AUTHOR : SARIKA PATHAK

DATE : 23 – 09 – 2023

In this era dominated by digital advancements, the realm of e-commerce has seamlessly woven itself into the fabric of our daily existence. From shopping for clothes and gadgets to ordering groceries and booking services, the convenience of online transactions has transformed the way we do business. One crucial aspect of this digital transformation is the payment gateway. In this article, we will delve into the world of payment gateways in India for e-commerce, exploring their significance, functionality, and also the top players in the Indian market.

1. Introduction to Payment Gateways

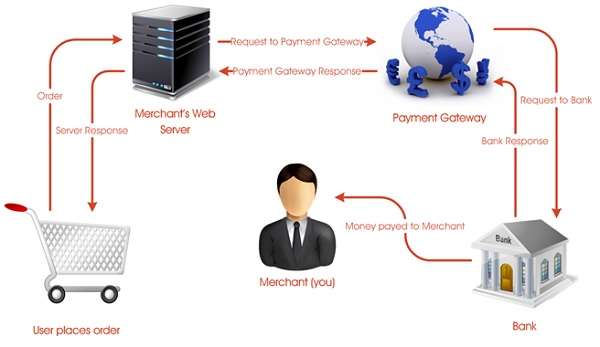

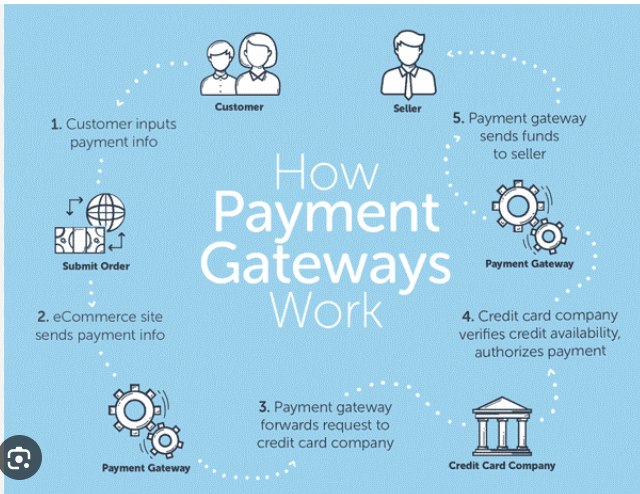

A payment gateway is a technology that facilitates online transactions by securely connecting an e-commerce website with a bank or financial institution. It acts as the intermediary that authorizes and processes payments made by customers. Essentially, payment gateways are the virtual cashiers of the e-commerce world, ensuring that funds are transferred securely from the customer’s account to the merchant’s account.

2. Why Payment Gateways Matter

Payment gateways play a pivotal role in the success of an e-commerce business. They offer several benefits, such as:

- Security: Payment gateways employ [1]encryption and also authentication techniques to protect sensitive customer data, reducing the risk of fraud and data breaches.

- Global Reach: With the right payment gateway, e-commerce [2]businesses can cater to customers worldwide, accepting payments in multiple currencies.

- Convenience: They offer customers a seamless and also hassle-free checkout experience, increasing the likelihood of completed transactions.

3. Types of Payment Gateways

1. Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure external page to complete their payment. This off-site approach is user-friendly and also reduces the burden of security compliance on the merchant.

.2. Self-hosted payment gateways

Self-hosted payment gateways allow customers [3]to complete transactions on the merchant’s website. While offering more control, they require rigorous security measures and compliance.

6. Setting Up a Payment Gateway

Payment Gateway process of setting up a payment gateway involves registration, verification, and integration with your e-commerce platform[4]. Each gateway may have specific requirements and documentation.

7. Security Measures

Payment Gateway Security is paramount in payment gateways. Look for gateways that are Payment Card Industry Data Security Standard (PCI DSS) compliant and also offer additional security layers like two-factor authentication.

8. Transaction Fees and Charges

Different payment gateways have varying fee structures. Pay attention to transaction fees, setup costs, and any hidden charges when choosing a gateway.

9. Integrating Payment Gateways with Payment Gateway in India for E-commerce

Integration varies depending on your e-commerce platform. Most gateways provide detailed documentation and customer support to help with the integration process.

10. Challenges in the Payment Gateway Industry

The payment gateway industry faces challenges like evolving regulations, increasing competition, and the constant need for innovation to stay ahead.

11. Future Trends

The future of payment gateways holds exciting possibilities, including the integration of blockchain technology, enhanced security measures, and expanded global reach.

13. International Expansion

Payment Gateway today’s interconnected world, expanding your e-commerce business beyond national borders can be a game-changer. Payment gateways that support multi-currency transactions enable you to tap into global markets effortlessly. By accepting various international currencies, you can attract customers from different parts of the world, broadening your customer base and revenue streams.

14. Mobile Commerce

The ascent of smartphones has heralded the emergence of mobile commerce, often referred to as m-commerce. Payment gateways that are optimized for mobile devices play a pivotal role in this trend. These gateways provide a seamless and also user-friendly checkout experience for customers who prefer to shop on their smartphones or tablets. As the number of mobile shoppers continues to grow, having a mobile-responsive payment gateway is no longer an option but a necessity.

15. Analytics and Customer Insights

Understanding your customers’ behavior is essential for the success of your e-commerce venture. Modern payment gateways offer advanced analytics and also reporting tools that provide valuable insights into customer preferences, purchasing patterns, and transaction history. By leveraging this data, you can make informed decisions, tailor your marketing strategies, and enhance the overall shopping experience for your customers.

Future Innovations in Payment Gateways

16. Blockchain Integration

The adoption of blockchain technology is on the horizon for payment gateways. Blockchain offers enhanced security, transparency, and also reduced transaction costs. It has the potential to revolutionize the way payment gateways handle transactions, making them even more secure and efficient.

16. Blockchain Integration

The adoption of blockchain technology is on the horizon for payment gateways. Blockchain offers enhanced security, transparency, and reduced transaction costs. It has the potential to revolutionize the way payment gateways handle transactions, making them even more secure and efficient.

17. Biometric Authentication

As technology evolves, biometric authentication methods like fingerprint scanning and facial recognition are becoming more prevalent. Payment gateways are likely to incorporate these biometric authentication options, further enhancing transaction security and convenience.

18. Voice Commerce

Voice-activated virtual assistants like Amazon’s Alexa and also Google Assistant are changing how consumers shop online. Payment gateways may soon integrate with these voice-activated systems, allowing customers to make purchases using voice commands.

19. Conclusion

In conclusion, payment gateways are the lifeblood of e-commerce in India. Opting for the appropriate payment gateway can profoundly influence the prosperity of your business. Consider factors like security, compatibility, and customer experience when making your selection.

Frequently Asked Questions (FAQs)

1. Are payment gateways safe for e-commerce?

Yes, payment gateways use robust security measures like encryption and also authentication to ensure the safety of online transactions.

2. What are the typical fees associated with payment gateways in India?

Transaction fees, setup costs, and also annual maintenance fees are common charges associated with payment gateways.

3. Can I use multiple payment gateways for my e-commerce store?

Yes, it’s possible to integrate multiple payment gateways to offer customers more payment options.

4. How long does it take to set up a payment gateway for my e-commerce website?

The setup time varies depending on the gateway and your website’s complexity, but it typically takes a few days to a week.

5. What should I do if I encounter payment gateway issues on my e-commerce website?

Contact the customer support of your chosen payment gateway for assistance in resolving any issues.