AUTHOR : BABLI

DATE : 9/12/23

Introduction

In the vast ocean of merchant service providers, businesses often find themselves perplexed by the multitude of options. Understanding the importance of these services in the digital age is the first step toward making an informed decision. With the e-commerce landscape evolving rapidly, the need for reliable and efficient MSPs has never been greater.

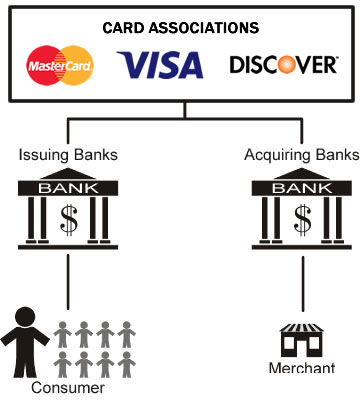

Understanding Merchant Services

Merchant services encompass a broad spectrum, ranging from payment processing to point-of-sale systems. To unlock the full potential of these services, businesses must comprehend the intricacies and functionalities that make up this critical aspect of their operations.

The Need for Reliable Merchant Service Providers

Efficiency in business operations and customer satisfaction hinge on the reliability of chosen MSPs. Seamless transactions and secure payment processing are no longer optional but imperative for success in today’s competitive market.

Top Criteria for Choosing Merchant Service Providers

Choosing the right MSP involves evaluating various criteria, including security features, cost-effectiveness, and integration capabilities. A transparent fee structure is essential for avoiding unexpected costs down the line.

Breaking Down the List: Top 5 Merchant Service Providers

- Provider 1: Features, pros, and cons

- Highlighting the standout features of the first provider, along with potential advantages and drawbacks.

- Provider 2: Unique offerings and customer testimonials

- Exploring the distinctive offerings of the second provider, supported by testimonials from satisfied customers.

- Provider 3: Scalability and flexibility for businesses of all sizes

- Emphasizing how the third provider caters to businesses of various sizes, offering scalability and flexibility.

- Provider 4: Innovations in technology and payment solutions

- Showcasing the technological advancements and cutting-edge payment solutions offered by the fourth provider.

- Provider 5: Competitive pricing and customer support

- Analyzing the competitive pricing structure and the quality of customer support provided by the fifth provider.

Navigating the Diverse Options: Specialized Merchant Service Providers

For businesses with unique needs, specialized MSPs offer tailored solutions. Whether operating in niche markets or requiring specific functionalities, exploring these options can lead to a more customized and effective approach.

Merchant Services in the Digital Age

Integration with e-commerce[1] platforms and the rise of mobile payments[2] are transforming the landscape of merchant services. List of Merchant Service Providers Adapting to these technological advancements is crucial for staying competitive.[3]

Challenges Faced by Businesses in Selecting Merchant Service Providers

Despite the benefits, businesses[4] encounter challenges in selecting the right MSP. From navigating complex regulations to avoiding common pitfalls, understanding[5] and overcoming these obstacles is essential.

The Future of Merchant Services

As advancements in technology persist, merchant services also undergo continuous evolution. Exploring emerging trends and anticipated developments provides businesses with insight into the future landscape of MSPs.

Case Studies: Success Stories with Merchant Service Providers

Real-world examples of businesses thriving with their chosen MSPs offer valuable insights. These case studies provide tangible evidence of the impact a well-chosen provider can have on business success.

Tips for Optimizing Merchant Service Provider Relationships

Regular assessments, staying updated on new features, and leveraging the full potential of chosen MSPs are vital for optimizing relationships and ensuring continued success.

Educational Resources for Businesses

Workshops, webinars, and online guides serve as valuable educational resources. Staying informed about the latest industry trends and updates is integral to making well-informed decisions.

Customer Reviews and Testimonials

Gauging customer satisfaction through online reviews and testimonials provides a firsthand perspective on the experiences of other businesses. Leveraging this information aids in making informed decisions.

Comparative Analysis: How MSPs Stack Up Against Each Other

Benchmarking key features and services allows businesses to compare MSPs objectively. This comparative analysis aids in making decisions aligned with specific business requirements.

Conclusion

In conclusion, the world of merchant service providers is vast, but navigating it effectively is crucial for businesses aiming to thrive in the digital age. Choosing the right MSP involves a careful evaluation of needs, industry-specific requirements, and future scalability.

FAQs

- Q: How do I determine the right merchant service provider for my business?

- A: Consider your specific business needs, evaluate security features, and assess scalability before choosing an MSP.

- Q: Are specialized merchant service providers worth considering for small businesses?

- Yes, specialized MSPs often offer tailored solutions that can benefit small businesses with unique requirements.

- Q: What role do customer reviews play in selecting a merchant service provider?

- A: Customer reviews provide valuable insights into the real-world experiences of businesses with a particular MSP.

- Q: How can businesses stay updated on the latest trends in merchant services?

- A: Participate in workshops and webinars and regularly check reputable online resources for updates and insights.

- Q: Is it essential to regularly reassess and review the chosen merchant service provider?

- A: Yes, regular assessments ensure that the chosen MSP continues to meet the evolving needs of your business.