AUTHOR : REON ATWELL

DATE : 02-11-2023

Introduction

In today’s fast-paced digital world, businesses rely on efficient and secure payment processing solutions to ensure smooth transactions. A PPW plays a pivotal role in enabling businesses to accept payments online, providing convenience to both merchants and customers. This article delves into the functionalities, benefits, and key considerations of a PPW, highlighting its significance in the e-commerce landscape.

Understanding PPW

What is a PPW

A payment processing website is an online platform that facilitates the electronic transfer of funds between buyers and sellers. It acts as an intermediary, securely transmitting payment information from the customer’s card or account to the merchant’s account.

How Does it Work?

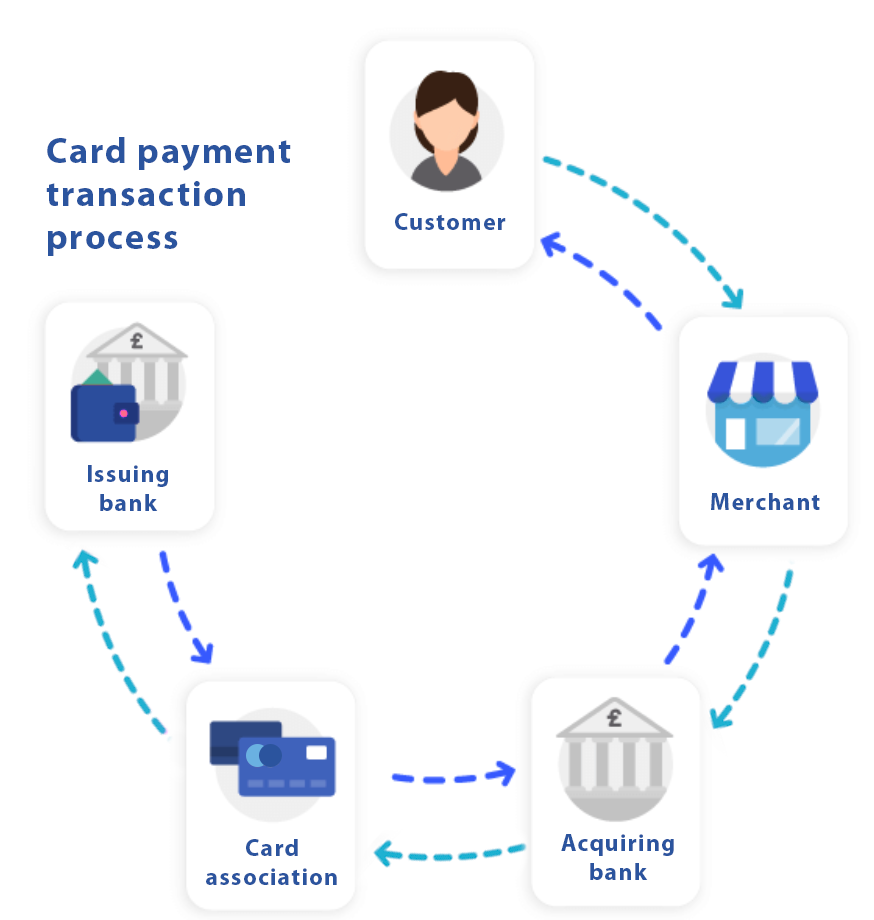

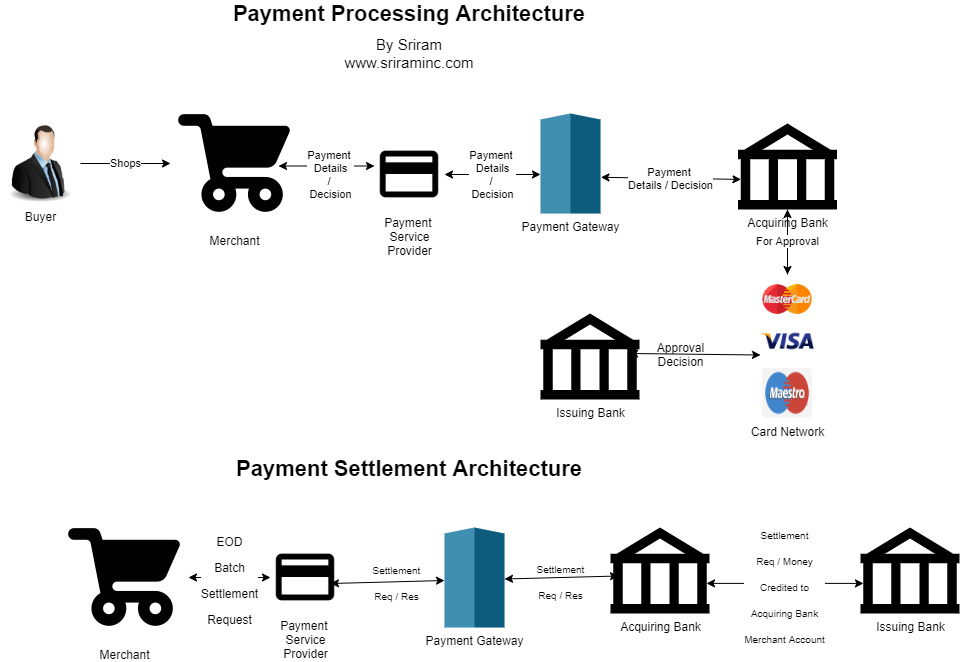

- Initiating the Transaction: The process begins when a customer initiates a payment on the merchant’s website.

