AUTHOR : REON ATWELL

DATE : 02-11-2023

Introduction

In the ever-evolving landscape of financial transactions[1], selecting the right payment processing solution is crucial for businesses of all sizes. This process often begins with the issuance of a Request for Proposal (RFP) to potential service providers. In this article, we’ll delve into the intricacies of Payment Processing RFPs, their importance, and how to craft one effectively.

Understanding Payment Processing RFPs

A Payment Processing RFP is a formal document that outlines a company’s requirements and expectations for a payment processing solution. It serves as a means to solicit proposals from qualified service providers.[2]

Importance of a Well-Structured RFP

A well-structured RFP sets the foundation for a successful partnership. It provides clarity to potential vendors about the company’s needs and allows for accurate and competitive proposals[3].

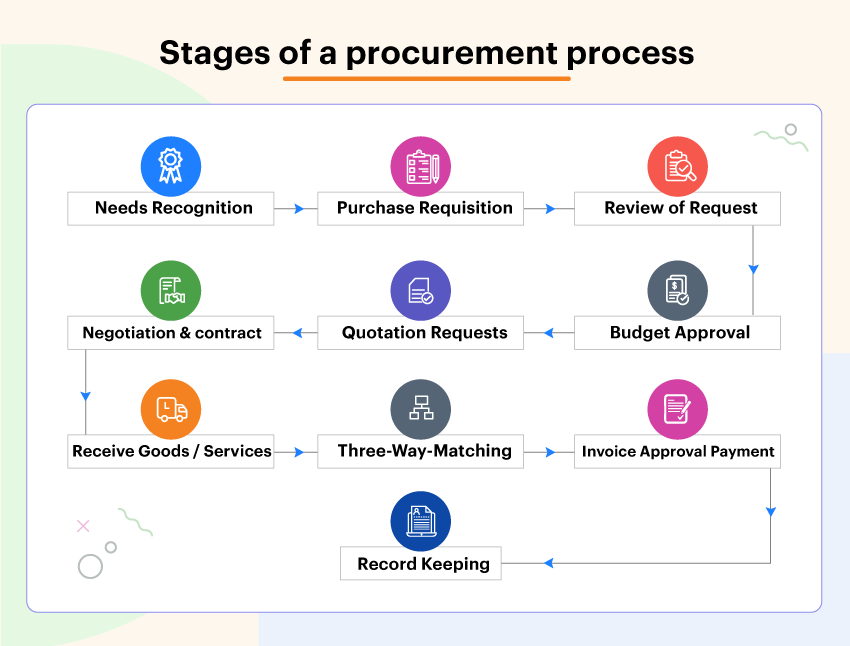

Key Components of a Payment Processing RFP

4.1. Company Information

This section introduces the issuing company, providing background, mission, and any specific values or requirements[4] that vendors should align with.

4.2. Scope of Services Required

Clearly define the services needed, including payment types, transaction volume, and any special features required.

4.3. Technical Specifications

Detail the technical requirements for the payment processing solution, including compatibility with existing systems and any specific integrations [5]needed.

4.4. Pricing and Fee Structure

Provide a clear breakdown of expected costs, including setup fees, transaction fees, and any other relevant expenses.

4.5. Security Measures

Outline the necessary security protocols to safeguard sensitive financial information.

4.6. Compliance and Regulation

Specify any industry-specific regulations or certifications the vendor must adhere to.

4.7. Case Studies and References

Request examples of successful implementations and references from similar clients.

