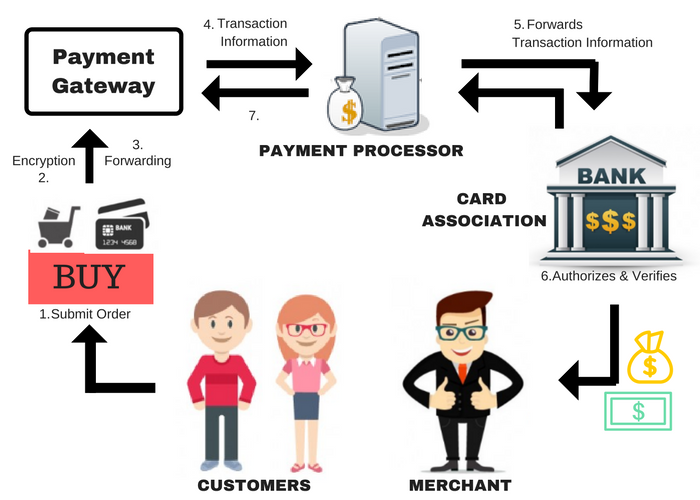

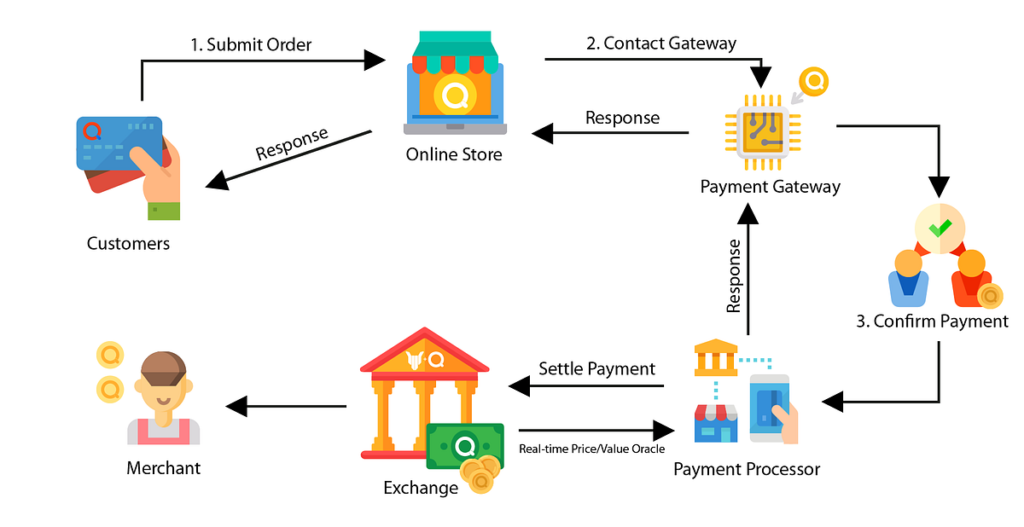

In the digital age, businesses rely on payment gateways to process online payments[1] efficiently and securely. The Payment Gateway Process Flow Diagram[2] illustrates the steps involved in completing a transaction through an online payment gateway. This diagram is a useful tool for understanding the complex interaction between various stakeholders in the transaction process. In this article, we will break down the steps of the payment gateway process[3], explain the role of each entity involved, and how the Payment Gateway Process Flow Diagram enhances the understanding of secure payment transactions.

What is a Payment Gateway Process Flow Diagram?

A Payment Gateway[4] Process Flow Diagram is a visual representation of the transaction process that occurs when a customer makes a payment online. It highlights each step, from the initiation of a payment by the customer to the final transfer of funds to the merchant’s account. This diagram helps businesses, developers, and customers understand how payment data flows securely through multiple channels to ensure a seamless payment experience.

The process typically involves multiple entities, such as the customer, the merchant, the payment gateway, the payment processor[5], the card network, and the issuing bank. Each of these participants plays a critical role in ensuring that the transaction is authorized, processed, and completed.

Key Components of the Payment Gateway Process Flow Diagram

Initiation of the Transaction

Understanding how a payment journey begins, from the user clicking ‘Buy Now’ to the initiation of the payment process.

