Author : Annu Chauhan

Date : 24-08-2023

Introduction

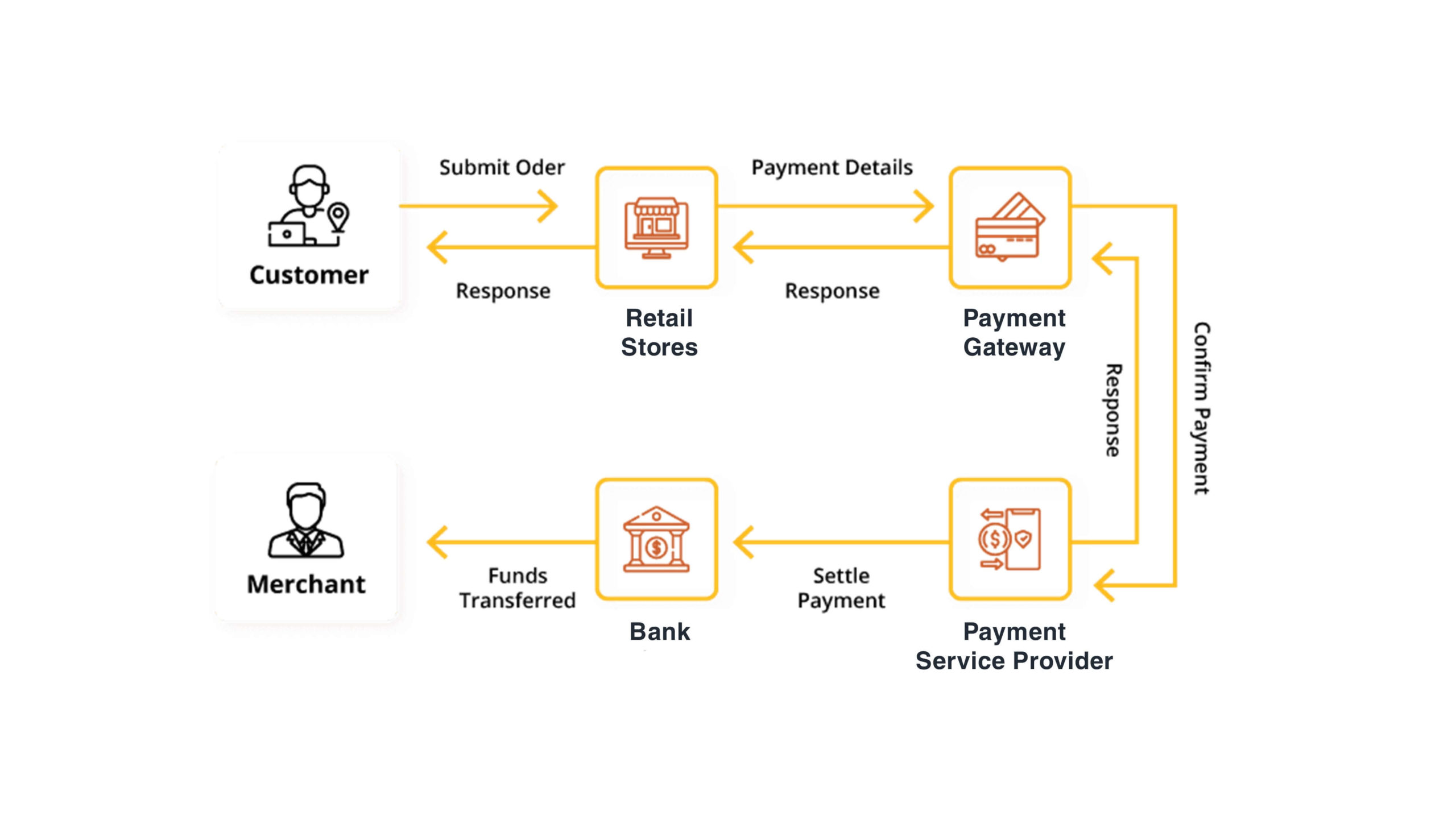

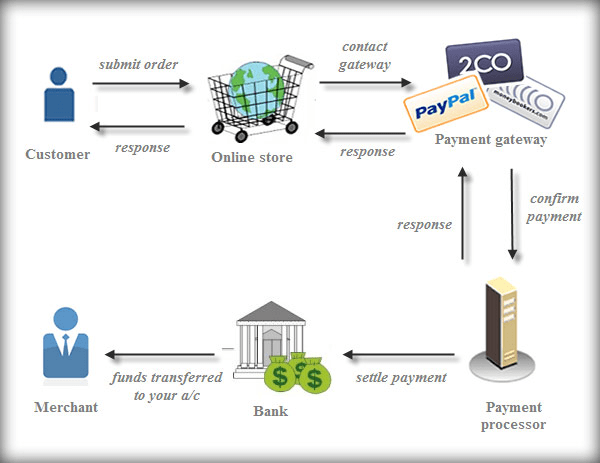

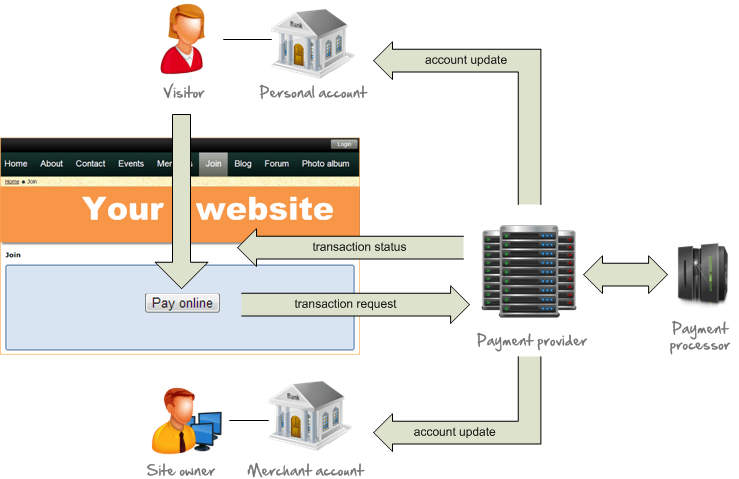

In the modern business landscape, seamless payment processing is pivotal. Selecting a suitable payment processing provider can significantly impact your business’s efficiency and also customer satisfaction.

