AUTHOR : HANIYA SMITH

DATE : 17/10/2023

Introduction

In the ever-evolving digital landscape, payment gateway integration in mobile applications has become crucial for businesses. With the surge in online transactions, especially on mobile devices, it’s essential to provide a seamless and secure payment experience for users. This article will guide you through the process of payment gateway integration in Android Studio, making it easier for you to monetize your Android app.

Understanding Payment Gateways

What is a payment gateway?

A payment gateway is a technology that facilitates online payments by connecting a mobile app or website to a financial institution. It ensures the secure transfer of customer payment data to the acquiring bank for processing.

Why Payment Gateway Integration Matters

Efficient payment gateway integration is essential for a hassle-free customer experience. Users demand simplicity and security, and integrating a payment gateway into your Android app can also meet these expectations.

Prerequisites

Setting Up Android Studio also

Before we dive into the integration process, make sure you have Android Studio installed and configured on your system. If this is unavailable, you have the option to access it through the official site.

Obtaining Merchant Account

To enable payment gateway integration, you need a merchant account with a payment service provider. Ensure you have one in place before proceeding.

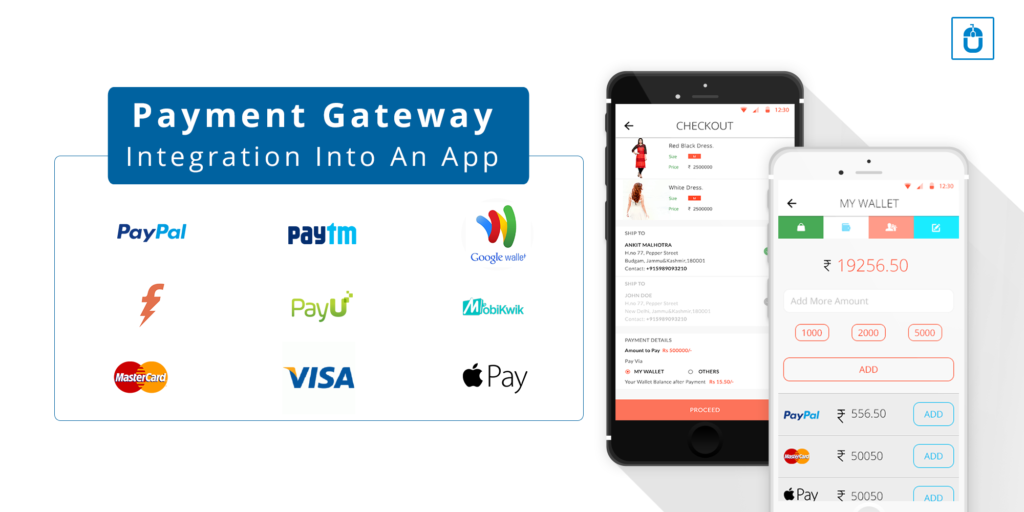

Choosing the Right Payment Gateway

Research and Selection also

The success of your payment gateway integration depends on choosing the right service provider. Research and also compare options, considering factors like transaction fees, security features, and the variety of payment methods supported.

Step-by-Step Integration

Create a New Android Studio Project

Begin by creating a new Android Studio project or opening an existing one where you want to integrate the payment gateway.

Add the Payment Gateway Library

To start the integration process, you need to add the payment gateway’s library to your project. You can typically find detailed instructions in the payment gateway provider’s documentation.

Configure Payment Gateway Settings

Access your merchant account and also configure the payment gateway settings. You will need API keys, merchant credentials, and other relevant information to establish a connection.

Implement the payment option in Your App

Create a user-friendly payment option in your app, allowing customers to select their preferred payment method. Ensure the design aligns with your app’s theme.

Handle Payment Confirmation as well.

Implement a mechanism to handle payment confirmation, including successful and failed transactions. Provide clear feedback to the user after each transaction.

Testing and security are also

Test Transactions

Before deploying your app with the integrated payment gateway, perform thorough testing to ensure it functions correctly. Make both successful and failed transactions to verify its behavior.

Ensure Data Security

Data security is paramount. Encrypt sensitive information and also follow best practices to protect user data during payment processing.

Deployment

Publish Your App

Once you’ve successfully integrated the payment gateway and also ensured its security, you’re ready to publish your app on the Google Play Store or your chosen distribution platform.

Advanced Features

In-App Purchases

Consider implementing in-app purchases as part of your payment gateway integration strategy. This allows users to buy digital goods or premium features within your app, enhancing monetization.

Subscription Models

For apps that offer premium content or services, integrating subscription models through your chosen payment gateway can provide a steady stream of revenue.

Multi-Currency Support

If your app has a global user base, ensure that your payment gateway supports multiple currencies to accommodate users from around the world.

Troubleshooting and Customer Support also

Handling Payment Failures

Set up mechanisms to handle also payment failures[1] efficiently. Provide users with clear instructions on what to do next, such as updating their payment information.

Customer Support Integration

Consider integrating customer support features into your app for users who encounter payment-related issues. This enhances user satisfaction and loyalty.

Security Considerations

Ensuring the safety of payment data is paramount when handling financial information.Here are some security best practices:

PCI DSS Compliance

Ensure that your payment gateway provider is PCI DSS (Payment Card Industry Data Security Standard) compliant. This is a set of security standards also designed to ensure that all companies that accept, process, store, or transmit credit card[2] information maintain a secure environment.

