AUTHOR : SAYYED NUZAT

DATE : 26-08-2023

In today’s rapidly evolving digital landscape, seamless and secure payment processing is essential for businesses of all sizes. Payment processors play a pivotal role in facilitating smooth financial transactions between businesses and also their customers. These services have revolutionized the way payments are made and received, offering a plethora of benefits that cater to the modern business environment.

1. Introduction to Payment Processor Services

As businesses expand their online presence, the need for efficient payment processing solutions becomes increasingly important. Payment processor services refer to third-party platforms that handle electronic transactions on behalf of businesses, ensuring the secure transfer of funds between buyers and also sellers.

2. How Payment Processors Work

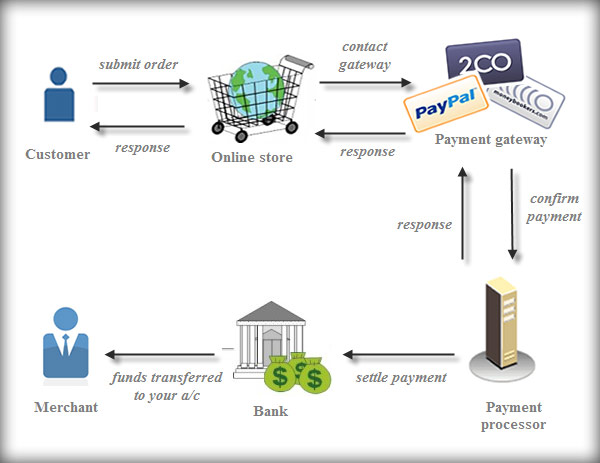

Payment processors act as intermediaries between businesses and also financial institutions. When a customer[1] initiates a payment, the processor securely transmits the transaction details to the bank or credit card company. After verification, the processor confirms the transaction’s approval, allowing the business to fulfill the order.

2.1. Encryption and Security

Payment processors employ advanced encryption techniques to safeguard sensitive customer information, such as credit card[2] details and personal data. This ensures that transactions are conducted in a secure[3] and also confidential manner.

3. Types of Payment Processor Services

Several payment processor services cater to different business needs:

3.1. Online Payment Gateways

Online payment gateways [4]facilitate real-time authorization of online transactions, allowing customers to pay for goods and also services seamlessly.

3.2. Mobile Wallets

Mobile wallets have gained popularity, enabling customers to make payments using their smartphones, thereby eliminating the need for physical credit cards.

3.3. Point of Sale (POS) Systems

POS payment processors are essential for retail businesses, enabling them to accept card [5]payments in physical stores.

3.4. Recurring Billing

For subscription-based businesses, recurring billing processors automate the regular billing process, enhancing convenience for both the business and the customer.

4. Advantages of Payment Processor Services

4.1. Enhanced Customer Experience

Payment processors offer various payment options, enhancing customer convenience and improving their overall shopping experience.

4.2. Global Reach

Businesses can expand their reach internationally by accepting payments in different currencies through payment processors.

4.3. Security and Fraud Protection

Robust security measures provided by payment processors protect businesses and also customers from fraudulent activities.

5. Considerations When Choosing a Payment Processor

5.1. Transaction Fees

Different processors have varying fee structures. Businesses need to consider these fees against their budget and also transaction volume.

5.2. Integration

Compatibility with existing business systems is crucial. The chosen processor should seamlessly integrate with the business’s website or software.

6. The Future of Payment Processors

As technology continues to evolve, payment processors are likely to incorporate more innovative features, such as biometric authentication and AI-powered fraud detection.

7. Conclusion

In today’s digital age, payment processor services have become the backbone of modern business transactions. Their seamless functionality, security features, and also diverse payment options make them indispensable for businesses aiming to thrive in the digital marketplace.

FAQs about Payment Processor Services

Q1. What exactly is a payment processor service?

A1. A payment processor service is a third-party platform that handles electronic transactions between businesses and also their customers securely.

Q2. How do payment processors ensure security?

A2. Payment processors use advanced encryption techniques to protect sensitive customer data during transactions.

Q3. Can payment processors handle international transactions?

A3. Yes, many payment processors allow businesses to accept payments in various currencies, facilitating international transactions.

Q4. Are mobile wallets safe to use?

A4. Yes, mobile wallets employ security measures like PINs, biometric authentication, and also encryption to ensure safe transactions.