AUTHOR : RIVA BLACKLEY

DATE : 02-11-23

Introduction

In today’s fast-paced business environment, efficient payment processing is vital for any company’s success. Payment processing software has revolutionized the way businesses manage their financial transactions. This article delves into the world of payment processing software, discussing its various aspects, benefits, and how it can enhance your business operations.

What is PPS?

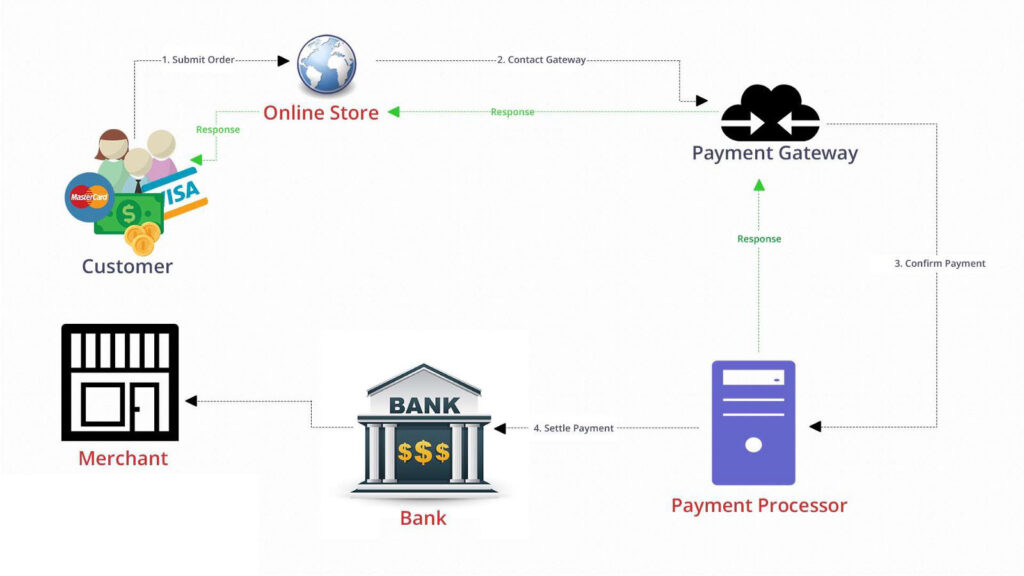

Payment processing software, often referred to as a payment gateway, is a digital tool that facilitates the seamless transfer of funds between a customer and a business. It acts as a bridge between the customer’s payment method and the business’s bank account. This software[1] is essential for online and point-of-sale transactions, ensuring that payments are processed securely and swiftly.

The Benefits of PPS

- Efficiency: Payment processing software streamlines transactions, reducing manual errors and processing time.

- Security: It offers advanced encryption and security [2]measures, protecting sensitive financial data.

- Versatility: Accept payments through various methods like credit cards, e-wallets, and mobile payments.[3]

- Automation: Automate recurring payments and subscription[4] billing, saving time and effort.

- Reporting and Analytics: Gain insights into transaction data for informed decision-making.

Different Types of PPS

There are various types of PPS available, catering to different business needs. These include:

- E-commerce[5] payment gateways

- Mobile payment apps

- Point-of-sale (POS) systems

- Virtual terminals

Selecting the ideal PPS for your business demands careful consideration and a keen eye for your specific needs and objectives.

Selecting the right PPS for your business is crucial. Consider factors like:

- Business Type: E-commerce businesses have different requirements than brick-and-mortar stores.

- Seamless integration is paramount, ensuring that the PPS effortlessly meshes with your current infrastructure and operations.

- Cost: Compare pricing models and fees.

- Security Features: Prioritize advanced security measures.

- Customer Support: Prompt and efficient support is vital.

When assessing PPS, it’s vital to pinpoint the key attributes that align perfectly with your business requirements.

- Tokenization: Protect customer data by replacing sensitive information with tokens.

- PCI Compliance: Ensure compliance with Payment Card Industry Data Security Standard.

- Multi-currency Support: Useful for businesses with international customers.

- Recurring Billing: Automate subscription payments.

- Fraud Protection: Advanced tools to detect and prevent fraudulent transactions.

Top PPS Providers

Some of the industry-leading payment processing software providers are:

- PayPal

- Stripe

- Square

- Authorize.Net

- Braintree

Integrating PPS with Your Business

To fully leverage payment processing software, you need a seamless integration with your business operations. This allows you to accept payments from various channels and provides a better overall customer experience.

Security in Payment Processing

Security is paramount in payment processing. Payment processing software employs encryption and security protocols to protect sensitive data, ensuring your customers can trust your business with their financial information.

The Future of PPS

As technology continues to evolve, payment processing software will also see innovations. Expect more advanced security measures, faster transaction speeds, and increased compatibility with emerging payment methods.

Case Studies: Successful Implementation

Explore real-world examples of businesses that have benefited from payment processing software. Learn how they improved efficiency and customer satisfaction.

Challenges in Payment Processing

Discuss common challenges faced in payment processing, such as fraud, chargebacks, and system outages. Provide tips on how to mitigate these issues.

Common Myths about PPS

Debunk some misconceptions surrounding payment processing software. Address concerns and provide clarity on its benefits and security.

Expanding Your Business Horizons

Payment processing software is not just a tool for processing transactions; it’s a gateway to expanding your business horizons. Here are a few additional points to consider:

International Expansion

If your business has aspirations of reaching a global audience, payment processing software with multi-currency support can be a game-changer. It allows you to accept payments in various currencies, making it easier for international customers to do business with you. This feature is especially beneficial for e-commerce businesses looking to tap into new markets.

Mobile Payments

In today’s mobile-driven world, having the capability to accept payments via mobile devices is a necessity. Many payment processing solutions offer mobile apps or integrate seamlessly with popular mobile payment apps like Apple Pay and Google Pay. This means customers can make purchases swiftly and securely using their smartphones, which is increasingly important for businesses with a strong online presence.

Subscription-Based Services

Payment processing software is a boon for businesses offering subscription-based services. Whether it’s a monthly magazine subscription or a software-as-a-service (SaaS) model, these systems automate recurring billing, ensuring that customers’ payments are processed on time without any manual intervention. This not only streamlines your revenue stream but also enhances the customer experience.

Conclusion

Payment processing software is a game-changer for businesses of all sizes. It offers efficiency, security, and versatility in managing financial transactions. By choosing the right software and implementing it effectively, your business can thrive in the digital age.

Unique FAQs

- Is payment processing software suitable for small businesses?

- Yes, many payment processing solutions are designed for businesses of all sizes.

- What security measures are in place to protect customer data?

- Payment processing software employs encryption, tokenization, and compliance with industry standards to safeguard data.

- Can I use multiple PPS providers for different purposes?

- Yes, you can integrate multiple providers based on your business needs.

- How long does it take to integrate PPS with my existing systems?

- The time required for integration varies but can range from a few days to a couple of weeks.

- What is the cost associated with PPS?

- Costs depend on the provider and the services required. It can include setup fees, transaction fees, and monthly subscription charges.