AUTHOR : EMILY PATHAK

DATE : 14 – 09 – 2023

In the contemporary era of digitization, businesses are perpetually adapting to fulfill the constantly shifting expectations of their clientele. This evolution includes the way payments are processed[1]. High-risk merchant processing[2] is a topic of utmost importance in this context. In this comprehensive guide, we will delve into the intricacies of high-risk [3]merchant processing, addressing its significance, challenges, and also solutions.

1. Understanding High Risk Merchant Processing

High-risk merchant[4]processing refers to the specialized handling of payments for businesses[5] operating in industries prone to a higher risk of chargebacks, fraud, or regulatory issues. Such businesses may include online gambling, adult entertainment, pharmaceuticals, and also e-cigarettes, among others.

2. Why Businesses Fall into the High-Risk Category

Several factors can push a business into the high-risk category. These may include a high chargeback rate, a history of payment processing issues, operating in a controversial industry, or dealing with international transactions.

3. The Implications of Being a High-Risk Merchant

Being labeled as a high-risk merchant has significant implications. Businesses may face higher processing fees, stricter underwriting requirements, and also limited access to traditional payment processors.

4. Common High-Risk Industries

High-risk industries encompass a wide range of businesses. Some of the most common ones include online gaming, adult entertainment, CBD products, and also travel services. Each industry carries its own unique set of challenges.

5. Challenges Faced by High-Risk Merchants

High-risk merchants encounter numerous challenges, such as difficulty obtaining approval for a merchant account, higher transaction fees, and the constant threat of chargebacks. These challenges can impede business growth.

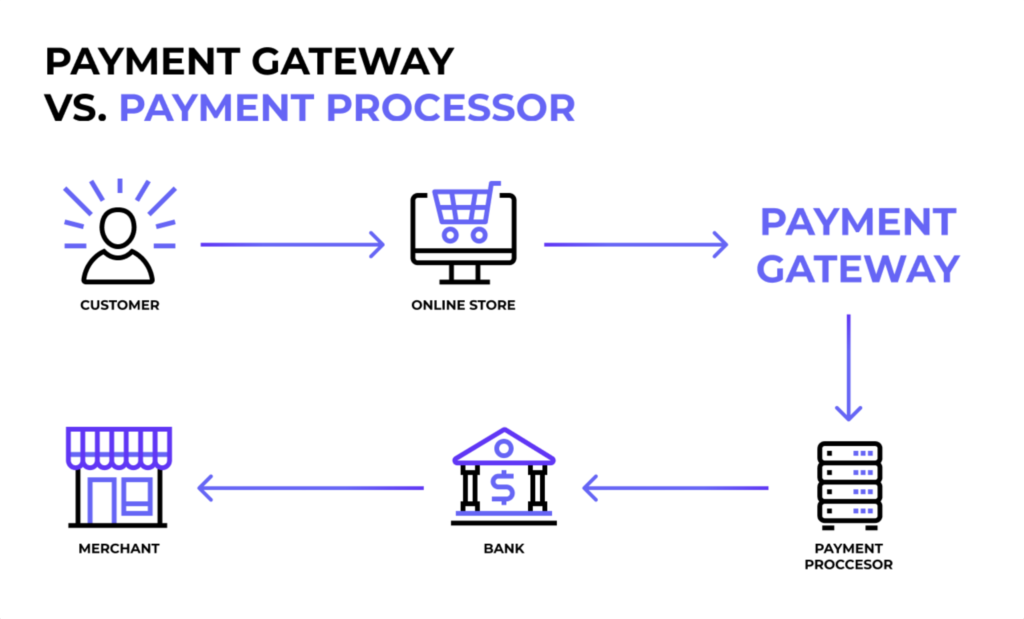

6. Navigating High-Risk Payment Processing

Effectively maneuvering through the intricate terrain of high-risk payment processing{1} necessitates a well-thought-out and strategic approach. Merchants must carefully select a payment processor that specializes in high-risk industries and also understands their unique needs.