Data Encryption

Delving into the vital role of encryption in safeguarding sensitive information during online transactions.

User Authentication

Exploring the methods employed by payment gateways to verify the of users, ensuring secure transactions.

Authorization Request

A step-by-step breakdown of how the payment gateway seeks authorization from the issuing bank before proceeding with the transaction.

Transaction Processing

Navigating through the of processing the transaction, including communication between the payment gateway and the acquiring bank.

Payment Authorization

Understanding how the authorization received is utilized to complete the transaction successfully.

Fund Settlement

Insight into the process of settling funds between the acquiring bank and the merchant after a successful transaction.

Benefits of a Well-Defined Payment Gateway Process Flow

Enhanced Security

Highlighting how a structured payment gateway process minimizes the risk of fraud and data breaches.

Improved User Experience

Exploring the correlation between a seamless payment process and increased customer satisfaction.

Global Transaction Compatibility

Discussing the importance of a versatile payment gateway that accommodates various currencies and payment methods.

Quick and Efficient Transactions

Emphasizing the role of an optimized payment gateway process in expediting financial transactions.

Challenges and Solutions

Security Concerns

Addressing common security challenges and the measures taken by payment to mitigate risks.

Technical Glitches

Exploring potential technical issues and the strategies implemented to ensure a smooth payment process.

Integration Challenges for Merchants

Insight into the challenges merchants might face when integrating payment gateways and effective solutions.

Regulatory Compliance

Navigating the complex landscape of payment regulations and how payment gateways ensure compliance.

Deconstructing the Payment Gateway Process Flow Diagram

Initiating the Transaction

Understanding the inception of a payment journey, triggered by a user’s action but commencing a sophisticated sequence of events.

Fortifying with Encryption

Delving into the critical role of encryption in shielding sensitive user information throughout the online transaction.

Authentication Dance

Exploring the intricate dance of user authentication methods, ensuring the legitimacy of participants in the transaction.

Authorization Request

A step-by-step breakdown of how the payment gateway seeks approval from the issuing bank before advancing with the transaction.

Processing the Transaction

Navigating through the complexities of processing the transaction, emphasizing the communication between the payment gateway and the acquiring bank.

Payment Green Light

Understanding how the received authorization is the key to successfully completing the transaction.

Settling Financial Transactions

Insight into the behind-the-scenes action of settling funds between the acquiring bank and the merchant after a successful transaction.

Merchant Integration Challenges

Insight into the challenges merchants might encounter when integrating payment gateways and effective solutions.

Breaking Down the Payment Gateway Process Flow Diagram

Commencement of the Transaction

Understanding the genesis of a payment journey, initiated by a user’s click but setting off a sophisticated sequence of events.

Fortification with Encryption

Delving into the critical role of encryption in safeguarding sensitive user information throughout the online transaction.

Authentication Ballet

Exploring the intricate dance of user authentication methods, ensuring the legitimacy of participants in the transaction.

Conclusion

The Payment Gateway Process Flow Diagram is an essential tool for understanding how online payments work. It provides a detailed and visual representation of each step, from payment initiation to the transfer of funds, ensuring that businesses, developers, and customers can easily comprehend the complex process. With a solid understanding of the payment gateway process, businesses can enhance their payment systems, improve security, and offer a seamless transaction experience to their customers.

FAQs

- Q: How does a payment gateway ensure the security of my financial information?

- A: Payment gateways employ robust encryption methods to safeguard sensitive data during transactions.

- Q: Can payment gateways process transactions in different currencies?

- A: Yes, most payment gateways are designed to handle transactions in various currencies.

- Q: What happens if there is a technical glitch during a transaction?

- A: Payment gateways have mechanisms in place to address technical issues promptly, ensuring a smooth transaction process.

- Q: How long does it take for funds to be settled after a successful transaction?

- A: The duration of fund settlement varies, but it is typically completed within a few business days.

- Q: Is compliance with payment regulations a concern for payment gateways?

- A: Yes, payment gateways prioritize regulatory compliance to ensure secure and lawful transactions.

Get In Touch