Streamlined Transactions: Enhancing Customer Experience

Opting for the right payment processing provider ensures smoother transactions, reducing the chances of abandoned purchases and boosting sales also.

Diverse Options, Delighted Customers

Offering multiple payment choices—credit cards, digital wallets, bank transfers—caters to diverse customer preferences also expands your market reach.

Safety First: Securing Financial Data

Safety is non-negotiable. Reputable payment processors use encryption also fraud detection, safeguarding sensitive financial data and building customer trust.

Speedy Processing: Accelerating Success

Speed matters. A dependable payment provider processes transactions swiftly, contributing to positive shopping experiences and repeat business also.

Seamless Integration: Making Multichannel Management Easy

Unity matters. The right provider seamlessly integrates with your various e-commerce platforms, simplifying transaction management across channels.

Real-Time Insights: Informed Business Decisions

Knowledge is power. A suitable payment solution offers real-time analytics, providing insights to fine-tune your strategies according to customer behavior.

Cost-Effective Solutions: Saving Every Penny

Savings matter. Opt for a provider with clear pricing structures and competitive rates also, bolstering your profit margins over time.

Dependable Support: Troubleshooting with Ease

Reliability matters. A robust provider with excellent customer support ensures prompt issue resolution, minimizing disruptions to your business.

Global Ambitions: Crossing Borders Smoothly

Expansion matters. Choose a payment processing partner that facilitates international transactions and also accepts diverse currencies.

Recurring Convenience: Meeting Subscription Needs

Consistency matters. If you offer subscriptions, opt for a provider with automated recurring payment support for seamless billing.

Mobile Adaptability: Capturing the Mobile Audience

Accessibility matters. Ensure your chosen provider offers mobile-optimized solutions for customers shopping on smartphones and tablets also.

Combatting Cart Abandonment: Smoothing the Checkout Flow

Simplicity matters. User-friendly payment processing minimizes checkout hurdles, reducing the likelihood of abandoned carts.

Trust Building: Establishing Credibility

Credibility matters. Employing a reputable payment provider builds trust, reassuring customers as they finalize their transactions.

Expanding Horizons: The Power of a Reliable Payment Processing Provider

Unraveling Complexities: Making Informed Decisions

Clarity matters. Understanding the world of payment processing providers empowers you to make the right choice for your business.

Transitioning with Ease: Switching Providers Seamlessly

Flexibility matters. When circumstances change, knowing that you can transition to a new provider smoothly offers peace of mind.

Tailoring Solutions: Finding the Perfect Fit

Customization matters. A provider that offers tailored solutions addresses your specific business needs, ensuring a seamless fit.

Exploring Innovations: Staying Ahead of Trends

Adaptability matters. A forward-thinking payment processing provider keeps you updated with the latest industry trends and also innovations.

Partnership Dynamics: Growing Together

Collaboration matters. Choosing a provider that aligns with your business goals lays the foundation for a fruitful partnership.

Financial Visibility: Tracking Transactions Effectively

Insight matters. Real-time tracking of transactions helps you stay on top of your financial flow and also aids in decision-making.

Holistic Approach: Beyond Transactions

Comprehensiveness matters. Some providers offer more than just transaction processing—look for added value in services provided.

Data Security: Fortifying Against Threats

Fortification matters. The emphasis on data security ensures protection against evolving cyber threats also breaches.

Evolving Solutions: Adapting to Change

Progress matters. An adaptable provider evolves with your business, accommodating changes and also expansions effortlessly.

Industry Reputation: Choosing Wisely

Reputation matters. Research a provider’s reputation in the industry to ensure reliability also credibility.

Pioneering Technology: Future-Proofing Your Business

Innovation matters. Embrace a provider that leverages cutting-edge technology to future-proof your payment processing.

Regulatory Compliance: Navigating Legalities

Compliance matters. Ensure your chosen provider adheres to relevant financial regulations also standards.

User-Friendly Interfaces: Enhancing User Experience

User experience matters. An intuitive interface simplifies the payment process for both you and also your customers.

Transparent Pricing: No Hidden Surprises

Honesty matters. Transparent pricing structures eliminate unpleasant surprises down the line.

Sustainability Commitment: Responsible Choices

Ethics matter. Choose a provider with a commitment to sustainability also responsible business practices.

Conclusion

Selecting the right payment processing provider isn’t just about transactions; it’s about forging a partnership that propels your business toward success.

FAQs About Payment Processing Providers

1. How do payment processors ensure secure transactions?

Security matters. Providers use encryption and also advanced fraud detection to keep transactions safe.

2. Can one provider handle online and in-person transactions?

Versatility matters. Many providers offer solutions for both online and physical store transactions.

3. What’s the typical pricing structure for payment processing?

Clarity matters. Pricing includes transaction and monthly fees also, along with a percentage of the transaction.

4. Can I switch providers later?

Flexibility matters. Transitioning to a new provider is possible, though it may involve technical adjustments.

5. How soon can I implement a new payment solution?

Promptness matters. Many providers offer quick setups, allowing you to start processing payments sooner.