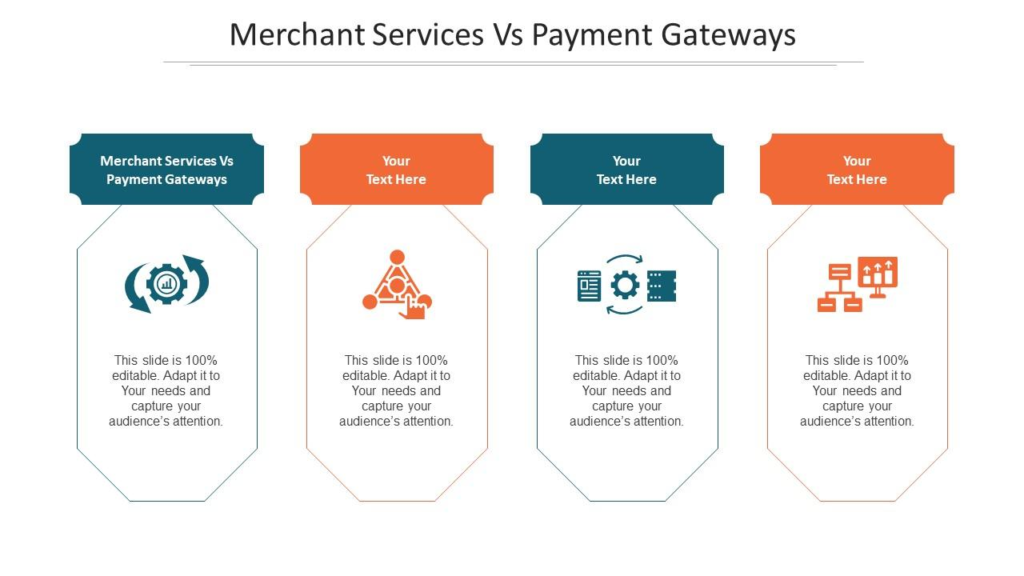

7. Choosing the Right High-Risk Merchant Services Provider

Selecting the right merchant services provider{2] is crucial for high-risk businesses. It’s essential to partner with a company that offers tailored solutions, robust fraud prevention measures, and also competitive pricing.

8. Key Considerations for High-Risk Merchant Accounts

High-risk merchant accounts come with specific considerations, including contract terms, processing fees, and chargeback management. Merchants{3} should thoroughly review these details before signing up.

9. Risk Mitigation Strategies

High-risk merchants{4] must implement effective risk mitigation strategies to minimize chargebacks and also fraud. This may involve thorough customer verification, transaction monitoring, and alos fraud prevention tools.

10. The Role of Chargebacks in High-Risk Processing

Chargebacks can be particularly detrimental to high-risk merchants. Understanding the causes of chargebacks and implementing strategies to reduce them is vital for long-term sustainability.

11. High-Risk Payment Gateway Options

Choosing the right payment gateway is essential. High-risk payment gateways offer features like tokenization and also advanced fraud detection to protect businesses from fraudulent transactions.

12. The Importance of PCI DSS Compliance

High-risk merchants must adhere to Payment Card Industry Data Security Standard (PCI DSS) compliance to safeguard sensitive customer information. Non-compliance can lead to severe consequences.

13. Pros and Cons of High-Risk Processing

High-risk processing has its advantages and disadvantages. While it provides opportunities for businesses that might otherwise struggle to find payment solutions, it also comes with increased costs and risks.

14. Emerging Trends in High-Risk Merchant Processing

The high-risk merchant processing industry is continually evolving. Merchants should stay updated on emerging trends and technologies to remain competitive and also secure.

15. Conclusion: Embracing High-Risk Processing

In conclusion, high-risk merchant processing is a specialized field that offers opportunities and challenges in equal measure. Businesses operating in high-risk industries must carefully assess their payment processing needs, partner with the right service providers, and implement robust risk mitigation strategies to thrive in this complex landscape.

FAQs

- What is high-risk merchant processing? High-risk merchant processing involves handling payments for businesses operating in industries prone to chargebacks, fraud, or regulatory issues.

- Why do businesses become high-risk merchants? Businesses may become high-risk merchants due to factors like high chargeback rates, operating in controversial industries, or dealing with international transactions.

- What are the challenges faced by high-risk merchants? High-risk merchants encounter challenges such as difficulty obtaining merchant accounts, higher transaction fees, and the constant threat of chargebacks.

- How can high-risk merchants mitigate risks? High-risk merchants can mitigate risks through thorough customer verification, transaction monitoring, and also the use of fraud prevention tools.

- What are some emerging trends in high-risk merchant processing? Emerging trends in high-risk processing include the adoption of advanced fraud detection technologies and increased focus on regulatory compliance.