AUTHOR : ANNU CHAUHAN

DATE : 01-09-2023

In today’s digital age, e-commerce has become an integral part of our lives. Whether you’re a small business owner or an individual entrepreneur, the ability to process payments online is crucial for success. Enter the world of website payment processors, a vital component of any online business. In this article, we will delve into the intricacies of website payment processors, discussing their importance, functionality, also how to choose the right one for your needs.

Understanding Website Payment Processors

What Are Website Payment Processors?

Website payment processors, often referred to as payment gateways, are online tools or services that facilitate the seamless and also secure transfer of funds between customers and businesses during online transactions. They act as intermediaries, ensuring that sensitive financial information is kept safe and also that payments are processed efficiently.

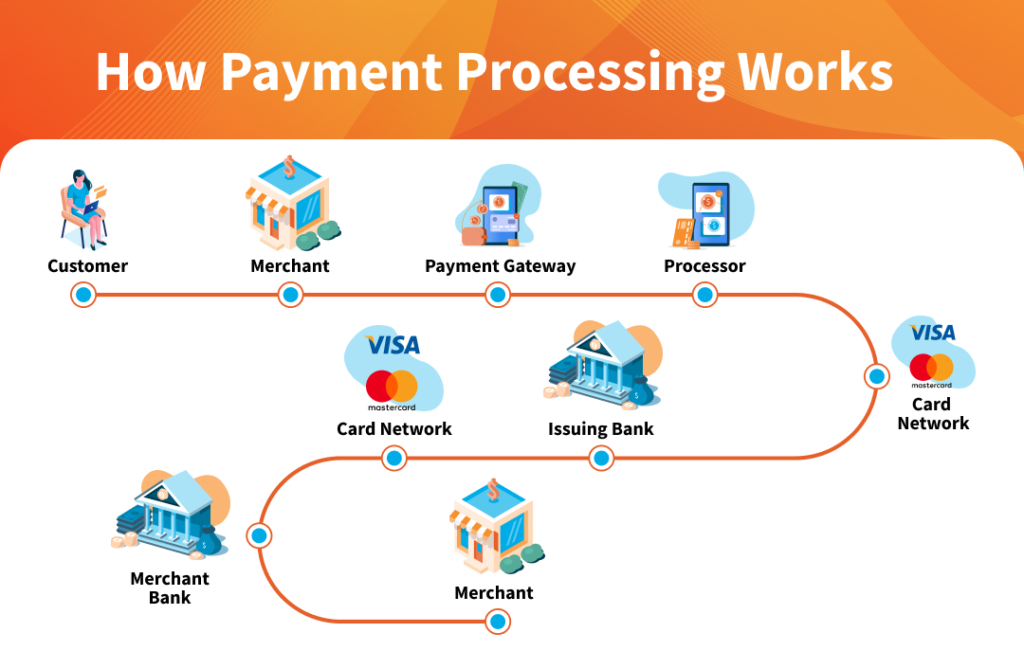

How Do Website Payment Processors Work?

These processors function by encrypting payment data, such as credit card numbers, also transmitting it securely between the customer’s browser and also the merchant’s server. Once the payment is authorized, the processor transfers the funds from the customer’s account to the merchant’s account.

The Importance of Choosing the Right Payment Processor

Selecting the appropriate website payment processor is a critical decision for any online business. Here’s why it matters:

Security and Trust

Customers need to trust that their payment information is safe when making online purchases. A reputable payment processor employs robust security measures, reducing the risk of data breaches and fraud also.

User Experience

A seamless and user-friendly payment process enhances the overall shopping experience. The right payment processor ensures that customers can make payments quickly and without hassle.

Payment Options

Different customers prefer different payment methods. A good payment processor offers a variety of payment options, catering to a broader customer base.

How to Choose the Right Website Payment Processor

With numerous options available, selecting the right website can be overwhelming. Here are some factors to consider:

Transaction Fees

Different payment processors charge varying transaction fees. Consider your business’s size and also transaction volume to find a cost-effective solution.

Integration

Ensure that the payment processor can seamlessly integrate with your e-commerce platform.

Security Features

Look for processors with advanced security features like SSL encryption and fraud detection also.

Popular Website Payment Processors

Now, let’s explore some of the popular website payment processors that businesses commonly use:

PayPal

PayPal is one of the most widely recognized payment processors, known for its user-friendly interface and also robust security features. It’s an excellent choice for small to medium-sized businesses.

Stripe

Stripe is a developer-friendly payment processor that offers extensive customization options. It’s popular among businesses with more complex payment needs.

Square

Square is renowned for its point-of-sale solutions, making it an ideal choice for businesses that operate both online and offline also.

Expanding Payment Horizons

Mobile Payments

In an era where smartphones are ubiquitous, mobile payments have gained significant traction. Many website payment processors now offer mobile integration, allowing customers to make purchases conveniently from their mobile devices. This functionality not only caters to the growing mobile user base but also enhances the overall shopping experience.

International Transactions

For businesses looking to expand globally, website that support international transactions are crucial. These processors can handle multiple currencies and also provide localized payment options, making it easier for customers from around the world to make purchases.

The Future of Website Payment Processors

The world of e-commerce is ever-evolving, and website are no exception. Here’s a glimpse into what the future holds for these essential tools:

Enhanced Security

As online threats continue to evolve, payment processors will invest heavily in advanced security measures. Biometric authentication, machine learning algorithms, and blockchain technology are likely to become standard features, ensuring the highest level of security for both merchants and customers also.

Seamless Integration

Future payment processors will focus on seamless integration with emerging technologies. This includes integration with augmented reality (AR) and virtual reality (VR) platforms, enabling immersive shopping experiences that blur the line between online and also in-person shopping.

Sustainability

As environmental concerns grow, there will be a push for eco-friendly payment processing solutions. Sustainable payment processors will aim to reduce their carbon footprint, supporting businesses’ efforts to adopt greener practices.

Choosing Your Payment Processor Wisely

In this rapidly changing landscape, making an informed decision about your website payment processor is more critical than ever. Here are some additional considerations:

Customer Support

Prompt and effective customer support is also invaluable. Choose a payment processor with a reputation for excellent customer service to resolve any issues swiftly.

Scalability

Your business may grow over time. Ensure that your chosen payment processor can scale with your needs, accommodating higher transaction volumes without a hitch.

Payment Analytics

Access to detailed payment analytics can provide valuable insights into your customers’ behavior. Look for processors that offer comprehensive reporting tools to help you make data-driven decisions.

Conclusion

In this digital age, website payment processors are the unsung heroes of e-commerce. They enable businesses to thrive in the online marketplace by providing secure, convenient, and also versatile payment solutions. As the e-commerce landscape continues to evolve, selecting the right payment processor will remain a critical decision. Consider the factors discussed in this article, and you’ll be well on your way to ensuring the success and growth of your online venture.

FAQs

1. Are website payment processors safe?

Yes, reputable website payment processors prioritize security and also employ advanced encryption techniques to protect customer data.

2. Can I use multiple payment processors for my business?

Yes, depending on your needs, you can integrate multiple payment processors to offer a variety of payment options to your customers.

3. How do I set up a payment processor on my website?

Setting up a payment processor typically involves creating an account with the chosen processor, integrating it with your website or e-commerce platform, and configuring payment settings.

4. What is the typical transaction fee for website payment processors?

Transaction fees vary among payment processors. They can range from a fixed fee per transaction to a percentage of the total purchase amount.

5. Is it essential to have a website payment processor for an online business?

Yes, having a reliable website payment processor is essential for processing payments securely and efficiently in an online business.