AUTHOR:- MARIA SK

DATE:- 03/11/2023

Introduction

In the rapidly evolving landscape of financial technology the United Arab Emirates (UAE) has emerged as a powerhouse in the Middle East, becoming a global hub for commerce, trade, and tourism. As businesses and also individuals flock to this dynamic region, the demand for efficient payment processing solutions has skyrocketed. In this article, we will delve into the world of payment processors in the UAE, exploring their significance, features, and the impact they have on the local and international business communities.

The UAE’s Thriving Economy and Payment Processing

The United Arab Emirates boasts a robust and diversified economy, driven by sectors like tourism, real estate, and the financial industry. As a result, a plethora of businesses, from small startups to multinational corporations, operate within its borders. This has naturally fueled the need for secure and efficient payment processing solutions that can meet the demands of this ever-expanding market.

The Role of Payment Processors

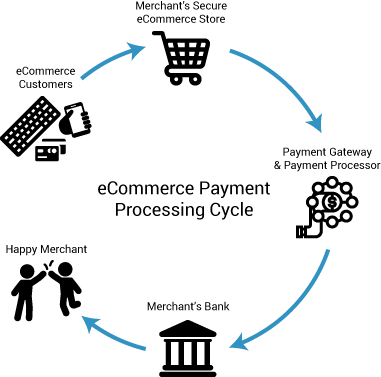

Understanding Payment Processors

Payment processors are intermediaries that facilitate electronic transactions between merchants and customers. They play a crucial role in ensuring that payments are securely and also swiftly transferred from the buyer to the seller. In the UAE, several payment processors have stepped up to the plate, offering a range of services to cater to various business needs.

Why Payment Processors Matter

- Global Reach: Payment processors in the UAE enable businesses to accept payments from customers worldwide, breaking down geographical barriers.

- Security: They employ cutting-edge security measures to safeguard financial information, providing peace of mind to both buyers and sellers.

- Efficiency: Transactions are processed in real-time, reducing the risk of payment delays and enhancing the overall customer experience.

Key Players in the UAE Payment Processing Industry

Several payment processors have established a strong presence in the UAE, each offering unique features and services. Exploring some of the notable contenders in the field:

1. Network International

Network International stands as a premier provider of payment solutions across the Middle East and Africa. They offer a comprehensive suite of services, including card processing, digital[1] payment solutions, and merchant acquiring services. With a vast network of partners and clients, Network International has solidified its position as a key player in the region.

2. PayTabs

PayTabs[2] is another significant player, known for its innovative payment solutions. They cater to both small and large businesses, offering features like multi-currency support, fraud protection, and seamless integration with e-commerce[3] platforms.

3. Telr

Telr specializes in providing secure and also efficient payment solutions for e-commerce businesses. They stand out for their focus on user-friendliness, making it easy for businesses to set up and manage online payment processing.

Benefits of Using UAE Payment Processors

Streamlined Transactions

Payment processor[4] in the UAE simplify the payment process, reducing the friction associated with traditional banking methods. This streamlines the transaction[5] process, leading to increased customer satisfaction and loyalty.

Global Expansion

For businesses looking to expand globally, UAE payment processors are invaluable. They enable international transactions and also support multiple currencies, making it easier to tap into new markets.

Enhanced Security

UAE payment processors prioritize security, implementing advanced encryption and fraud prevention measures. This not only protects businesses but also builds trust among customers.

The Future of Payment Processing in the UAE

As the United Arab Emirates continues to grow as a global economic player, the future of payment processing in the region looks promising. Several trends and developments are shaping the landscape, offering businesses and consumers even more convenience and security.

Contactless Payments and Mobile Wallets

One of the significant trends in payment processing is the increasing use of contactless payments and also mobile wallets. With the rise of smartphones and the widespread adoption of NFC (Near Field Communication) technology, consumers in the UAE are now making payments with a simple tap or wave of their phone. Payment processors are rapidly adapting to this trend, ensuring that businesses can accept these forms of payments seamlessly.

Cryptocurrency Integration

The UAE has been at the forefront of embracing cryptocurrencies. With regulatory frameworks in place, businesses are now exploring the use of digital currencies for transactions. Payment processors are actively working to integrate cryptocurrencies into their platforms, giving customers more options for making payments and also investments.

E-commerce Integration

The growth of e-commerce has been phenomenal in the UAE, and payment processors are integral to this expansion. As online shopping becomes the norm, payment processors are developing solutions tailored to the needs of e-commerce businesses. This includes features like instant payment verification, shopping cart integration, and also secure payment gateways.

Conclusion

In the heart of the Middle East, the United Arab Emirates continues to redefine itself as a global business hub. With a flourishing economy and a focus on innovation, the demand for efficient payment processors is on the rise. These processors play a pivotal role in driving business success, promoting financial security, and enhancing the overall economic landscape of the UAE.

FAQs

1. Are payment processors in the UAE safe to use?

Yes, UAE payment processors employ state-of-the-art security measures to ensure the safety of transactions and also financial information.

2. Can small businesses benefit from UAE payment processors?

Absolutely! Many UAE payment processors cater to the needs of small businesses, offering cost-effective solutions and also user-friendly platforms.

3. How can UAE payment processors help businesses expand internationally?

UAE payment processors support multiple currencies and also international transactions, making it easier for businesses to tap into global markets.

4. What are the fees associated with using UAE payment processors?

Fees vary depending on the provider and the services chosen. It’s essential to compare options to find the most cost-effective solution for your business.

5. Is it easy to integrate UAE payment processors with e-commerce platforms?

Yes, many UAE payment processors offer seamless integration with popular e-commerce platforms, ensuring a hassle-free setup for businesses.