AUTHOR:- MARIA SK

DATE:- 03/11/2023

In the fast-paced world of banking, payment products play a pivotal role in shaping financial transactions. From the days of cash and checks to the modern era of digital wallets and mobile payment apps, these products have evolved to offer increased convenience[1], security, and also accessibility[2] to customers. This article explores[3] the diverse landscape of payment products in banking, discussing their types, benefits, challenges, and the future of this dynamic industry.

1. Introduction to Payment Products in Banking

Banking has come a long way from the traditional methods of handling payments. Payment products are financial tools and instruments designed to facilitate transactions, making it easier for individuals[4] and businesses to manage their money. These products are essential for day-to-day financial activities and have adapted to the changing needs of consumers.

2. The Evolution of Payment Products

The evolution of payment products is a fascinating journey through time. From the use of physical cash and checks to the advent of electronic payments, the industry has seen remarkable advancements. Technological innovations have paved the way for new, efficient, and secure payment methods, ensuring[5] that customers have a wide array of options to choose from.

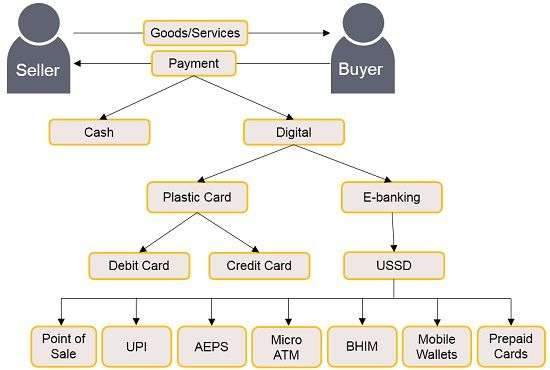

3. Types of Payment Products

3.1. Cash

Cash is the oldest form of payment and is still widely used today. It offers immediate liquidity and can be used for various transactions. However, it has its limitations, such as the risk of loss or theft.

3.2. Checks

Checks were once a popular method of payment, but their usage has declined with the rise of digital alternatives. They provide a paper trail of transactions, making them useful for record-keeping.

3.3. Debit Cards

Debit cards are linked to a bank account and allow customers to make purchases and withdraw cash. They offer convenience and also security, as they require a personal identification number (PIN) for transactions.

3.4. Credit Cards

Credit cards enable users to make purchases on credit, with the option to pay off the balance at a later date. They often come with rewards and incentives, making them a popular choice for consumers.

3.5. Digital Wallets

Digital wallets securely store payment information on a mobile device, ensuring the safety also convenience of your financial transactions. They offer contactless payment options, making transactions quick and hassle-free.

3.6. Mobile Payment Apps

Mobile payment applications such as Apple Pay and Google Pay have become widely favored for their user-friendly and efficient payment solutions. Users can link their bank accounts or credit cards to the app and make payments with a simple tap.

3.7. Online Banking

Online banking allows customers to manage their accounts, pay bills, and also transfer funds from the comfort of their homes. It has become an essential tool for modern banking.

4. Benefits of Payment Products

4.1. Convenience

Payment products offer unparalleled[14] convenience, allowing users to make transactions anytime and anywhere. Whether it’s paying bills, shopping online, or splitting a restaurant bill, these products streamline the process.

4.2. Security

Security is a top priority in banking. Payment products employ encryption and authentication measures to protect users from fraud and also unauthorized[12] access.

4.3. Record Keeping

Digital payment methods automatically record transactions, providing users with a clear financial history. This feature simplifies budgeting[13] and also financial planning.

4.4. Rewards and Incentives

Credit cards and some digital wallets offer rewards, such as cashback[20] or travel points, incentivizing customers to use their products.

5. Challenges and Concerns

5.1. Security Risks

While payment products enhance security, they are not immune to risks. Phishing[19], identity theft, and data breaches remain concerns in the digital age.

5.2. Overreliance on Digital Payments

Overreliance on digital payments may leave individuals vulnerable[16] if systems fail or if they lack access to technology.

5.3. Inclusivity and Accessibility

Not everyone has access to smartphones[17] or the internet, raising concerns about financial inclusivity. Traditional payment methods like cash and checks are still necessary for some individuals.

6. The Future of Payment Products

The future of payment products is an exciting landscape. We can expect continued innovation, with advancements in biometric[15] authentication, blockchain[18] technology, and enhanced security measures. The industry will also focus on improving inclusivity and expanding access to financial services.

7. Conclusion

Payment products in banking have come a long way, catering to the diverse needs of consumers. They have transformed the way we handle our finances, offering convenience, security, and an array of choices. While challenges exist, the future promises even more innovative and accessible payment solutions.

8. Frequently Asked Questions (FAQs)

Q1. What are the most common payment products in banking?

The most common payment products include cash, checks, debit cards, credit cards, digital wallets, mobile payment apps, and also online banking.

Q2. Are payment products secure to use?

Yes, payment products employ robust security measures to protect users from fraud and also unauthorized access.

Q3. What are the benefits of using digital wallets?

Digital wallets offer convenience and security, enabling users to make quick and also contactless payments.

Q4. How is the banking industry addressing inclusivity concerns?

The banking industry is working to expand access to financial services and also ensure that traditional payment methods remain available to those who need them.

Q5. What can we expect in the future of payment products?

The future of payment products will bring more innovation, enhanced security, and improved accessibility, with a focus on biometric authentication and also blockchain technology.