AUTHOR : KHOKHO

DATE: 29/11/2023

Introduction

In the ever-evolving landscape of e-commerce, the use of credit cards for online transactions has become Widespread. To facilitate Smooth and also secure transactions, the role of payment gateways, especially those designed for credit cards, cannot be Exaggerated. Let’s delve into the intricacies of payment gateways, focusing on the vital aspects of transactions[1].

How Payment Gateways Work

Understanding the Seller’s behind payment gateways is crucial. At its core, a payment gateway acts as a bridge between the Seller’s website and also the financial institutions[2] involved in processing the payment[3]. This ensures that the sensitive information, such as credit card details, is transmitted securely.

Features to Look for in a Credit Card Payment Gateway

When choosing a credit card[4] payment gateway, certain features should beGiven Priority. Security measures, integration options, and also compatibility with different[5] platforms are Essential to ensure a smooth and also reliable payment process.

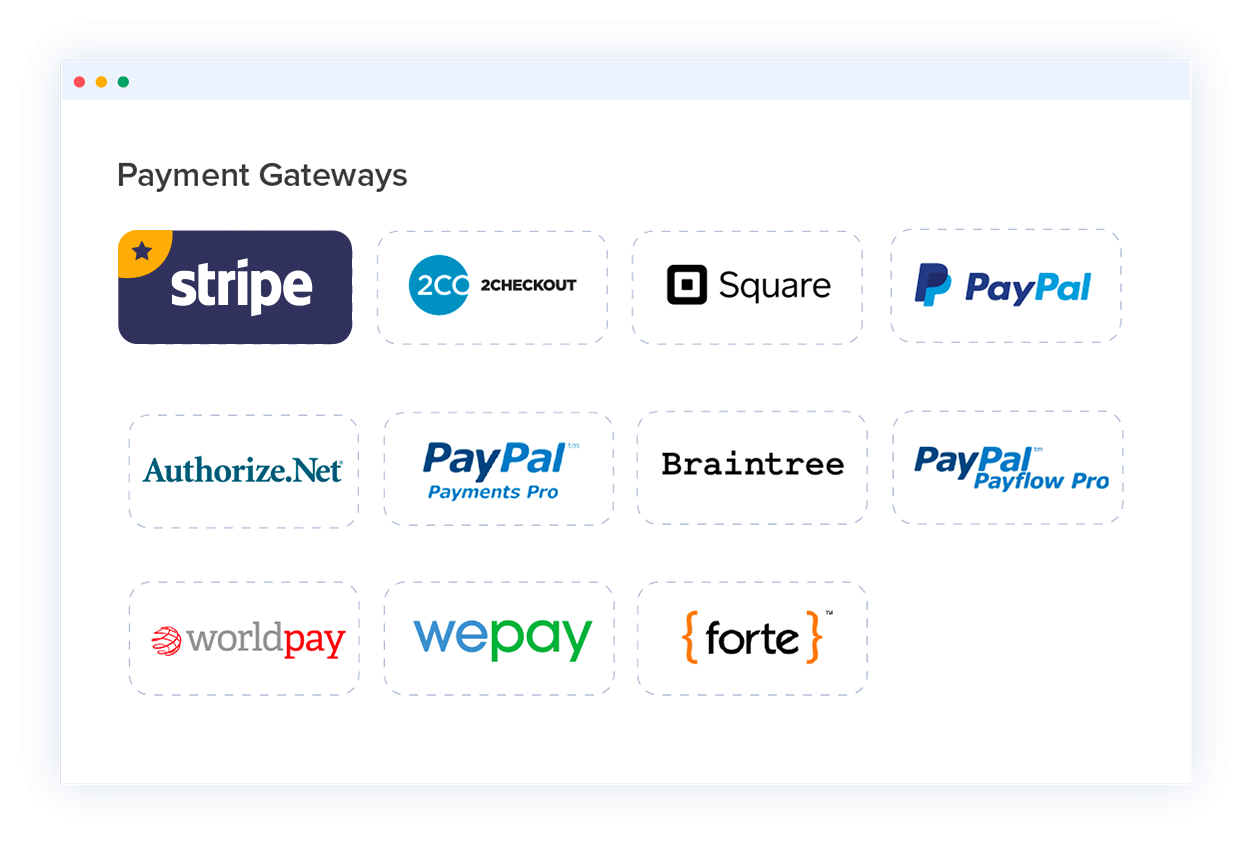

Top Credit Card Payment Gateways in 2023

In 2023, several stand also out for their efficiency and also reliability. Examining the key features of these gateways can aid businesses in making informed decisions.

Selecting the optimal payment gateway tailored to the unique needs and also scale of your business is a pivotal decision in Given Priority financial transactions.