- Authorization: The payment details are encrypted and sent to the payment processor for authorization.

- Validation and Verification: The processor verifies the customer’s information and ensures the availability of funds

- Transaction Approval: Upon successful validation, the processor sends an approval signal to the merchant.

Benefits of a PPW

Streamlined Transactions

Streamlining transactions is crucial for businesses looking to provide a seamless buying experience. A payment processing website ensures that payments are processed efficiently, reducing the risk of delays or errors.

Enhanced Security

- Secure Socket Layer (SSL) Encryption: PPW use SSL encryption to protect sensitive information during transmission.

- Fraud Prevention Measures: Advanced algorithms detect and prevent fraudulent transactions safeguarding both merchants and customers.

Global Reach

A payment processing website enables businesses to cater to a global audience by accepting payments in various currencies and from different regions. This widens the market and enhances revenuepotential

Accessibility and Convenience

- Multiple Payment Options: Customers can choose from various payment method including credit cards, digital wallets, and bank transfers.

- 24/7 Availability: Unlike traditional payment [1]methods, a payment processing website operates round the clock, accommodating customers from different time zones.

Key Considerations for Choosing a Payment Processing Website

Integration and Compatibility

The chosen payment processing website[2] should seamlessly integrate with the existing e-commerce platform or website. Compatibility ensures a smooth flow of transactions.

Fees and Charges

- Transaction Fees: Understand the fees associated with each transaction, including flat feesand percentage-based charges.

- Hidden Costs: Be aware of any hidden costs that may impact the overall profitability.

Security Measures

Prioritize platforms that employ robust security [3]measures, including encryption protocols and fraud detection algorithms, to safeguard sensitive information.

Customer Support

Choose a payment processing website provider that offers reliable customer support, ensuring prompt assistance in case of any technical issues or concerns.

Conclusion

In conclusion, a payment processing website is an indispensable tool for modern businesses aiming to thrive in the digital [4]landscape. Its role in streamlining transactions, ensuring security,[5] and expanding global reach cannot be overstated. By carefully considering the integration, fees, security, and support options, businesses can select a payment processing website that aligns with their specific needs and goals.

Selecting the most suitable payment processor for your business is a pivotal decision that directly impacts the efficiency and security of your transaction processes.

Selecting the right payment processor is crucial for the success of any online business. With a plethora of options available, it’s important to carefully assess your business’s unique needs and goals. Below are additional elements to take into account when making the crucial decision of selecting a payment processor for your business.

Integration Flexibility

E-commerce Platform Compatibility

Ensure that the payment processor seamlessly integrates with your chosen e-commerce platform. Whether you’re using Shopify, WooCommerce, or a custom-built solution, compatibility is key to a smooth transaction process.

API Availability

For businesses with more complex needs, having access to a robust API (Application Programming Interface) is essential. This allows for custom integrations and tailored solutions.

Payment Methods Supported

Credit and Debit Cards

A reliable payment processor should support major credit and debit cards to cater to a wide range of customers.

Alternative Payment Methods

Consider whether the processor accepts alternative payment methods such as digital wallets (e.g., PayPal, Apple Pay) or cryptocurrencies. This can expand your customer base and enhance convenience.

Transaction Fees and Pricing Structure

Transparent Fee Structure

Look for a payment processor that provides a clear breakdown of their fees, including transaction fees, monthly fees (if applicable), and any additional costs.

Volume-based Pricing

Some processors offer tiered pricing based on transaction volume. Evaluate your expected sales volume to determine which pricing model is most cost-effective for your business.

Security Measures

PCI Compliance

Verify that the chosen payment processor adheres to the stringent security standards set forth by PCI DSS (Payment Card Industry Data Security Standard) compliance.This certification signifies adherence to strict security standards.

Tokenization and Encryption

Advanced security features like tokenization and end-to-end encryption add an extra layer of protection to sensitive customer data.

Customer Support and Reliability

24/7 Support

Opt for a payment processor that offers round-the-clock customer support. This ensures that you can address any issues promptly, regardless of the time zone.

Downtime and Reliability

Check the processor’s track record for uptime and reliability. Periods of unavailability can result in missed revenue opportunities and dissatisfied clientele.

FAQs

Q1: Is it necessary to have a payment processing website for an online business?

Yes, a payment processing website is crucial for accepting online payments securely and efficiently, providing convenience to customers.

Q2: Can a payment-processing website handle international transactions?

Absolutely. A well-designed payment processing website can process payments in multiple currencies, allowing businesses to cater to a global audience.

Q3: Are there any risks associated with online payments?

While payment processing websites employ advanced security measures, there is always a slight risk of fraudulent activities. However, these risks are minimized with the right security protocols in place.

Q4: How can I choose the right payment processing website for my business?

Consider factors like integration capabilities, fees, security measures, and customer support when evaluating payment processing website options.