Data Encryption

Implement strong data encryption mechanisms to protect sensitive information, such as credit card details. Using SSL (Secure Sockets Layer) or its successor, TLS (Transport Layer Security), is essential for securing data in transit.

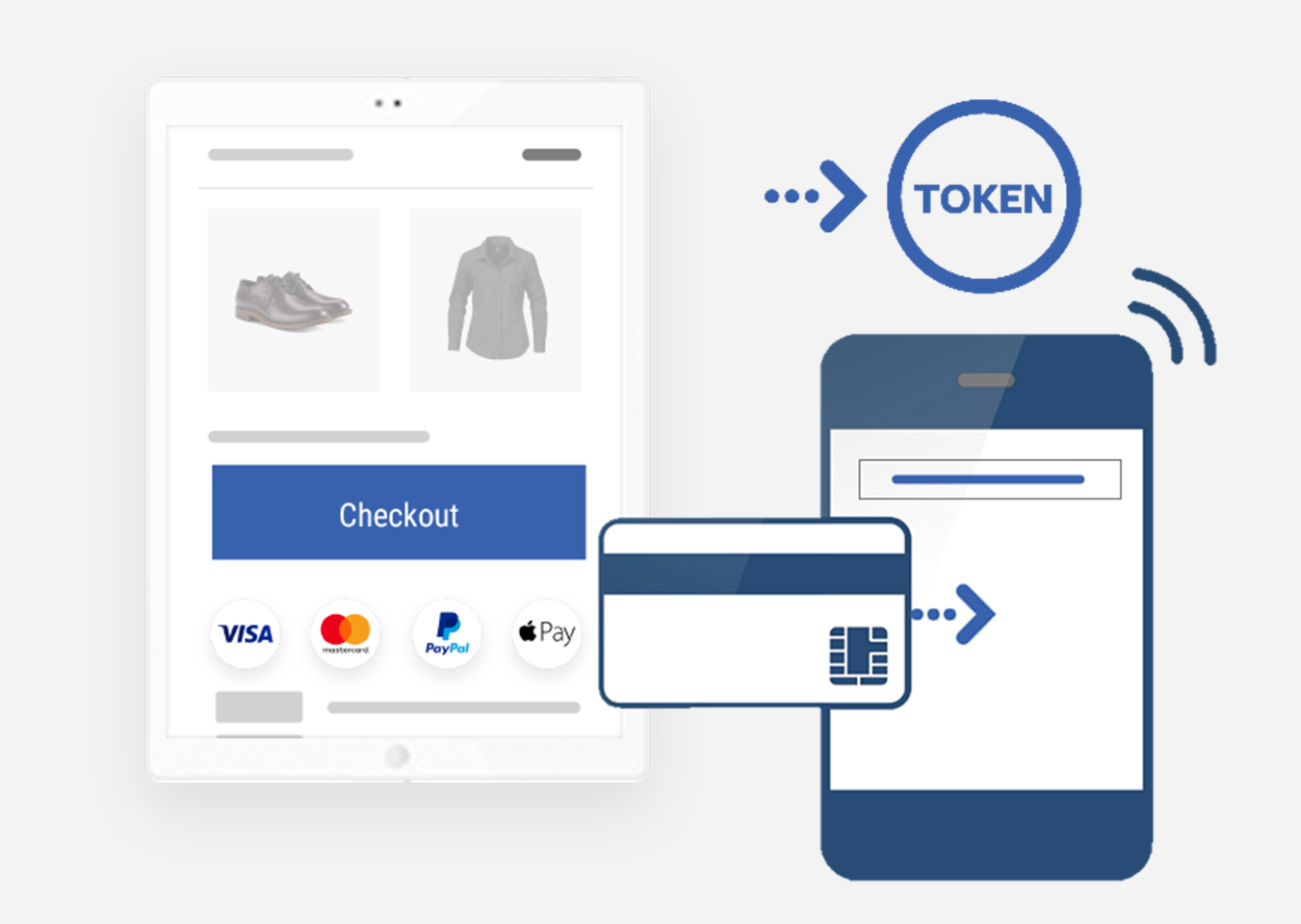

Tokenization

Consider using tokenization, a process that replaces sensitive data with unique identification symbols. This reduces the risk of data breaches.

User Experience Optimization

A seamless user experience is crucial for a successful payment gateway integration:

One-Click Payments

Implement one-click payment options for returning customers to streamline the checkout process.[3]

Mobile Responsiveness

Ensure that your payment gateway solution is mobile-responsive, providing an excellent experience for users on various devices.

Conclusion

Integrating a payment gateway into your Android app is a significant step towards enhancing user experience and monetizing your application. It’s crucial to choose the right payment gateway provider, follow the integration steps diligently, and also prioritize data security. With a well-integrated payment gateway, you can boost your app’s revenue and keep your customers satisfied.

FAQs

1. What is the cost associated with payment gateway integration?

The cost of payment gateway integration varies depending on the service provider. It typically includes setup fees, transaction fees, and also monthly subscription fees.[4]

2. Can I use multiple payment gateways in one app?

Yes, you can integrate multiple payment gateways in your app, allowing users to choose their preferred method.

3. Is it essential to encrypt user data during payment processing?

Yes, data security is crucial. Encryption ensures that sensitive information remains protected during the payment process, building trust with your users.

4. Which payment gateway is the best for small businesses?

Several payment gateways cater to small businesses, including PayPal, Stripe, and also Square. Choose one that aligns with your business needs.

5. How do I handle refunds through a payment gateway?

Each payment gateway has its refund process. Refer to the documentation provided by your chosen service provider for specific instructions.