Selecting the most Appropriate payment gateway involves considering factors such as business size, industry, and also specific transaction needs. Tailoring the choice to align with these aspects enhances the overall efficiency of the payment process.

Setting Up a Credit Card Payment Gateway

Implementing a may seem daunting, but a step-by-step guide canStreamline the process. Addressing common challenges ensures a seamless integration into your online platform.

Security Measures in Credit Card Transactions

As cyber threats continue to evolve, prioritizing security in credit card transactions is paramount. Exploring the best practices for maintaining transaction security Protects both businesses and also customers.

Recent Trends in Payment Gateway Technology

The landscape of payment gateways is ever-changing. Emerging technologies are shaping the future, influencing user experience and also transaction security. Staying abreast of these trends is essential for businesses seeking a competitive edge.

Benefits of Credit Card Payment Gateways for Customers

Customers reap various benefits from credit card payment gateways, including convenience, enhanced security, and also participation in rewards and also cashback programs. Understanding these advantages fosters customer satisfaction and also loyalty.

Challenges in Credit Card Payment Processing

While credit card payment gateways offer numerous benefits, challenges such as fraud prevention and also managing chargebacks require careful consideration. Implementing effective solutions is crucial for a successful payment processing system.

The Future of Credit Card Payment Gateways

Predicting the future of credit card payment gateways involves anticipating advancements and also addressing potential challenges. A forward-looking approach is key to staying competitive in the rapidly evolving digital landscape.

Case Studies: Successful Implementation of Payment Gateways

Real-world examples of businesses successfully implementing credit card payment gateways highlight the positive impact on business growth and also customer satisfaction. Drawing insights from these cases informs strategic decision-making.

Tips for Optimizing Credit Card Payment Processes

Optimizing credit card payment processes involves streamlining checkout procedures and also reducing transaction friction. Implementing these tips enhances the overall user experience and also encourages repeat business.

Customer Support and also Credit Card Payment Gateways

Responsive customer support is a cornerstone of a reliable . Effectively handling customer queries and also issues fosters trust and also confidence among users.

Recent Trends in Payment Gateway Technology

The payment gateway landscape is not static; it’s influenced by emerging technologies that redefine the user experience and also bolster security measures. In 2023, we witness an array of trends shaping the future of payment gateways.

Voice-Activated Payments

As voice-activated technologies continue to gain popularity, payment gateways are integrating voice commands for transactions(1). Imagine a world where you can verbally authorize a purchase or confirm a payment – it’s not just futuristic; it’s becoming a reality.

Blockchain and Cryptocurrency Integration

The rise of blockchain and also cryptocurrencies has ushered in a new era for payment gateways. Some gateways now support transactions in popular cryptocurrencies, adding an extra layer of anonymity and also security to financial transactions(2).

Biometric Authentication

The reliance on traditional passwords is diminishing. The increasing adoption of biometric authentication, exemplified by the utilization of fingerprint and also facial recognition technologies,. Payment gateways(3) are leveraging biometrics to enhance security and also provide a frictionless payment experience.

Contactless Payments

The global shift towards contactless transactions has accelerated, driven by the need for hygiene and convenience. Payment gateways(4) are adapting to support various contactless payment methods, including NFC-enabled cards and mobile wallets.

Artificial Intelligence for Fraud Detection

Artificial Intelligence (AI) plays a pivotal role in identifying patterns and anomalies in transaction data. Payment gateways are employing(5) AI algorithms to detect and prevent fraudulent activities in real-time, providing an extra layer of security.

Benefits of Credit Card Payment Gateways for Customers

Understanding the benefits that credit card payment gateways offer to customers sheds light on why they are a preferred choice in online transactions.

Conclusion

In conclusion, the world of credit card payment gateways is dynamic and multifaceted. As technology advances and consumer expectations evolve, businesses must stay adaptable. Choosing the right payment gateway, prioritizing security, and embracing emerging trends are crucial steps in navigating the landscape successfully.

FAQs

- What makes a credit card payment gateway secure?

- Security protocols, encryption, and compliance with industry standards contribute to the security of a payment gateway.

- How do credit card payment gateways prevent fraud?

- Fraud prevention measures include advanced algorithms, transaction monitoring, and two-factor authentication.

- Can I use the same payment gateway for different e-commerce platforms?

- It depends on the compatibility of the payment gateway with the specific platforms. Some gateways offer versatile integration options.

- What role does customer support play in credit card transactions?

- Responsive customer support is crucial for addressing issues promptly, building trust, and ensuring a positive user experience.

- How often should businesses update their payment gateway technology?

- Regular updates are essential to stay ahead of security threats and leverage the latest features. The frequency may vary based on technological advancements and industry standards.