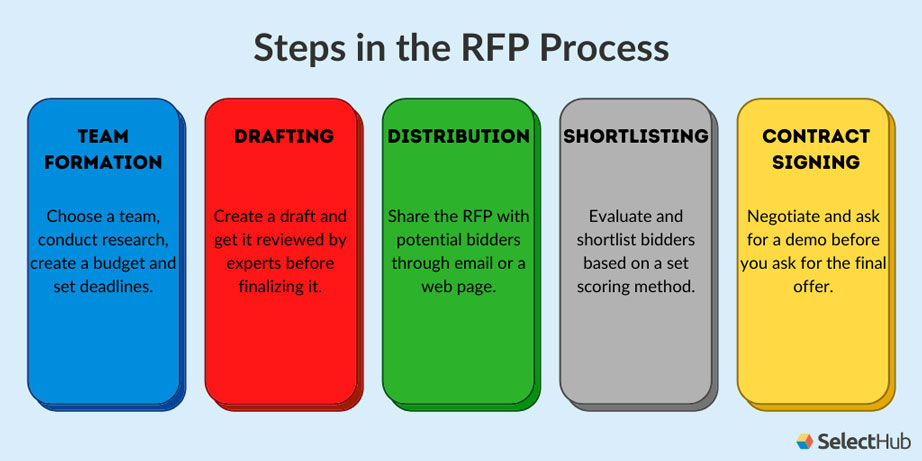

Writing an Effective Payment Processing RFP

5.1. Clear Objectives and Requirements

Clearly state the company’s objectives and specific requirements for the payment processing solution.

5.2. Detailed Specifications

Provide comprehensive details on each aspect of the required services and functionalities.

5.3. Budget Considerations

Set a realistic budget and be transparent about cost expectations.

5.4. Timeline and Milestones

Define project timelines milestones, and any critical deadlines.

5.5. Evaluation Criteria

Establish clear criteria for evaluating vendor proposals, considering factors like experience, expertise, and pricing.

Selecting the Right Payment Processing Partner

6.1. Research and Shortlisting

Conduct thorough research to identify potential vendors and create a shortlist based on their suitability

6.2. Proposal Evaluation

Evaluate received proposals against the established criteria to identify the best-fit solution

6.3. Interviews and Demonstrations

Conduct interviews and request demonstrations from shortlisted vendors to assess their capabilities.

6.4. Due Diligence

Perform due diligence, including background checks and client referrals, to ensure the selected vendor is a reliable partner.

Conclusion

A well-crafted Payment Processing RFP is the cornerstone of a successful partnership with a payment processing provider. By following these guidelines, businesses can streamline the selection process and ultimately enhance their financial operations.

Selecting the Right Payment Processing Partner (Continued)

6.1. Research and Shortlisting

Begin by conducting extensive research on potential payment processing vendors. Look for companies with a proven track record in your industry and positive client testimonials. Consider factors such as their reputation, customer service, and technological capabilities.

6.2. Proposal Evaluation

Once you receive proposals from shortlisted vendors, it’s time to dive into the details. Evaluate each proposal against the established criteria. Pay close attention to how well each vendor addresses your specific requirements and how their pricing aligns with your budget.

6.3. Interviews and Demonstrations

Take the opportunity to schedule interviews and request demonstrations from the shortlisted vendors. This step allows you to interact directly with the teams, ask questions, and get a firsthand look at their systems in action. It’s also a chance to assess their responsiveness and willingness to address your concerns.

6.4. Due Diligence

Before finalizing your decision, conduct due diligence on the selected vendor. This involves checking their financial stability, reviewing any legal or regulatory issues, and contacting their existing clients for references. A reliable and transparent partner is essential for a smooth payment processing experience.

Conclusion

In the dynamic world of payment processing, a well-structured RFP is your compass to finding the perfect partner. It sets the stage for a collaborative and fruitful relationship with a payment processing provider. By following the steps outlined in this guide, businesses can navigate the process with confidence, ultimately enhancing their financial operations.

FAQs

8.1. What is a Payment Processing RFP?

A Payment Processing RFP is a formal document that outlines a company’s requirements and expectations for a payment processing solution.

8.2. Why is a well-structured RFP important for payment processing?

A well-structured RFP provides clarity to potential vendors about the company’s needs, allowing for accurate and competitive proposals.

8.3. How do I write an effective Payment Processing RFP?

To write an effective Payment Processing RFP, clearly state your objectives, provide detailed specifications, set a realistic budget, establish timelines, and define evaluation criteria.

8.4. What should I consider when selecting a payment processing partner?

Consider factors like vendor experience, expertise, pricing, security measures, and compliance with industry regulations.