AUTHOR : ANNU CHAUHAN

DATE : 24-08-2023

In the dynamic world of e-commerce and also digital transactions, payment processing service providers play a crucial role in facilitating smooth and secure monetary transactions between businesses and their customers. These service providers offer a range of solutions that streamline the payment process, enhance security, and provide convenience to both merchants and consumers. In this article, we’ll delve into the world of payment processing service providers, exploring their benefits, functions, and also the criteria to consider when choosing the right one for your business.

Introduction: Understanding Payment Processing Services

In an era where online transactions have become the norm, payment processing service providers offer a bridge between businesses and their customers also, enabling seamless transactions over various digital platforms. These service providers facilitate the exchange of funds securely, efficiently, and in compliance with industry regulations.

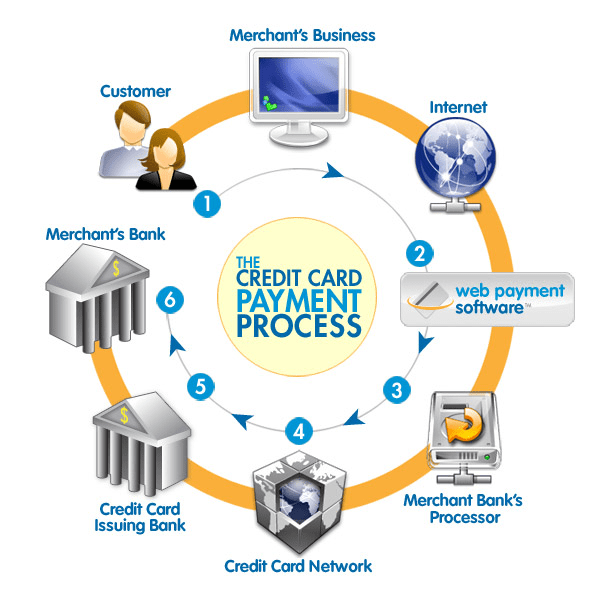

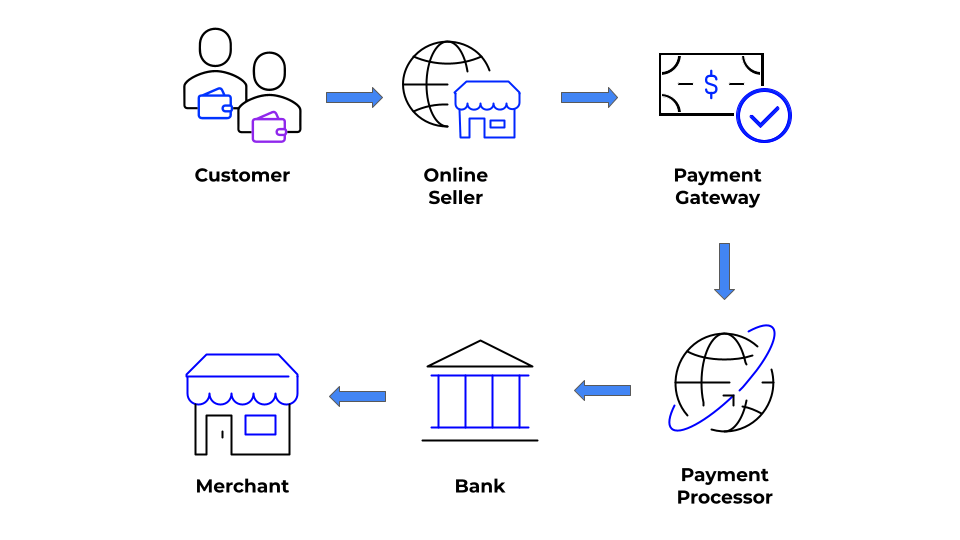

How Payment Processing Works

Payment processing involves multiple steps that ensure the transfer of funds from the customer’s account to the merchant’s account. The process begins when a customer initiates a transaction, either through a website, mobile app, or in-person point-of-sale system.

Benefits of Using Payment Processing Service Providers

Payment processing service providers bring a myriad of benefits to businesses. Firstly, they offer a diverse range of payment options, catering to customers across the globe. This variety includes credit and debit card payments also, digital wallets, and even emerging options like cryptocurrency.

Types of Payment Processing Services

Traditional Merchant Accounts

A traditional merchant account is a dedicated bank account that allows businesses to accept payments through credit and debit cards. This option provides more control over the payment process and can be suitable for larger businesses with high transaction volumes.

Payment Gateways

A payment gateway is a secure service that validates credit card payments and facilitates their processing. It encrypts sensitive information to ensure safe transmission between the customer, merchant, and financial institutions.

Third-Party Processors

Third-party processors handle the entire payment process on behalf of the merchant. They simplify the process by handling payment authorization, transaction processing, and fund settlement.

Factors to Consider When Choosing a Payment Processing Service Provider

Several crucial factors need to be considered when selecting a payment processing service provider for your business. Transaction fees are a significant consideration as they directly impact your bottom line.

The Role of Payment Processing in E-Commerce

In the realm of e-commerce, payment processing plays a pivotal role in determining the success of a business. It directly influences the customer’s shopping experience and can even impact cart abandonment rates.

Security Measures in Payment Processing

Security is a paramount concern in payment processing. Encryption and tokenization are two key security measures that protect sensitive customer data.

Emerging Trends in Payment Processing

The payment processing landscape is constantly evolving, with several trends shaping the industry’s future. Mobile payments are gaining traction due to their convenience and speed.

How Payment Processing Impacts Cash Flow for Businesses

Efficient payment processing can significantly impact a business’s cash flow. With quicker transaction processing and settlement, businesses can access their funds faster.

Challenges Faced by Payment Processing Service Providers

Despite their benefits, payment processing service providers face challenges. One significant challenge is the ever-present threat of fraud and cyberattacks.

Top Payment Processing Service Providers in the Market

Several payment processing service providers stand out in the market due to their features and reputation.

Steps to Integrate a Payment Processing System

Integrating a payment processing system requires careful planning and execution. The process involves registration, verification, integration, testing, and finally, launching the system.

Ensuring a Smooth Customer Experience during Checkout

A streamlined and hassle-free checkout experience is essential for customer satisfaction. Payment processing service providers contribute to this experience by offering various payment options and secure processing.

The Future of Payment Processing

As technology continues to advance, payment processing is expected to witness further transformation. Contactless payments and the integration of cryptocurrencies are likely to become even more prevalent.

Conclusion

In conclusion, payment processing service providers are the unsung heroes of modern commerce. Their seamless facilitation of transactions, robust security measures, and constant adaptation to technological trends make them indispensable to businesses worldwide. Selecting the right payment processing service provider requires a careful evaluation of factors like fees, security, and integration capabilities.

FAQs (Frequently Asked Questions)

- What is a payment processing service provider? A payment processing service provider is a company that offers solutions for businesses to accept and process digital payments from customers.

- How do payment processing service providers ensure security? They implement security measures such as encryption, tokenization, and fraud detection to safeguard sensitive customer information.

- What types of payment options can businesses offer through these service providers? Businesses can offer various payment options, including credit and debit cards, digital wallets, and alternative methods like cryptocurrency.

- Are payment processing systems only for online businesses? No, payment processing systems are used by both online and offline businesses to facilitate transactions with their customers.